When it comes to your finances, your top priority should always be understanding where your money is going and what returns to expect from your investment. But it doesn’t need to be complicated. In this guide, we’ll teach you how to invest money the smart way.

Firstly, why should anyone invest money? Will investing make me rich?

Many people stockpile their money in a savings account. They believe doing so keeps them safe from the risk of losing their money. And they’re not entirely wrong — it’s true that every investment that promises a good return is also associated with a small or big risk.

However, you should remember that your savings account assets will always depreciate over time. That’s due to the low-interest rate of about 0.01% and the simultaneous increase in inflation. In addition, starting next year, almost all Swiss banks will start charging fees for account management and other services, such as cash withdrawals.

With that in mind, a bank account may not be the ideal place to “invest” your money.

We’ve written a blog post about the smart alternatives to savings accounts in the past – for those who are able to take a longer-term view, one solution is investing your money!

Maybe you’ve seen Hollywood blockbusters and are now dreaming of getting lucky on the stock market. But as you can easily see, there’s often considerable risk to make a quick buck.

Let’s be clear: we don’t recommend putting all your eggs in one basket and running the risk of losing it all on the stock market.

One way to reduce risk is to diversify your money. Diversification entails allocating your money between companies from different industries, countries and other factors.

Diversifying your investments might not produce wealth overnight, but at least you can sleep peacefully knowing your return doesn’t depend on a single factor.

What does “investing money” actually entail?

First, let’s clarify what we generally mean when talking about investments. Remember: not every purchase is an investment. Investing money means “…putting it into financial schemes, shares, property or a commercial venture with the expectation of achieving a profit”.

In contrast, consumer goods, such as a new fridge or a Honda Civic, generally lose value as time goes on.

Investing is done with the intention of creating return on investment (ROI). Although the idea of “making your money work for you” sounds appealing, investments typically come with a risk of losing money, and some also require additional work. For example: if you invest in a property, it’ll require management and maintenance in order to stay at market value.

There are some great alternatives that require less work — we’ll cover some investment options later in this article.

As mentioned before, growth-oriented investments always come with a degree of risk. At Inyova, we have strategies to ensure our customers’ investments offer a good balance between potential risk and potential return. However, there is no such thing as a “risk-free” investment. Read more about our approach in this article.

It’s also important to remember that investing money should always be approached with a long-term view. We recommend going into an investment with a view of holding it for at least five years.

Who should invest money?

Everyone! There’s no such thing as a “typical” investor.

At Inyova, we’re proud to say almost a third of our customers are women. And more than half are younger than 35.

The question of how to invest money the smart way is something that puzzles people in various situations and at different times in their lives. Regardless of whether you want to invest in stocks, buy a property or even if you prefer to invest online, the first step is always to save enough money to get started. Our savings plan can help you make a little more money each month. We’ve also put together the best savings tips to help you get started with saving in everyday life.

According to a study from the Federal Statistical Office, the average Swiss household can save around CHF 1,300 per month. Of course, this figure is heavily dependent on total income. Although the average household has around 15.5% of salary left over at the end of the month, low-income households cannot set much aside as savings.

According to another study, Swiss investors seem to be a bit wary of investing in the stock market. This is especially true of young Swiss citizens between the ages of 20 and 30 – many have never invested any money in shares.

From our point of view, it makes sense to start investing as early as possible, so as to commit your money for a longer period. That’s thanks to compound interest, the most powerful force for growing wealth. Compound interest happens when money earns interest… and then earns interest on that interest… and interest on that interest… and so on.

You don’t need a large fortune to invest money in the beginning. You can simply start by investing small amounts – we explain how in this article.

In general, at Inyova we advise you to start with at least CHF 2,000 so you can diversify your investment sufficiently. This enables your investment to be distributed across companies of different sizes, industries, and countries. You can also decide which companies you want to include in your portfolio, and how much of a risk you want to take.

Although it’s possible to withdraw money from Inyova at any time, we recommend you invest for at least five years. The longer the time of your investment, the more accurately we can calculate the returns you can expect from historical values.

Where can I invest my money?

There are various ways to invest money in Switzerland – we’ve listed the most popular options below.

If you want to learn more, check out our article “A Guide to Swiss Investment Options”, where we provide a more comprehensive overview of where to invest your money in Switzerland, and discuss the respective advantages, and disadvantages of various investment options.

