Your investment portfolio is undergoing a transformation: a purposeful upgrade designed to position your investment for reliable long-term returns with even more impact.

Why is your investment strategy changing now? The short answer: because the world is changing – and so are your opportunities to build wealth and create impact. By embracing innovation and global megatrends, your upgraded strategy is designed to help you capture new opportunities, strengthen long-term performance, and maximise your positive impact.

This article walks you through:

- Our updated investment philosophy

- How your upgraded portfolio positions you even more competitively in a changing environment

- The process that shapes your portfolio

To get a more general overview of the upcoming changes to your portfolio, head over to our Info Hub.

Investing in the future: our investment philosophy

Impact investing means building your wealth whilst doing good.

That’s why our investment philosophy starts with a simple but powerful belief: Companies tackling the world’s biggest challenges will be the winners of tomorrow – and hence are best positioned for long-term growth and strong returns.

From clean energy and sustainable food system innovators, to businesses that strengthen supply chains and drive digital inclusion, demand for these companies is growing fast. And with that growth comes opportunity for financial returns and real-world impact.

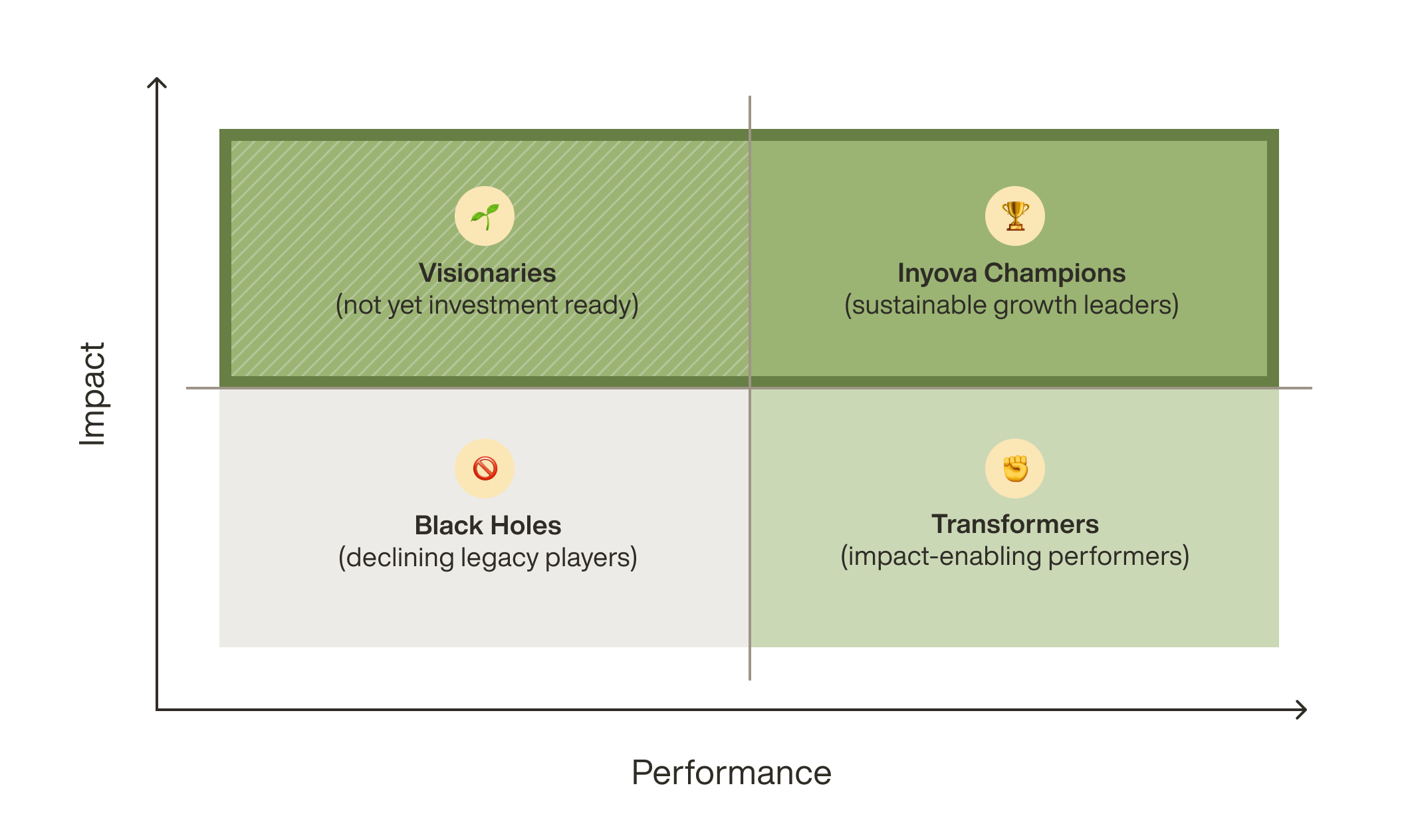

At Inyova, we assess companies along two key dimensions: how strong they are as a business, and how much good they do for the world. This framework helps us identify the most promising investment opportunities across four profiles:

Here’s how we think about the companies we select for you, based on their position in the impact-performance landscape:

- 🏆 Inyova Champions: These companies tick both boxes – they’re financially strong and truly sustainable. They represent the gold standard in our investment universe.

- 🌱 Visionaries: Some companies are sustainability pioneers but not yet financially ready. We keep an eye on them as future candidates for your portfolio.

- ✊ Transformers: These businesses are profitable but still need to improve on sustainability. That’s where our active ownership approach comes in – we engage with them to drive real progress.

- 🚫 Black Holes: Companies in outdated, high-risk sectors like coal and oil don’t make the cut. They’re excluded from your portfolio based on our strict sustainability criteria.

