Getting started is easy

Open your Inyova 3a account

Set up your pillar 3a fully online – simple and hassle-free.

Want to transfer an existing 3a? Easy! Simply open your Inyova 3a account, and we’ll guide you through the transfer.

Fund your account

Start saving sustainably for your retirement with a minimum investment of CHF 100 and unlock valuable tax benefits right away.

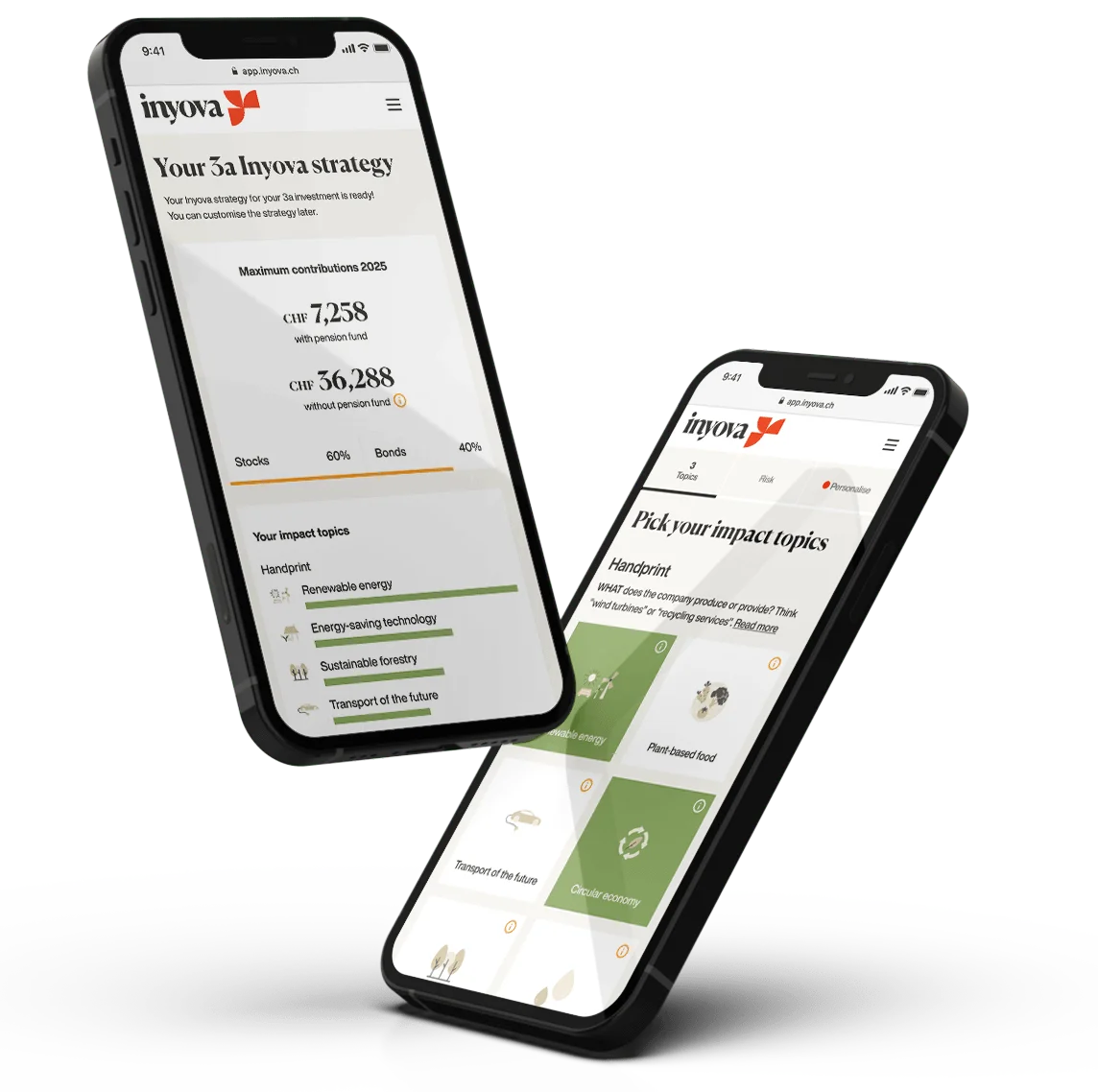

Monitor your impact investment

Stay up to date with our mobile app or browser, tracking both your financial performance and the real-world impact of your investments.

Annual Fee

0.8% p.a

fixed fee per year (paid monthly).

-

Local customer support Our friendly customer success team is here for you when you need it. -

Financial reporting & tax statements We provide a yearly tax statement at the beginning of each year that you can attach to your tax report or submit using eTax. -

Continuous risk management To manage your risk, we implement modern portfolio theory and diversify your investment across at least 30 different stocks. To reduce your risk exposure, we spread your investment across different industries, countries, currencies, company sizes, and other dimensions. -

Corporate Actions Management Corporate actions includes things like takeovers, bonus issues, rights issues, and consolidations at the companies you are invested in. We keep track of these and manage them on your behalf.

-

Dedicated impact team Inyova’s dedicated Impact Team are our in-house sustainability experts. They monitor the companies you invest in, and work with companies to improve their sustainability impact. The team also researches more companies to add to the Inyova universe. -

Annual rebalancing Your portfolio is well diversified and designed to grow with the stock market in the long term. We regularly rebalance your portfolio to maintain the optimal level of risk. This usually happens once per year, but it happens more regularly if there is an imbalance. -

Your own pension foundation account Liberty Foundation for 3a Retirement Savings is an occupational benefits institution subject to the supervision of the competent supervisory authority. Inyova is based in Zurich and fully regulated in Switzerland by PolyReg. Your account meets all regulatory standards. -

All transactions & currency exchange fees Your annual fee covers all deposits, transactions, and foreign exchange fees. Our foundation partner may charge an administration fee if you withdraw your Pillar 3a before retirement.

Impact investing means investing into the future.

With impact investing you participate in the sustainable transition of our economy – and generate long-term returns. We help you to make your investment future-proof.