Talking publicly about money has always been considered rude, especially in Switzerland. And even in private family settings, financial topics are often not considered to be a welcome dinner table conversation. Dr. Mara Catherine Harvey, a financial expert and mother, believes that it is time to change the narrative of how we talk about money, especially when it comes to money conversations with our children.

In our webinar “Financial Parenting” she explained why talking to your kids about money can boost their confidence and convey lifelong money skills that they’ll benefit from for the rest of their lives.

In this article you will find Dr. Mara Catherine Harvey’s top 5 tips to start a child-friendly conversion about money for parents and all people with children in their lives.

Tip 1: Start the conversation early

Why is it so important to start early? Money doesn’t only have an impact with the transactions you make, it’s also a reflection of your own values. By talking about money with your child, you can teach them your values and help them make good choices in their future. “That’s why money and values go hand in hand”, said Dr. Mara Catherine Harvey in our “Financial Parenting” webinar.

She recommends starting as early as possible: “As soon as your child is old enough to understand that money is not something that they should stick up their nose, they are ready to have a conversation about it.” Children develop key habits and understandings much earlier than you would expect. Cause and effect are understood by age 3, confidence begins to be shaped by around age 5, and adult money habits are already set by age 7. This means, the earlier you start talking about money with your kids, the easier it will be for them to develop healthy money habits in the future.

Tip 2: Talk about equality and injustices

Did you know that there’s already a visible pay gap of 10-30% by the age of 10 for young girls? “It’s simply because all of the biases we see in the labour market are visible throughout society. Girls tend to get steered towards the chores that earn less pocket money and boys get steered towards the chores that are more valuable. Or the boys are just bolder and have more confidence than girls when asking for money,” explains Dr. Harvey. That’s why she has written a children’s book series to change the narrative for an equal financial future: “You cannot be what you cannot see, that’s why girls do need to know that there are pay gaps out there.”

Unfortunately, there are more injustices than just gender inequality in our world, and they are equally important to discuss. An important feature of money is also the impact it has on the world, as Dr. Mara Catherine Harvey explains: “When it comes to spending money, it’s crucial to teach children about sustainability and impact. Because money is not just a transmission of value: it’s a transmission of values. If children had their say, would they give money to firms that don’t care for the planet, or rather to firms that are building a sustainable future? Children must know that they have a voice because they can make choices that matter with their money. This is key for their financial future and it is vital to ensure a sustainable future for all.”

Are you interested in finding out more about how investing for kids works and what kind of values you and your children can choose from? You’ll find a detailed description of what you need to know before investing for kids in this article.

Tip 3: Introduce pocket money as a learning opportunity

For Dr. Harvey, it’s not about which approach is right or wrong, it’s about what kind of message you are teaching your child by giving them an allowance: “Reflect carefully on the money messages you are conveying to your child. I am a big fan of tying pocket money to chores because it’s a learning opportunity that is going to be important in their later life”.

Assigning chores to your child gives them the opportunity to learn how to earn money. It gives them the opportunity to discuss with you what chores they might be doing and what each chore is worth. As Dr. Harvey put it in our webinar: “That skill, to ask what something is worth, and to negotiate with you as a parent, is going to be a skill set for life.”

Tip 4: Talk about options to store the money

While a piggybank is surely a good start, you can talk to your children about banks and explain what they do. It’s also important to explain to your child why money in a piggy bank can’t grow. While the notion of interest is very hard to grasp for little minds, it’s the only way to explain how money can grow when it’s working for you instead of just sitting around in a jar.

Dr. Mara Catherine Harvey sees this topic as an excellent opportunity to not only talk about how money can grow by investing it, “but also how it can cost money when you are using debit or credit cards later in life”.

Tip 5: Think long-term

“Research believes that kids today are very likely to live beyond the age of 100 years. Longevity is the biggest challenge they are going to face if they are not equipped with the financial literacy skills that will get them through those 100 years”, warns Dr. Mara Catherine Harvey. Increased life expectancy will put extra pressure on the already struggling pension systems of today, jeopardising post-retirement quality of life for anyone relying on these systems. “Technically, 30% of every penny they earn in their entire working life, needs to be set aside in order to be used in retirement.”

That’s why children seem to be the best investors: they have time on their side. The longer you keep your investment, the longer it can grow. And the more you invest, the higher the returns might be. As Dr. Mara Catherine Harvey knows from experience: “Good habits start early and teaching a child to save should be like teaching a child how to brush their teeth”.

Talking about money doesn’t only help your child to develop into a responsible adult, it also gives them confidence, negotiation skills, and healthy money habits. Or as Dr. Mara Catherine Harvey sums it up: “You are your child’s most important role model in money matters.”

