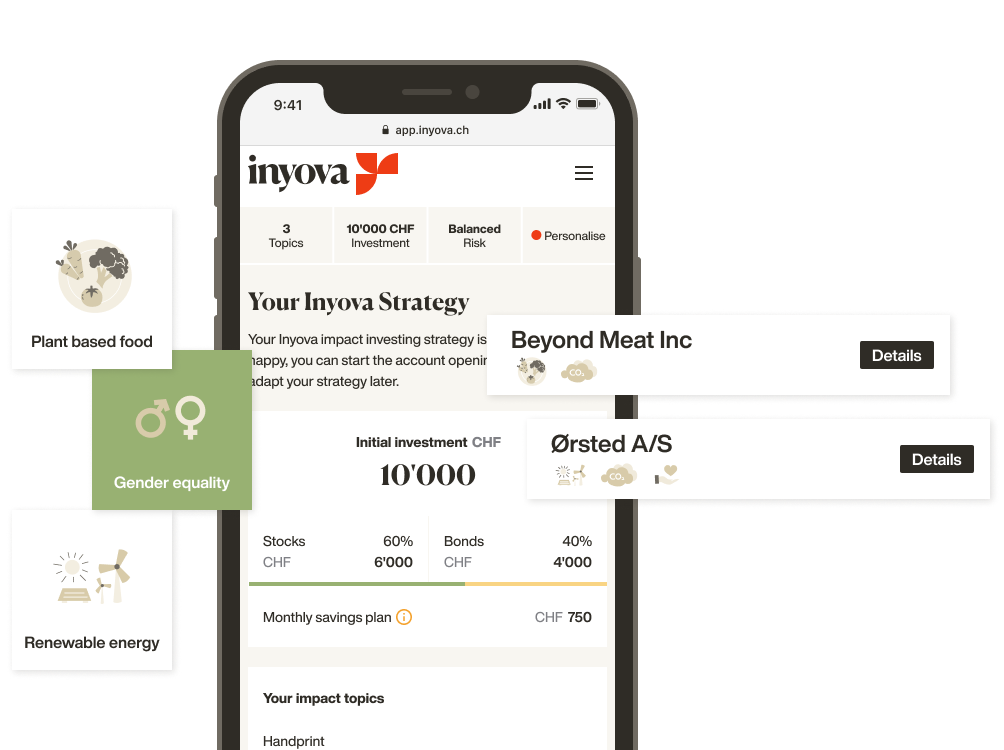

Inyova is combining positive impact & financial returns

We are the leading impact investing platform in Europe. With us you invest in companies that support a sustainable economy – without compromising on returns.

What

experts say

Your investment strategy will include a mixture of stocks in publicly listed companies (also known as shares or equities), as well as government bonds. With Inyova, you invest in a set of government bonds from industrialised countries around the world, rather than any individual bond. You also have the choice to invest a lump sum, or set up a regular savings plan.

We take care of the ongoing technical management on your strategy, with activities such as risk management and rebalancing.

We focus on stocks and bonds because we feel that other financial products are unnecessarily complex. Our approach is to put you as close to your investment as possible. For example, when you buy shares in a company, you directly buy a part of that company. So-called derivatives, on the other hand, (financial products which price depends on other financial instruments) put an unnecessary layer between you and your investment without providing better security or returns.

We balance your mix of bonds and stocks according to your financial objectives and risk profile. Generally speaking, stocks have higher long-term profits, but bigger fluctuations in value day-to-day. Government bonds have better short-term stability, but less profit in the long-term. With this in mind, we recommend a higher proportion of stocks if you intend to hold onto your investment for a longer time period and vice versa.

Every investment comes with a level of risk, and it’s important to understand that the stocks and bonds in your investment portfolio can move down in value at times.

To manage your risk, we implement modern portfolio theory and diversify your investment across at least 30 different stocks. To reduce your risk exposure, we also distribute your investment across various industries, countries, currencies, company sizes, and other dimensions. This way, if one company or industry does not perform well, your investment as a whole will barely be affected.

