The last 12 months have been shaky for stock markets around the world. In this article, we briefly cover what happened, some of the causes of this slide, and what it means for you (whether you have already invested, or are considering starting an investment soon). We wrap up by sharing 7 tips to help you minimise your risk on the stock market.

This article was published in 2018. Click here to read 3 Ways to Invest During the Corona Virus Crisis.

What’s been going on?

Let’s start by looking back. The year 2017 was an euphoric time on the stock market. Stocks were rising in double digits and all the world’s major economies showed positive signs. But the joy was short-lived.

By August 2018, the mood on both sides of the Atlantic had taken a dive. By the end of the year, the value of stock markets in the USA and Europe had dropped by around 10%.

Some industries suffered more than others. Over the course of the year, the stock price of Swiss technology companies U-Blox and AMS dropped by more than 50 and 70 percent respectively. In Europe, the overall value of the banking and automotive sectors fell by more than 30%.

What caused the stock market to be so volatile?

Several factors played a role in the performance of the stock market in 2018, the most important ones being:

- Rising interest rates in the USA

- The trade dispute between the USA and China

- Political unrest in Europe (Brexit, Italy, France, Spain)

- Slower than expected economic growth

What does this mean for you?

If you are thinking about investing: When stock market prices are low, many successful investors take the opportunity to buy more stocks at these lower prices. In a perfect situation, you would buy at the bottom of the market and benefit from prices bouncing back. But of course, it’s difficult to predict what will happen next. Stock markets can be unpredictable, and further losses can never be ruled out.

If you’re already invested: First, take a breath. We expect these events to happen along the way. If you invested through Inyova, these shakes and slides in the market are already reflected in your long-term profit expectations. For that reason, we recommend doing absolutely nothing. Many decades of financial data illustrate that the markets have always trended upwards in the long term, despite short-term turbulences along the way.

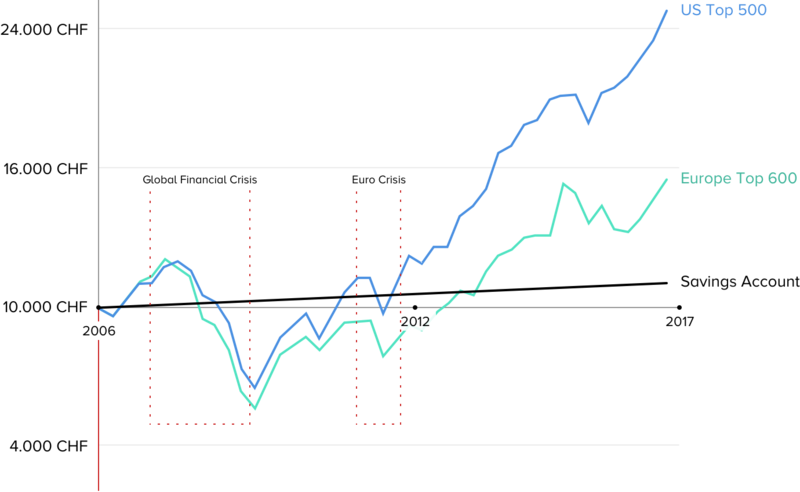

Let’s take a look at this chart:

Here, you can see the markets took a major hit during the Global Financial Crisis. But you can also see that investors who rode out the storm for a few years were soon making strong gains once again.

It’s also important to remember that the economy evolves in cycles with upswings and market corrections taking turns. So a market correction is nothing unnatural or problematic. Over the long run, the market typically grows, and short-term drops are just part of this long-term trend.

In general, if you have a well-diversified portfolio, our advice is to simply buy and hold. Rather than reacting to market changes, hold a steady course.

So why do people sell stocks when the market drops?

It’s an interesting psychological phenomenon: Humans take comfort in moving with the crowd.

When everyone is buying, there’s a “fear of missing out” that drives more and more people to buy. Since stock prices are driven by supply and demand, this pushes stock prices up. Likewise, nervous whispers can sometimes send a crowd of investors into a fear-driven selling frenzy. These emotional decisions will lead you to buy high and sell low. Obviously, that’s not the most strategic approach to investing.

7 tips for investing in the stock market successfully

- Diversify your investment across different companies, industries, countries, company sizes, and currencies.

- Consider the level of risk you’re comfortable with, and account for this in your strategy. If you are invested with Inyova, your risk tolerance is already reflected in the portfolio.

- Go into the stock market with a long-term view. The last thing you want to do is sell your investments in a less favourable market.

- Watch out for hidden fees.

- Avoid buying and selling stocks reactively. By the time you hear about something in the news, the stock price most probably already reflects that information.

- Be careful about making decisions because you’re over-excited, fearful, or nervous. Emotion often leads people to buying high and selling low. If you have a well-diversified portfolio, it is best to simply buy and hold.

- Don’t wait until the timing is ‘perfect’ to enter the stock market. As they say, the best time to invest was 20 years ago and the second best time is right now.

The bottom line

So, is the stock market safe right now?

If you have a well-diversified portfolio, and take a long-term view, there’s little reason to be worried about a stock market investment.

You will only feel the sting of recent events if you are forced to sell your stocks in a hurry. Prices are down right now, but many decades of financial data illustrate the markets have always trended upwards in the long-term, despite these short-term turbulences along the way. Of course, historical performance doesn’t always predict future performance.

At Inyova, all our customer portfolios are designed for diversification and long-term growth. Want to see how we do it? Start building your investment portfolio here (free and without any obligation).

If you have an Inyova investment strategy already, login to view it here.