A pension plan is the “ugly duckling” of savings goals. At a young age, most of us don’t get too excited at the idea of setting aside money now for a retirement in some hazy, distant future.

However, dealing with your pension early on can be hugely beneficial. It’s never too early to start thinking about your retirement plan, even if your retirement age is still decades away. In this article, you’ll find key information about Pillar 3a and how much you can deposit into it.

What is the maximum Pillar 3a deposit?

This maximum amount is determined annually by the Swiss Federal Social Insurance Office and is adjusted according to inflation.

This maximum amount is determined annually by the Swiss Federal Social Insurance Office and is adjusted according to inflation.

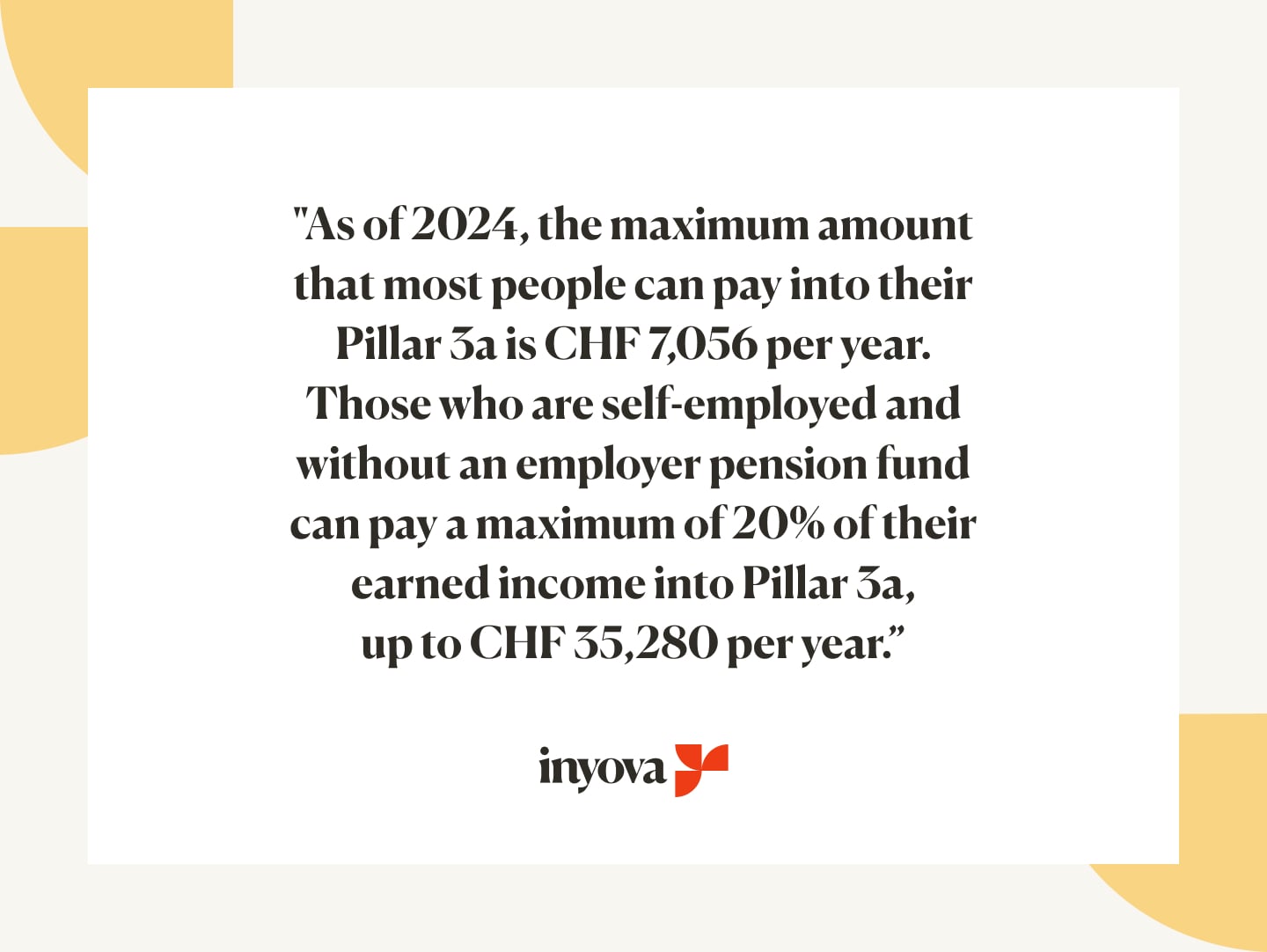

As of 2024, the maximum amount that most people can pay into their Pillar 3a is CHF 7,056 per year. Those who are self-employed and without an employer pension fund can pay a maximum of 20% of their earned income into Pillar 3a, up to CHF 35,280 per year.

At a young age, people tend not to care too much about a pension plan. However, it is good to know that one of the great advantages of Pillar 3a is that you’ll get one immediate benefit: tax relief.

(By the way – this is the reason why deposits into Pillar 3a are limited and only possible up to a maximum amount specified by law.)

As an innovative impact investing platform, Inyova is revolutionising private pension plans. Inyova’s Pillar 3a solution is a sustainable and transparent alternative to private pensions at traditional banks.

