The climate crisis is the predominant challenge of our time. As the fossil fuel industry is the largest emitter of CO2, the world needs to transition to clean energy at a rapid pace in order to have an effect on global warming.

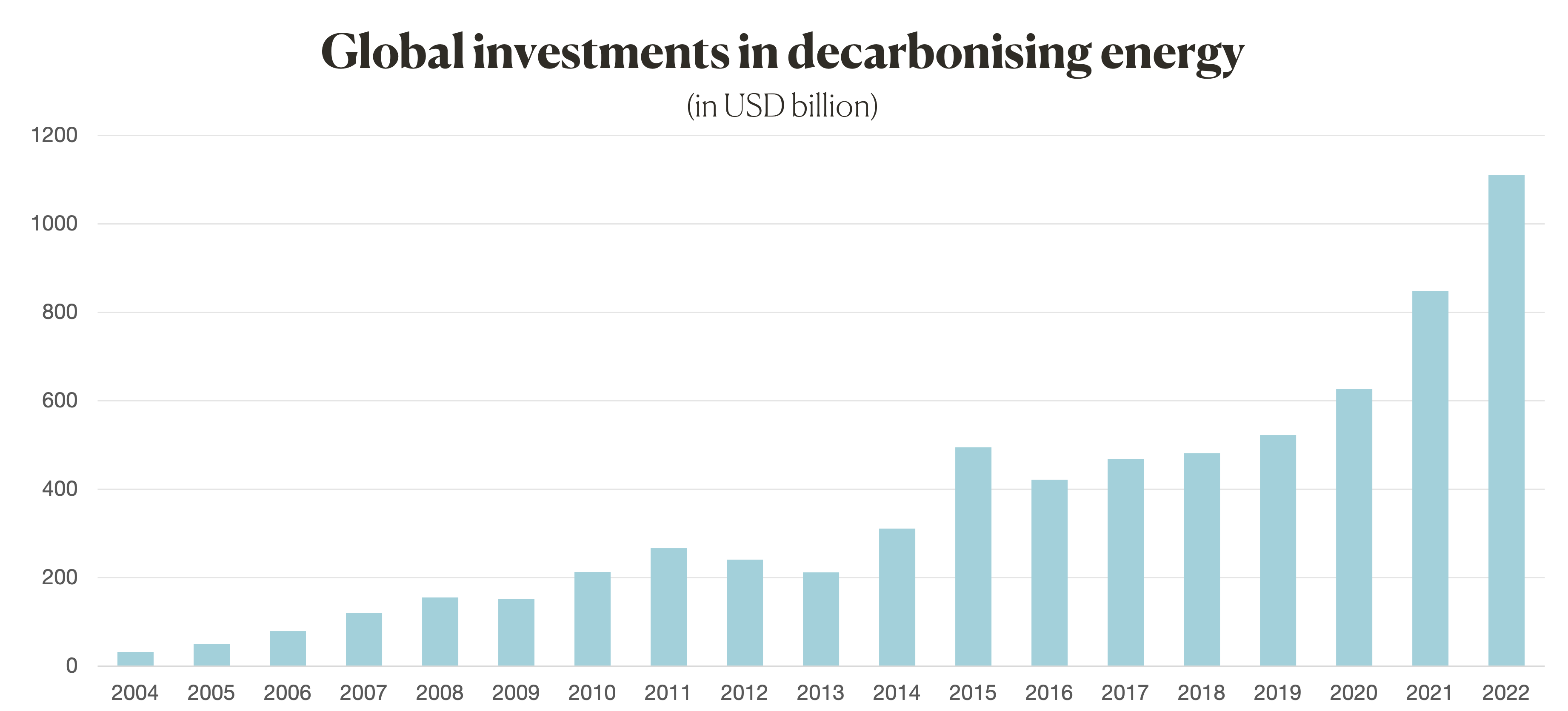

The good news is that last year set a phenomenal record in the clean energy space. Not only did total fundings surpass USD 1.1 trillion for the first time; but it was also the first time that the funding for clean energy was equal to that for fossil fuels. 🥳 By total funding, we mean commitments of businesses, financial institutions, governments and end-users towards a low-carbon energy transition. At the same time, these investments continue to fall short of what is needed to reach “net-zero” by 2050, a goal set by the European Union.