Your investments are focused where they can generate returns and do good – and where your shareholder voice can push for faster progress.

If you want to learn more about active ownership and the impact side of your new portfolio, you can dive deeper in this article – or explore the deep dives linked at the bottom.

The benefits: impact meets performance

Your upgraded investment strategy unlocks new opportunities for more reliable long-term investments and even deeper impact. Here’s what that means for your portfolio and your goals:

- Improved asset protection: Stronger risk management practices now better shield your investments against market downturns, providing more stability during volatile periods.

- More reliable long-term performance: Your portfolio is now better diversified and hand-picked by experts, ensuring each company is strategically positioned to benefit from long-term global megatrends.

- More impact: Companies are now selected with impact potential in mind. Together we now have a much stronger voice in influencing them to create tangible change.

The process that shapes your portfolio

At the core of your upgraded portfolio lies a strong foundation. Our investment process is based on research, strategy, and real-world insight.

1. The foundation: Inyova’s Sustainable Vision 2050

Our stock selection process starts with our Sustainable Vision 2050: a long-term outlook that defines how a low-carbon, sustainable economy in 2050 will look and which companies will shape it. It connects your sustainability values to investment opportunities.

This vision helps us identify the companies best positioned to shape a more sustainable economy and deliver long-term growth in the meantime. It’s rooted in global trends like decarbonisation, digital inclusion, and resource resilience – powerful shifts that are already reshaping the world around us.

We seek out the intersection of companies that can…

- Contribute to long-term financial returns

- Create real, measurable impact in the world

To deliver real-world impact & value-alignment for you, we apply strict screening criteria and deep analyses. Want to explore the vision in more detail? Read our Impact Deep Dive.

2. Positioned for success: crafting your portfolio

Reliable long-term performance is at the core of smart investing – and your upgraded portfolio is built to deliver it, targeting businesses that could double in value over the next decade (approx. 7.5% annual returns).

We’ve expanded and enhanced our investment approach to give you more opportunities for strong, stable returns:

- A broader investment universe: we now start with over 1,000 globally listed companies – more than triple our previous selection. This means better diversification, greater resilience, and more high-potential businesses to choose from.

- Expert selection process: our team now combines deep human-led research with advanced data to identify companies that are financially sound, able to create impact, and well positioned to thrive in the long run.

- A portfolio designed to adapt: your portfolio is built using clear investment guidelines and strong risk management frameworks – considering sectors, regions, currencies, and market dynamics – so it remains balanced and resilient across different scenarios.

Here’s how we build your portfolio:

- We screen for financial strength, to make sure every company is a solid long-term investment.

- We look for future champions, identifying businesses aligned with global megatrends and impact potential.

- We carefully balance the portfolio, so your investments work together to provide stability and growth.

Throughout the process we draw from an expanded range of proven investment frameworks that have been refined over decades, including:

- quantitative screenings of key sector metrics, like Return on Invested Capital

- market sentiment analysis, including forward-looking tools like Porter’s 5 Forces

- custom-built valuation models

- proprietary research and expert insights

From there, your portfolio is carefully constructed using clear investment guidelines around sectors, currencies, and other important factors. Each company is chosen for its ability to contribute to impact and perform across a range of scenarios. That means looking at how companies are likely to behave individually and in combination with others, across different market conditions and sustainability themes.

In short: your upgraded portfolio reflects a far more advanced investment process, giving you the confidence that your money is being managed with both precision and purpose to deliver on your financial and impact goals.

3. Staying ahead: ongoing evaluation & monitoring

In today’s evolving markets, long-term success depends on being able to adapt. That’s why your upgraded strategy includes ongoing evaluation and active oversight – helping us spot changes early and take action when needed.

We now monitor each company in your portfolio using:

- Daily price movements vs. our internal fair value estimates

- Major news or changes in outlook

- Weekly re-evaluation of each company’s investment case

This ongoing oversight allows us to:

- ✅ Protect your portfolio in a fast-evolving market

- ✅ Capture new opportunities sooner

- ✅ Ensure your portfolio is made up of the strongest companies

Our team of experts in equity research, portfolio management, impact analysis, and corporate engagement deliver this ongoing quality for you. We make your investment grow, adapt, and deliver on your goals.

Our enhanced portfolio management framework gives your investment the flexibility to stay on course – even in the face of economic, political, or climate-related change.

So what can you expect next?

We’ve updated our approach to help you invest in companies that align with your values, drive real progress on global sustainability challenges, and deliver competitive long-term returns – creating a portfolio that truly invests in a future we all want to live in.

You can lean back. Your portfolio will be upgraded automatically. We’ll notify you by email once the switch is complete.

In the meantime, you’ve also received a contract update. This includes updates around Inyova’s FINMA status and investment strategy. You can review the full update here.

Ready to find out more?

Here’s where you can explore more details:

- Get an overview of the upcoming upgrade

- How your new portfolio generates impact

- FAQs: Answers to your most common questions

Have more questions? Email us at [email protected] or call 044 271 50 00.

Your investment is powerful. Use it to create the future you believe in.

Disclaimer: Past performance of financial markets and instruments is never an indicator of future performance. The statements or information contained in this document do not constitute a recommendation, offer, or solicitation to buy or sell any security or financial instrument. Inyova AG assumes no liability whatsoever with regard to the reliability and completeness of the information contained in this article. Liability claims regarding damage caused by the use of any information provided, including any kind of information which is incomplete or incorrect, will therefore be rejected. Furthermore, the statements contained in this document reflect an assessment at the time of publication and are subject to change. References and links to third party websites are outside the responsibility of Inyova AG. Any responsibility for such websites is declined.