Inyova offers attractive investment opportunities in a wide range of industries around the globe. By buying fractional shares, your portfolio is widely and effectively diversified – even with smaller investments. The minimum investment amount for Inyova’s Pillar 3a is only CHF 100.

How does the Swiss pension system work in 2024?

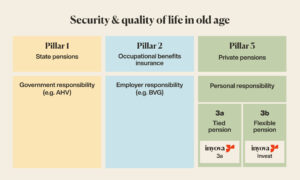

The Swiss pension system builds on the so-called 3-pillar principle.

The 1st pillar is the state pension, which aims to support the livelihood of every citizen. Deposits into the state pension scheme are required by law and are not credited to an account in your name. The money deposited is passed on directly to the current generation of retirees.

The 1st pillar is the state pension, which aims to support the livelihood of every citizen. Deposits into the state pension scheme are required by law and are not credited to an account in your name. The money deposited is passed on directly to the current generation of retirees.

However, with our ageing population, deposits are shared among an ever-increasing number of recipients. That’s why the other pillars of the Swiss pension system are essential.

The 2nd pillar is the mandatory pension that your employer pays. It is regulated by the Swiss Federal Act on Occupational Retirement, Survivors’ and Disability Pension Plans (BVG).

Depending on the employer and pension fund, extra occupational pension is also possible. This is not subject to the regulations of the BVG. The extra occupational pension is voluntary for the employer and is often only offered as a fringe benefit at managerial level.

Finally, the 3rd pillar brings private pension into play. The private pension plan serves to supplement the 1st and 2nd pillars and is intended to maintain your usual standard of living after you stop working in old age (hint: Pillars 1 and 2 are usually not enough!). Private pension plans are divided into restricted pension plans (Pillar 3a) and unrestricted pension plans (Pillar 3b).

Pillar 3a offers tax benefits, and the capital deposited into it is tied up until retirement – but don’t let that put you off! Early withdrawal of 3a assets is not impossible. If you plan to purchase a property, start a business or move abroad, you can withdraw your deposit prematurely under certain conditions.

The unrestricted, more flexible pension plan is based on the assets that you save privately for your pension. There are no requirements as to the form of investment. There are no maximum contributions in Pillar 3b, however, the contributions are not tax-deductible. One example of Pillar 3b is Inyova’s range of regular investment solutions. Account management is flexible, and capital can be withdrawn at any time without legal requirements.

Why you need to think about your pension plan

Having a pension allows you to maintain an enjoyable standard of living even once you’re retired. Additional luxuries – whether that’s a holiday home in Crete, a chic vintage car or a fully equipped home cinema – can be financed in old age with the help of Pillar 3a.

More and more often, the income earned through basic insurance and occupational benefits is no longer enough for retirement. With a private pension plan, you can proactively counteract this problem. The earlier you invest your money in Pillar 3a, the greater the expected capital growth and the more money you’re likely to have at your disposal in old age.

If you choose Inyova for your investment in Pillar 3a, you’ll also be doing good in the world with your investments. With Inyova’s 3a solution, you’ll be investing in your financial pension plan and protecting the most valuable capital – our planet – all without having to forego attractive potential returns.

By investing in innovative and environmentally conscious companies, you can fight against climate change, social inequality and other major problems of the modern world.

How to effectively manage your Pillar 3a account

In times when zero and even negative interest rates are shaping the Swiss financial landscape, it doesn’t make sense to hoard your money in your bank account. High fees, interest rates and inflation will eat into your savings.

That’s why more and more people in Switzerland are opting to invest their Pillar 3a assets on the stock market. At Inyova, the investment risk is reduced by diversifying across different companies, industries and regions.

If you want to profit from Pillar 3a in an optimal way, it is important to make regular payments into your Pillar 3a account. Some people choose to draw up a savings plan, where they set aside a certain amount every month for their private pension plan.

Keep in mind: If you regularly deposit a fixed amount and invest in the same assets, your capital is less dependent on market fluctuations. All of your deposits result in a balanced average cost at which your investment is made.

Here’s why you should choose Inyova’s sustainable Pillar 3a

Start with just CHF 100 and diversify your investment by taking advantage of the possibility to buy fractional shares from different companies, sectors and regions.

Make a difference

As an Inyova investor, you are actively helping to make the world a better place. With an investment in Inyova’s Pillar 3a solution, you’ll be supporting only companies that operate sustainably and are aware of their social responsibility. You’ll be investing in renewable energy and innovative, green and sustainable technologies.

Long-term returns

Help solve some of the biggest problems of our time – and do so without compromising your return on investment.

Tax savings

Payments into Pillar 3a can be deducted from your taxable income up to the maximum amount!

Personalised

Your investment is 100% personalised to what you value. You select the impact topics and can even add or remove individual stocks, if you like.

No nasty surprises

At Inyova, a key priority is keeping the fee structure clear. There are no hidden fees or other unusual costs to expect. Full transparency and a clear overview of costs emphasise Inyova’s commitment.

As a sustainable and transparent Swiss platform, Inyova sets new standards for pension plans. To invest your capital in the long term and in a safe and sustainable way for our planet and society, start an Inyova 3a here.