When it comes to personal finance, many investment managers have been playing a long game of “confuse and conquer”.

To win your business, they make their products and fee structures complex and sophisticated, all while emphasising the fantastic returns. Once you’re locked in, you start paying all sorts of hidden fees and charges.

Industry insiders have long known this practice is commonplace – but until now, it’s been difficult to pinpoint exactly how widespread the problem is.

Financial Times has now revealed the cost of investing in several popular funds, including BlackRock and Vanguard, is up to four times higher than first thought….

Wait, aren’t there laws & regulations that protect customers from hidden fees?

Up until the end of 2017, fund managers were able to pretend their “Ongoing Charge Figure” (OCF) was the full cost the customer incurs when they invest. In reality, customers pay much more.

Thanks to a very recent EU law change (known as MiFID II), banks and financial institutions have to be more upfront. This includes telling customers about sneaky things like “transaction fees” (which arise from investing into the fund or withdrawing money from it), “performance fees” (charged if the investment value grows) and “platform fees” (an all-encompassing fee that can cover just about anything the provider decides to charge you for).

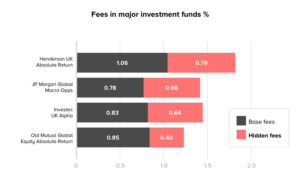

Scarily, Financial Times discovered the total cost of investing can swell to four times as much when these additional fees are taken into account. In one case, a major fund advertised fees of 1.06 percent, when the total cost of investing was actually 3.82 percent annually.

The chart below shows base fees (the advertised cost) versus hidden transaction fees in several major funds. It does not include additional hidden costs such as performance fees or platform fees, as this data was not available at the time of publication – more about that in a moment.

Some people may conclude that these numbers look fairly minor. But these extra fees can erode your returns significantly – in some cases, it can mean the fund manager is making more profit on your investment than you are.

What does the Loch Ness Monster have to do with the MiFID II regulation change?

The industry lobbied strongly against this regulation change, insisting the new rules wouldn’t reveal anything. In the UK, the major industry body went as far to call hidden fees the “Lochness Monster” of the investment world, claiming that these costs were a mythical beast that didn’t exist… hence there was no need to go looking for it.

Well guess what: When regulators forced fund providers to pull water out of the lake, the monster was there. What’s more concerning, is that we also have a clear case where the industry only came clean because it was forced to by legislation.

So what else is swimming in these murky waters?

Well… despite the new rules, it remains difficult to get a clear information of the total fees you incur when you invest your savings in many funds. Even the professionals are struggling! One wealth manager told Financial Times it was a “very time intensive exercise” and another admitted “I just gave up”.

Worse still, funds appear to be calculating fees differently (some in the industry suspect this is a strategy to make the fees appear cheaper) and at least one fund was reporting transaction fees in negative percentages at the time of publication.

The bottom line on hidden fees….

Although it’s good to see consumers getting more transparency, this is only one very small step in the right direction. We suspect there are more slimy monsters yet to be discovered.

Transparency is something we at Inyova care deeply about. We charge an all-inclusive fee between 0.6% and 1.2%, depending on the total balance in your account. Uniquely, we also show you the exact list of companies we recommend you invest in, before you decide whether it’s right for you.

Interested? The first step is to get your personalised impact investing strategy on our website – it’s free, and there’s no obligation to continue. We show you exactly what stocks we recommend, and you can tweak it until you’re happy. With every adjustment you make, our algorithm makes sure your portfolio is financially sound.

Get your free impact investing strategy here.

If you have an Inyova strategy already, login to view it here.