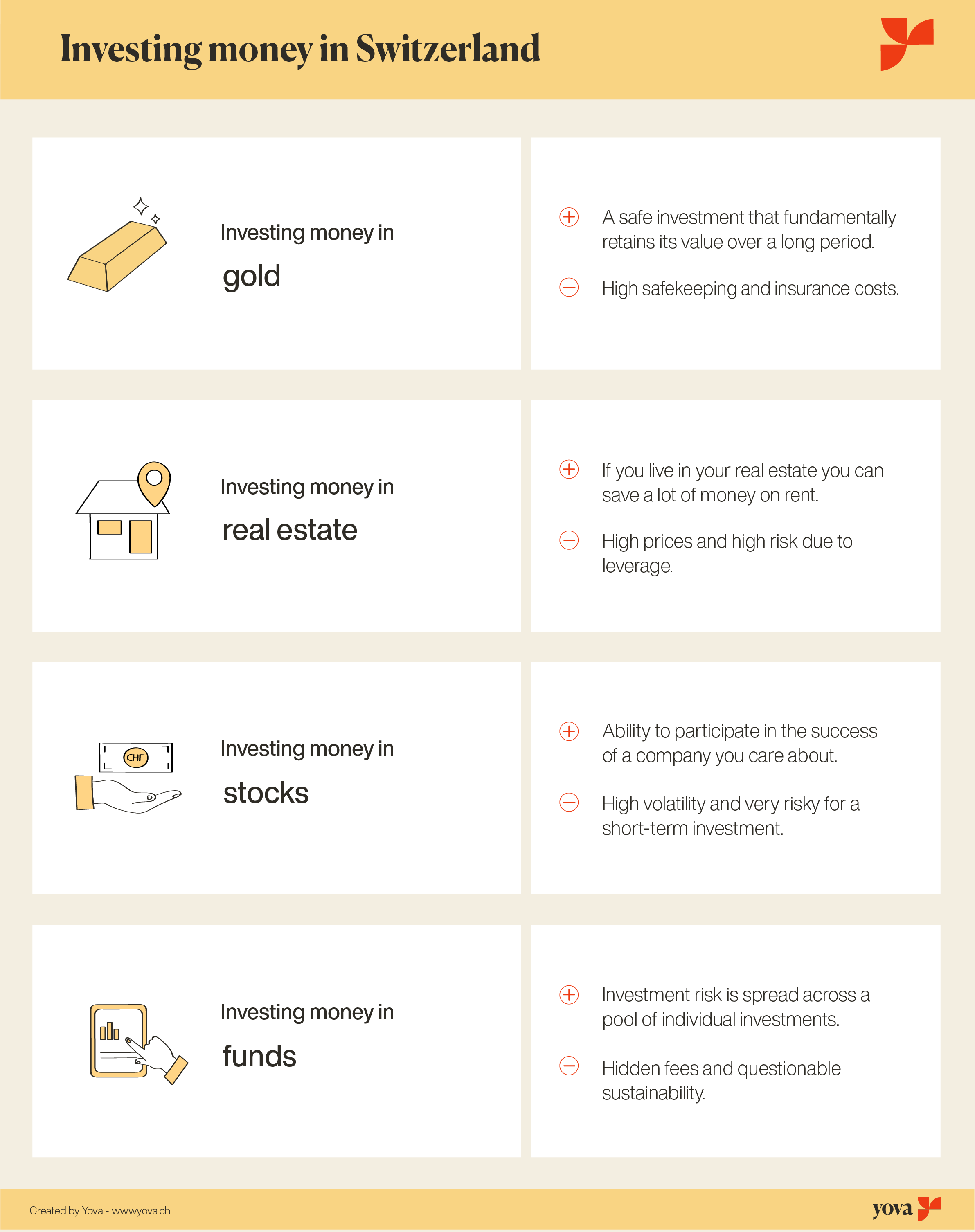

Investing money in gold

A recent study by the University of St. Gallen revealed that the Swiss are particularly keen about investing their assets in gold. Around two-thirds of those surveyed consider gold to be a sensible investment, and one-fifth said they intend to invest in gold soon.

Gold is considered a safe investment as it fundamentally retains its value over a long period. However, it’s important to note that the safekeeping and insurance costs of gold bullion are quite high.

Another thing to note: because precious metals don’t create a real return, you have to wait for the price of gold to climb.

If ethical investments are important to you, also be aware that mining precious metals often harms people and their environment.

Investing money in real estate

The Swiss enjoy investing their money in real estate, either as an investment or their own home. But real estate prices are high, and houses and apartments often have to be financed to a large extent by external borrowers. In turn, this carries a risk for you.