Bonds are spread across developed countries, which are likely to be stable and reliable borrowers. Stocks are selected from more than 1,100 of the largest companies in Europe and the USA.

We consider four factors before recommending particular companies for your portfolio:

– Your interests (such as electric cars and renewable energy) determine the direction of your strategy.

– All companies are assessed according to your values criteria (for example strong human rights and low emissions).

– Companies that fall into your exclusion criteria are eliminated altogether.

– We apply our investment expertise to control your risk exposure and diversify your strategy according to modern portfolio theory.

The fees are between 0.6% and 1.2%, depending on the size of your investment. There are no additional costs.

The administration fee includes the following services:

– The creation of your personalised strategy.

– Assistance with opening your personal trading account at our custodian bank.

– Continuous monitoring of your portfolio (for, e.g., risk control and necessary adjustments).

– All brokerage and transaction costs.

– Annual rebalancing (for more information, refer to “What is rebalancing?”)

– All costs involved in trading on stock exchanges.

– The fulfilment of shareholder obligations (if you don’t want to do this yourself)

– Continuous monitoring for compliance with your values. If a company no longer meets your value standards, we will be in contact.

By the way: Inyova never takes commissions or kickbacks in exchange for recommending you invest in particular stocks or bonds. Your investment strategy is based exclusively on your wishes, your financial situation and your goals – nothing else!

Inyova is designed for people who want to invest money for the future.

It is for people who are tired of the hidden fees that banks and funds charge.

It is for people who want 100% transparency around where their money goes, and what they pay for.

It is for people who want to be selective around what companies and activities they support with their money.

At Inyova, you invest in the companies that are helping to create the world you want to live in.

There are three main reasons why Inyova might not be a good fit for you:

- You intend to withdraw your money in less than 5 years. Although your investment is always accessible, equities and even bonds can drop in value. If you invest for 5 years or more, this is unlikely to affect you.

- You want to invest in only few individual companies. Diversification is an essential part of all Inyova portfolios. Every stock portfolio contains shares in at least 30 different companies. We believe that investing in fewer companies than that exposes you to undue risk of your investment losing money.

- You want to participate in the stock market by trading speculatively. As our investment strategies are risk-optimised and based on modern portfolio theory, Inyova is not the right partner for people trying to “outsmart” the market.

To activate your investment, you need at least 2,000 CHF in your trading account. Alternatively, you can start a savings plan with an initial deposit of 500 CHF, and add to that over time. Once your account reaches 2,000 CHF, the company stocks will be purchased in your name.

Once your Inyova investment is up and running, you can sit back and relax. But that is when our work is only just beginning. Here’s a taste of what we do on an ongoing basis:

– Ongoing risk management: We constantly check whether your portfolio meets your risk criteria and objectives.

– Protecting your values and interests: If a company no longer fits your specifications, we adapt your strategy accordingly. For example, we may exclude a company, or include a new one that becomes a champion in your favourite industry.

– Savings plan: If you want to make regular contributions to your investment, we ensure this money is invested according to your investment strategy.

– Annual rebalancing: Because the value of individual stocks moves up and down, the money in your portfolio is redistributed each year. This restores the specifications in your original investment strategy.

– Execution of shareholder obligations: As a shareholder, you have certain duties. For example, when a company is making strategic decisions. We take care of this on your behalf (unless you want to do it yourself!).

– Adapting your investment strategy: If your risk profile or asset situation changes (you win the lottery or have a baby), we can adjust your investment strategy at your request. Such changes are possible once per year.

We will send you instructions for opening your investment account at Saxo Bank Switzerland. This is where you transfer your money.

Everything in this account is yours – all the cash, shares and government bonds.

Nobody stands between you and your money, not even Inyova. As your asset manager, we are authorised by you to implement your investment strategy, buying stocks and bonds in your name, and performing the management activities outlined above. We cannot ever withdraw money from your account or transfer it anywhere but to your original account. You can check the activity in your account at any time – everything is 100% transparent and clearly recorded.