Source: Bloomberg, 2023. Clean Energy Sets $1.1 Trillion Record That’s Bound to Be Broken.

In this blog post, we will discuss which sectors are benefiting from the transition to more clean energy and what that means for your portfolio.

Clean energy – what’s that?

Clean energy refers to the sectors that support the energy transition. These are renewable energy like wind or solar power, energy storage, electrified transport, electrified heat, carbon capture and storage, hydrogen and sustainable materials. Almost all of them saw an investment influx in 2022.

Which sectors benefited the most from this transition?

Renewable energy, which includes wind, solar, biofuels and other renewables, remained the largest sector in investment terms. The sector set a new record of USD 495 billion in funds committed in 2022, which is an increase of 17% from the previous year.

Electrified transport, which includes spending on electric vehicles and associated infrastructure, came close to overtaking renewables, with USD 466 billion spent in 2022 – an impressive 54% increase year-on-year.

Where can we see this growth?

- Global passenger electric vehicle (EV) sales grew at an annual rate of 71% in Q3 2022. Interestingly, 3 of the top 5 best-selling EV brands are from China. The two major non-Chinese players in the space are Tesla and Volkswagen.

- While Tesla has been in the news recently for missing expectations around the number of vehicles they’re selling, the company hit a new record with 405,278 cars sold in the fourth quarter of last year.

- Still, while Tesla is selling more units than ever before, the once sole leader in the space is losing market share as more affordable brands are rising.

- Volkswagen also registered 28% annual growth. In fact, the vehicles that make up its electric fleet like the ID.4, ID.3 and ID.6 series were the top-selling Volkswagen models in the third quarter.

- As you may recall, Inyova has also been active in pushing BMW to speed up its transition towards e-mobility. To this end, we proposed a new board member at last year’s AGM. For more information on this active shareholder campaign, see here.

On the other hand, Hydrogen is the sector that received the least financial commitment at just USD 1.1 billion in 2022 (0.1% of the total). However, it is the fastest-growing sector with investment more than tripling over the year before. Companies like Verbund AG, which is one of the largest producers of electricity from hydropower, are also a part of the Inyova universe.

Could all this growth just be coming from inflation?

While inflation rose an epic 8% last year in the U. S., it makes up less than a third of the total year-on-year dollar increase. So, it’s really the expansion in nearly every sector that increased the total dollars invested.

How are these changes affecting my portfolio?

Although there was a lot of inflow in renewables this year, there are multiple forces at play when it comes to the performance of the companies’ stocks. In fact, many (if not most) of these companies suffered from the overall macroeconomic environment. This is because most companies in innovative spaces require large investments and are dependent on global supply chains. Hence these are especially affected by increasing interest rates and overall insecurity and disruption in markets. In case you want to refresh your knowledge of how interest rates affect the economy, you can check out our market update from November 2022.

Is this all good news?

Despite 2022’s impressive investments in the clean energy sector, global investment in lower-carbon technologies is still short of what is needed to effectively confront climate change. According to BloombergNEF, the investments in clean energy must triple for the world to get to “net-zero” by 2050. So, while these record-breaking numbers are certainly showing that we’re on the right track, we need to ramp up more quickly in order to effectively meet the challenges of climate change.

If you have any questions, please reach out to our Customer Success team. You can email us at [email protected] or call 044 271 50 00. We’re here to help!

Sources

Bloomberg, 2023. Even High Battery Prices Can’t Chill the Hot Energy Storage Sector.

Counterpoint, 2022. Global Passenger Electric Vehicle Market Share, Q2 2021 – Q3 2022.

Bloomberg, 2023. Clean Energy Sets $1.1 Trillion Record That’s Bound to Be Broken.

U. S. Inflation Calculator, 2023. Current US Inflation Rates: 2000-2023.