Do you want to watch the webinar? You can find the recording of “Financial Parenting” with guest speaker Dr. Mara Catherine Harvey and Inyova CEO Dr. Tillmann Lang here:

How can I start a sustainable investment for my child?

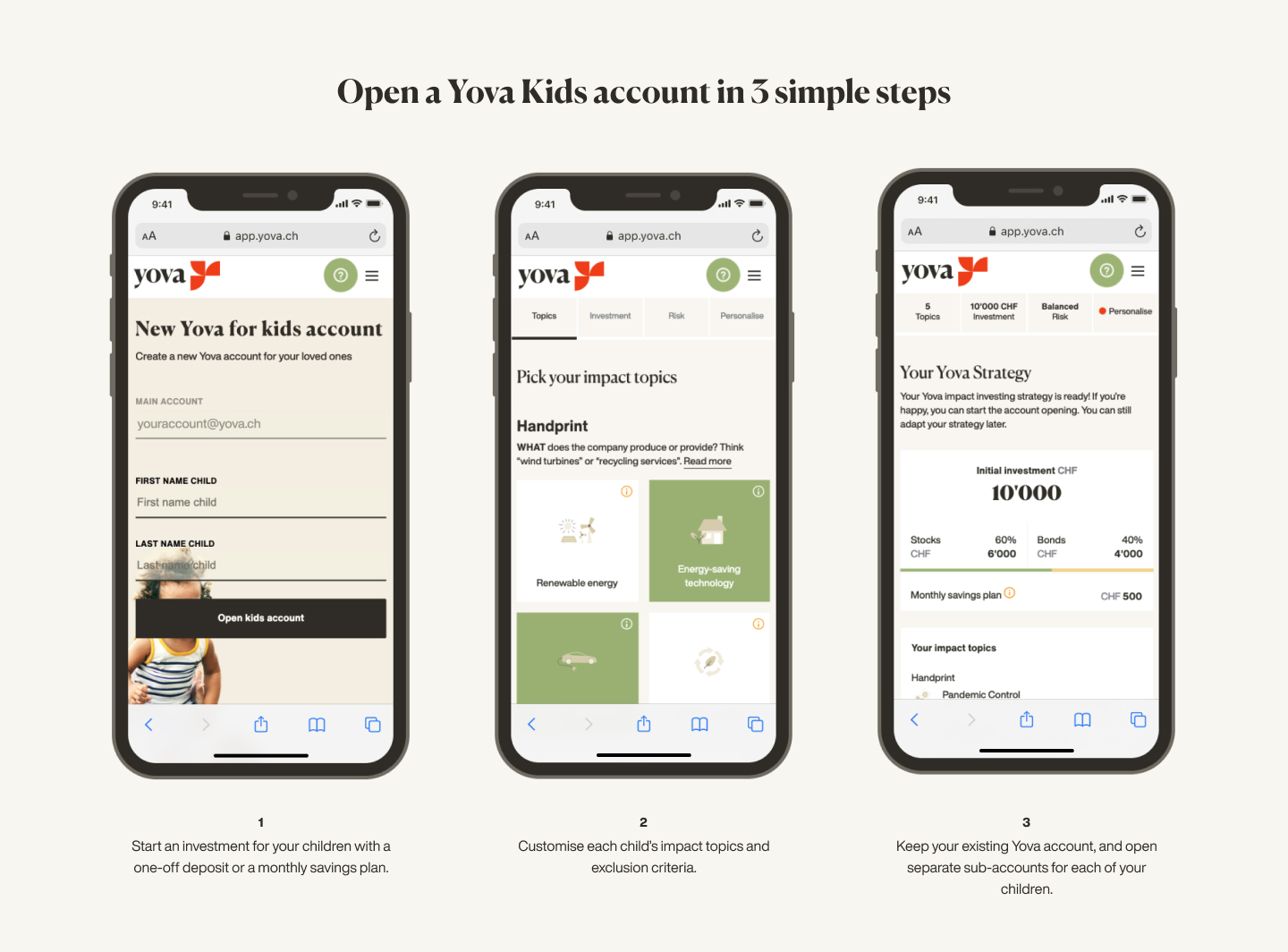

The first step is to get your personalised impact investing strategy – it’s free and non-binding. With our online tool, you can select impact topics that are important to you and your family. You can also use our hand- and footprints as a means of starting a conversation about values and choosing together what kind of companies you’d like to add or exclude from your portfolio. Your child’s Inyova strategy will be fully personalised, professionally diversified, and designed for an attractive financial return.

Get your free impact investing strategy here.