Yes! You can withdraw your money at anytime.

Because Inyova investments are based around highly-traded stocks and bonds, your investment is completely liquid. If you decide to withdraw your money, generally it will be in your account within seven business days.

Your money is held in an account in your name, at our transaction bank, Saxo Bank Switzerland. The bank is governed by Swiss law and the Swiss Financial Market Supervisory Authority (FINMA).

Importantly, your stocks and bonds are always kept separate from the assets of both Saxo Bank and Inyova – meaning if either party goes into bankruptcy, your stocks and bonds are not considered part of the company assets.

To you? Nothing. Your money, including all your stocks and bonds, are held by the custodian in a private account in your name. You can manage and withdraw your money at any time, even without us.

Nobody can predict how stocks and bonds will perform next year, next month, or even tomorrow. Daily fluctuations in the value of stocks and bonds are normal, and there is a risk you will lose money. Nevertheless, long-term profits have always made up for drops and even financial crises in the past. Historically, the stock market has increased in value by an average of 6% per year, and government bonds have increased by about 2%.

We use modern portfolio theory to optimise your potential returns within the level of risk you are able to take on. Your investment is diversified so that it develops in the same way as the global economy over time. It is designed to achieve profits in the long term, however small deviations are always possible and can never be excluded.

Inyova offers you an integrated investment solution – a strategy that harmonises your asset situation, your risk profile and your financial goals in the best possible way. But what makes us unique?

– Invest according to your values. Nowhere else can you control the impact your money has, including what companies and activities it supports. You decide what criteria is important to you, and we ensure your strategy is implemented with professional financial expertise.

– Enjoy full control and transparency. You know exactly what stocks you have invested in – and can change it if you wish. If you ask a bank advisor or fund manager what will happen to your money after you give it to them, they are unlikely to give you a good answer (and even if they can tell you, there’s no way you can bring about change).

–Nothing stands between you and your investment. With other investments, there are unnecessary layers and middlemen between you and your money. With Inyova, you own company shares and the government bond funds directly on an account in your name. This is what a modern investment should look like!

We are a young team that has absorbed financial industry knowledge without being absorbed by the financial industry itself. We have no desire to sell you complex financial products or charge you unnecessary fees.

We use the bank only as a custodian for you money, but we offer a level of transparency and customisation that you will not find anywhere else.

In addition, our financial expertise is supported by our extensive sustainability experience. Unlike banks, we manage your money together with you – ensuring your portfolio exists in harmony with your values.

That depends on what you compare Inyova strategies with. We are less risky than a private equity investment, but we can’t offer such high potential profits. We are riskier than leaving cash in a safe deposit box, but we offer a much higher potential return. We feel that we strike a happy balance: an optimal balance between risk and return.

– Compared to funds: We are much cheaper than traditional funds. This is because we don’t employ fund managers to move your money back and forth on a daily basis (who then collect a lot of fees and commissions in the process). Furthermore, we are more transparent. Our customers know where their money ends up.

– Compared to ETFs: In a nutshell, we allow you to directly buy company shares, rather than buying into a bundled product. For a detailed explanation, refer to the ETF question further down this page.

– Compared to real estate investing: Real estate is less liquid than a stock market investment. You can sell company shares on the stock market and quickly have the cash back in your account. Besides, real estate involves a lot of maintenance and hassle!

– Compared to a savings account or piggy bank: A diversified stock market investment is likely to grow over time, while a deposit in a savings account will be restained by the low interest rates on offer. On the other hand, the stock market can drop for a period of time, making it more volatile.

The bond component of an Inyova strategy is invested into an ETF (exchange-traded fund). This has two advantages:

It is much easier to trade and much more liquid than government bonds themselves.

It is also already diversified, as the ETF contains a variety of government bonds from industrialised countries around the world.

However, the stock part is not invested in an ETF, but into stocks directly. Stock-based ETFs have one big disadvantage: you cannot control what companies you invest in. You simply buy a bundled product. For example, you can put your money into an ETF based around the Swiss stock index, or a theme such as “Clean Energy”. But you won’t know what stocks such a fund contains. In addition, the fund manager gets to decide how to define “clean” – and he or she can change this definition at any time.