Let’s say you buy a house with 20% capital. If property prices then drop by a fifth, for example in the event of a real estate crisis, your capital will have disappeared. This means that you’ll probably have to invest a large part of your money in buying real estate, and all of your eggs will be in one basket.

Accordingly, we advise you to diversify your investment. This is because downturns in one industry or region are often compensated by upturns in another.

If you do decide to invest in the real estate market, you should also be aware that rental yields (income in relation to the purchase price) are well below 5% due to the high prices.

Part of the income earned from a rental property must also be invested in the management and maintenance of the property and to ensure that it is not left vacant.

Investing money in shares

Those who want to invest their money in various companies can do this through shares, and thereby become co-owners of the company. Investing in shares allows you to participate in the success of a company.

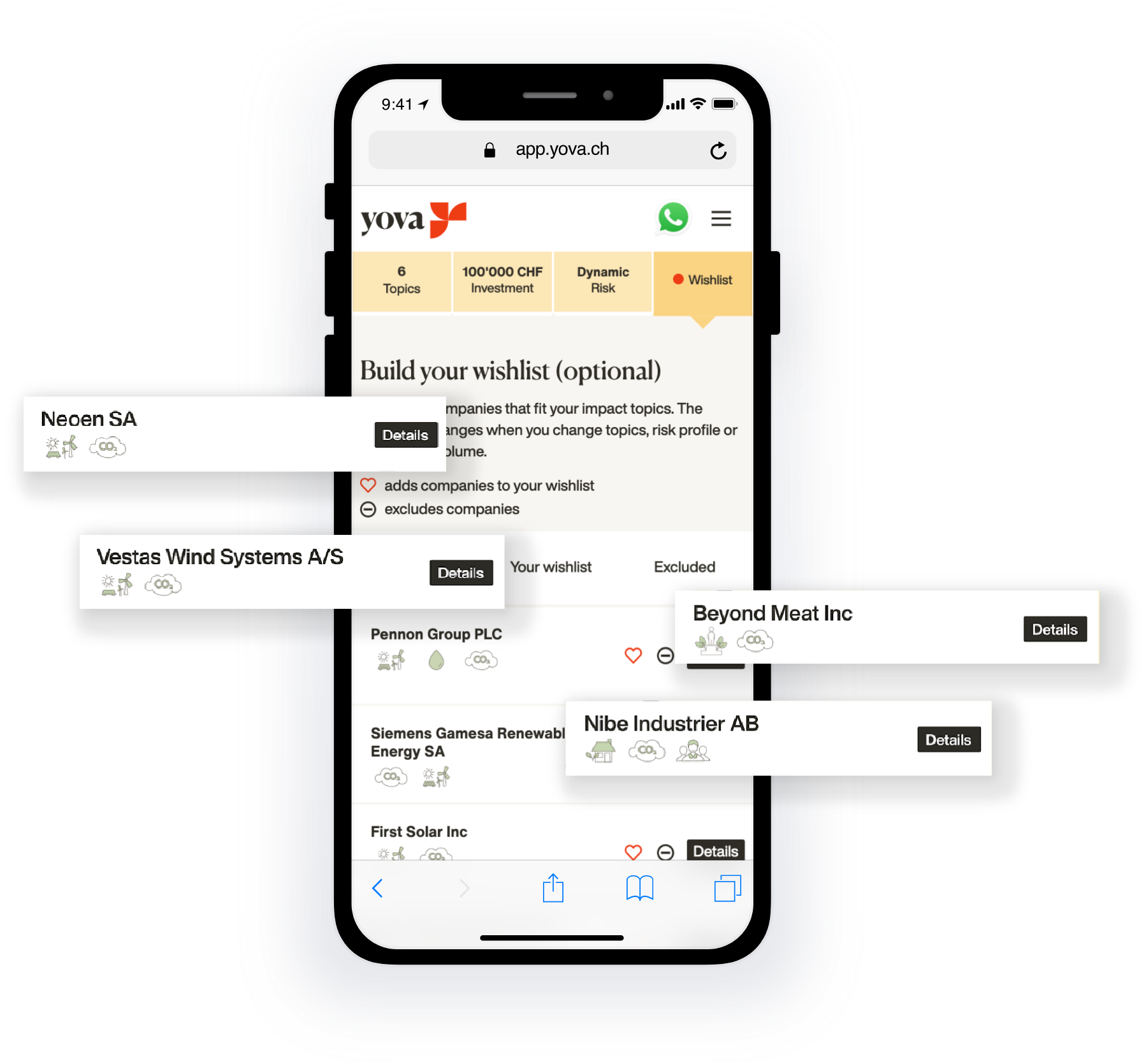

With Inyova, you can choose which companies you want to invest your money in. You’ll also see the impact of your investment. This allows you to invest in line with your values and avoid companies whose core values and principles do not match yours.