When you invest directly in the stock market, you know what exactly you have and you retain this control at all times.

The advantages of an ETF are that they are easy and low cost – but you lack personalisation and the fit with your values. At Inyova, you get these two things at a fair price tag!

As your asset manager, we don’t just give you advice and tips like an investment advisor. We also take care of implementing your investment strategy, and have authority to make and execute decisions in accordance with your investment strategy.

In a nutshell, we do the heavy lifting and day-to-day maintenance. You retain full control over the direction your investment takes, and you can access your money at any time – you don’t even need to go through Inyova to do this!

Your risk profile is a combination of your willingness to take risks (risk tolerance), as well as your financial capacity to take risks (risk capacity). When you take our discovery questionnaire, we ask you questions to understand your risk profile.

Risk capacity: How much risk you can afford to take on, considering your income and total wealth, your age, and how many people depend on you for financial support.

Risk tolerance: The level of risk you are emotionally comfortable with (we don’t want you losing sleep at night). Everyone is different, and some people don’t realise how risk-averse or risk-taking they are until they complete our discovery questionnaire.

In general, the longer your investment horizon, the better your investment can handle fluctuations in value, and the more profit you can expect. Generally, if you have a longer investment horizon in mind, we will recommend a higher the proportion of shares and a lower proportion of bonds.

Why? The most profitable investments tend to have bigger swings up and down in value across the short-term. But history shows that over time, the stock market’s upward swings are bigger than the downward swings. As an example, the value of stocks will usually fall significantly in an economic crisis. If you need to sell your stocks in the middle of the crisis, you may lose a lot of money. But if you can wait a few years, your stocks will probably be more valuable than government bonds again.

Shares bring more profit in the long run, but you may need to ride out short-term fluctuations.

100% of your money invested with Inyova is always available. Because you invest in highly liquid stocks and government bonds, you can withdraw your money at any time. However, if the stock market falls, you may end up selling your stocks at a less than ideal time.

One way around this is to define a “reserve” in your Inyova portfolio. This portion of your money will be invested in safer (but somewhat less profitable) government bonds. This is a great option if you already know you will soon need a certain part of the money.

Your investment strategy specifies what percentage of your money is invested in what companies. For example, it might state that 5% of your portfolio goes to Beyond Meat. But since individual stocks in your portfolio will grow faster or slower than others, Beyond Meat may end being more or less than 5% of your portfolio by the end of the year. In this case, your portfolio no longer reflects your strategy – and your risk is no longer optimally distributed. To correct this, we “rebalance” your portfolio by reallocating your money. This restores the correct distribution in your investment strategy.

At Inyova, we go by the Global Impact Investing Network (GIIN) definition:

Impact investments are investments made into companies, with the intention to generate social and environmental impact alongside a financial return.

We design your portfolio so you create impact without sacrificing your profits or taking on undue risk. However, we understand that some impact investors are happy to take on more risk or forgo some financial returns, in order to have an even greater impact. If this is your preference, we can adjust your investment strategy accordingly.

Inyova is a company based in Zurich, Switzerland, that was founded in 2017. We are a team of young entrepreneurs who built Inyova after years of working in both the financial and sustainability sectors. Our aim was to modernise the investment space, by giving people the control and customisation that is made possible by the digital-age, while also providing professional expertise and management. Above all, we wanted people to be able to invest in compliance with their personal values and vision for the world. Head to our ‘about us’ page to get to know the people in our team.

Two big beliefs motivated us to create Inyova:

We decided it was time to take responsibility. Responsibility for our environment, society, and the future world our children will live in. We knew a way to give you the opportunity to invest according to what you think is right – without having to sacrifice your financial goals.

We were not inspired with our experiences investing our own money. There was no transparency, and we had little influence over what our money did or who was allowed to manage our savings. We knew there was a better way!