If you want to invest without an asset manager, it’s important to understand in advance how to manage the risks of your investment. You’ll also need to deal with issues such as transaction fees and taxes.

When investing in the stock market, be aware that the market is subject to fluctuations and that stock prices can change daily. To compensate for these fluctuations, we recommend investing your money for a minimum of five years.

However, if you need to withdraw your money due to an emergency, you can sell the stock at short notice and generally have the money in your account within seven business days.

Investing money in funds

When you invest in a fund, you’re co-investing with other investors in a bundle of shares, bonds or other assets, not just a single company. These investment funds are managed by fund managers. You have no control over what exactly your money is invested in.

Having said that, a major disadvantage of funds is that often, you have little insight into the exact costs of the investment due to the complex structure. This can lead to an investment becoming more expensive than initially expected.

But where is the best place to invest my money?

This, of course, all depends on why you want to invest your money.

We recommend investing in a diversified portfolio of at least 30 to 40 corporate shares. The companies in your portfolio should be diversified across countries, industries, industries, company sizes, and currencies.

Are you wondering how you can invest your money for a high return?

With Inyova, you can create your own diversified equity portfolio free of charge and without obligation. Although we’d like to promise you your desired return on your investment, we simply can’t – but neither can any asset manager or ETF provider.

By diversifying your investment, however, we can design your portfolio so that it participates in the growth of the stock market. As the stock market rises in value, so will your portfolio.

What do I have to consider when investing money?

Of course, there are a few more things to consider when investing money.

Here are 3 common pitfalls to watch out for.

Difficult terminology

Many people describe the financial market as complicated. One reason for this is that there are many technical terms that you may not have heard before.

At Inyova, we try to make your entry into the stock market as easy as possible by using as few technical terms as possible. But if you happen to have a specific question about a certain term, please feel free to contact us at any time.

Sustainability and involvement

Another important question is how to invest your money the smart way without compromising your values. If you’re concerned about sustainability and environmental protection, it’s also important to invest your money in companies that represent these values.

But this is more difficult than it sounds. Even if you invest in a sustainability fund, you may inadvertently invest in companies that have little to do with sustainability, such as Nestle, McDonald’s or Total SA.

If you want to learn more about how this can happen, please have a look at our article: “Why Alibaba may be found in a sustainability fund”. You’ll see that many funds are structured in a way that makes it difficult to tell which companies you’re investing money into.

Our approach is to ensure that your investment is in line with your values. If you are avoiding plastic or eating less meat in your everyday life, you probably don’t want your investments to support companies with little concern for the climate crisis.

If you want to live a more sustainable lifestyle, it should also be reflected in your investment. Our online investment tool lets you choose the topics that are important to you so that your investment strategy is completely personalised to your wishes.

Hidden costs

Once you have decided to invest your money, you’ll encounter a new problem: it’s difficult to tell what the investment will cost.

Investments can incur many costs, such as transaction expenses or fees for the fund manager. In fact, many banks are experts at hiding fees. As a result, it may cost you dearly if you skim the fine print or fail to inform yourself sufficiently in advance.

We want you to know how much you’re going to end up paying for your investment. This is why we are transparent about all our fees.

At Inyova, we charge an all-inclusive fee between 0.6% and 1.2%, depending on the amount of your investment. With this, everything is included and there are no additional costs for you.

Summary: The most important tips for investing money in Switzerland

Decisions such as whether to start investing your money are often postponed. We hope our guide has made it easier for you to take the first step. To finish this guide, we’ve summarised our most important tips below.

And if you can’t think of an excuse why you haven’t invested your money yet, then let’s create a portfolio together!

Don’t put all your eggs in one basket

When investing money, make sure that your assets are split among a variety of investments, currencies, and companies from different industries, regions and other influencing factors.

Don’t abandon your values

If it’s important for you to buy organic food or green electricity in your daily life, your investment should also reflect these values. Although it is great to eat an organic tomato, your investment may have a much greater impact!

You can invest in shares without a lot of money.

It’s a misconception that only the rich can invest. In fact, starting with small amounts can be one of the best ways to achieve your financial goals. And unlike in the past, the digitalisation of private investment methods provides more investment opportunities for people of all budgets.