The year is 2020 and the dreams of science fiction authors have come true: We live in a world where robots have taken over the management of our finances.

Wait, how does it actually work?

Robo Advisors have been attracting more and more recognition in the financial world for a number of years now. In Switzerland, as well as throughout the world, investors are interested in this form of asset management because it’s considered a cost-effective and smart alternative to traditional investments.

But if the term “Robo Advisor” doesn’t ring a bell yet, you’ve come to the right place!

Our Inyova experts have created this ultimate guide for you, so you too will know what a Robo Advisor is all about, and the best ways to invest money with them in Switzerland.

Robo Advisor: Definition

Robo Advisor — when you hear this phrase for the first time and interpret it literally, you’ll probably imagine a robot taking on the role of a financial advisor, as mentioned at the beginning of this article. However, the term Robo Advisor is in fact somewhat misleading, because strictly speaking it’s neither a robot nor an advisor.

So what is a Robo Advisor?

Robo Advisors are digital asset managers that use an algorithm to ensure that each investment portfolio follows the best investment strategy for its owner.

Technically speaking, a Robo Advisor is nothing more than software that manages assets on behalf of an investor through predefined rules.

But that still sounds a bit too abstract, doesn’t it? Here’s a more concrete explanation:

Let’s assume you have some money on hand. Instead of keeping it in your savings account (where it’ll only lose value in the long run), you decide you want to invest it.

In the past, the next step to investing money would have been to get advice from the bank. The Robo Advisor makes this obsolete. With the digital service that Robo Advisors offer, you can quickly see what investment opportunities are available for your requirements — without leaving the house.

And since a Robo Advisor is easy to use, you don’t have to be a financial or banking expert to invest money.

In fact, a Robo Advisor enables you to put together an investment strategy almost by yourself. Because a Robo Advisor is a digital service, the costs for investors can be kept low. That’s the primary reason why this financial concept is gaining in popularity, especially in recent years.

When you decide to invest money in Switzerland with the help of a Robo Advisor, the first thing to do is create a profile with the desired service provider. To do so, you usually have to answer a few questions about your available capital, your risk tolerance and the time period you intend to hold your investment for.

And that’s all there is to it. The rest is done by the algorithm!

Most Robo Advisors make it difficult — or even impossible — to customise your investment. This is because the money of the investors is usually invested in a collective fund rather than in individual portfolios. In contrast, our Inyova app is designed transparently; you’ll instantly see which companies match the sustainability themes you’ve selected. You can then customise your portfolio by selecting your preferred companies, and excluding those you don’t want to invest in. With every change you make, our algorithm ensures that your portfolio is financially sound.

By the way: although we calculate your portfolio using an algorithm, there are many dedicated people working at Inyova who are always ready to help you if you have any questions about your investment.

With this in mind, the idea that Robo Advisors are nothing more than robots is not true — at least not with Inyova. Here are the most important differences between Inyova and typical Robo Advisors:

- Inyova’s customers are the direct owners of each stock in their portfolio. There are no financial products or unnecessary layers between you and your money.

- By investing through Inyova, you’re investing sustainably and in a socially responsible manner — becoming a shareholder in the companies that are solving the greatest challenges of our time.

- At Inyova, you can include or exclude specific companies. Don’t like Tesla? In just one click, it’s removed from your strategy.

- We have no hidden charges. Our simple fee includes everything — and there will never be any additional costs.

- We are a digital service that is human at heart. Our team is always here to answer your questions. In addition, we host regular events — and you’re invited!

Which Robo Advisors are available in Switzerland?

Digital investment advisors are still relatively new in Switzerland. Nonetheless, there are already a number of financial companies that are dedicated Robo Advisors.

We compared the 7 most popular Robo Advisors in Switzerland. We paid close attention to the features that are important for you as an investor, for example, minimum deposit, service fees and any additional fees.

Robo Advisor comparison in Switzerland

| Robo-Advisor | Investment focus | Customer Service | Direct ownership of company shares | Minimum deposit | Fees |

| Inyova | Impact investing – Investments in companies that contribute to a more sustainable world. A mix of stocks and government bonds. | Tüv certified Service / Hotline / Email / Contact formula | Yes | CHF 2,000 | 0.6% – 1.2% incl. of all fees |

| Swissquote | DIY asset management, mostly based on ETFs and B2B Services. | Hotline / Mail / Online Meeting | Yes if you purchase individual shares. | CHF 10,000 | 0.45 – 0.75% plus flat fee of 0.5% and fees for every trade. |

| Selmafinance | ETFs | Hotline / Mail / Live Chat | No | CHF 2,000 | 0.47 – 0.68% plus product costs (~0.22%) |

| BLKB | Different investment options like real estate, cash etc. | Hotline / Branch / Mail | No | CHF 5,000 | 0.75% plus product costs (~0.28%) |

| Clevercircles | High level of security, B2B services, different investment options | Mail / Hotline | No | CHF 10,000 | 0.45% – 0.65% plus product costs (~0.20%) |

| Truewealth | ETFs | Mail / Hotline | No | CHF 8,500 | 0.5% plus Product costs (~0.20%) |

| Simplewealth | ETFs | No | CHF 10,000 | 0.5% (min CHF 20/ month) plus product costs (~0.20%) |

Note: All the data is as of August 2022

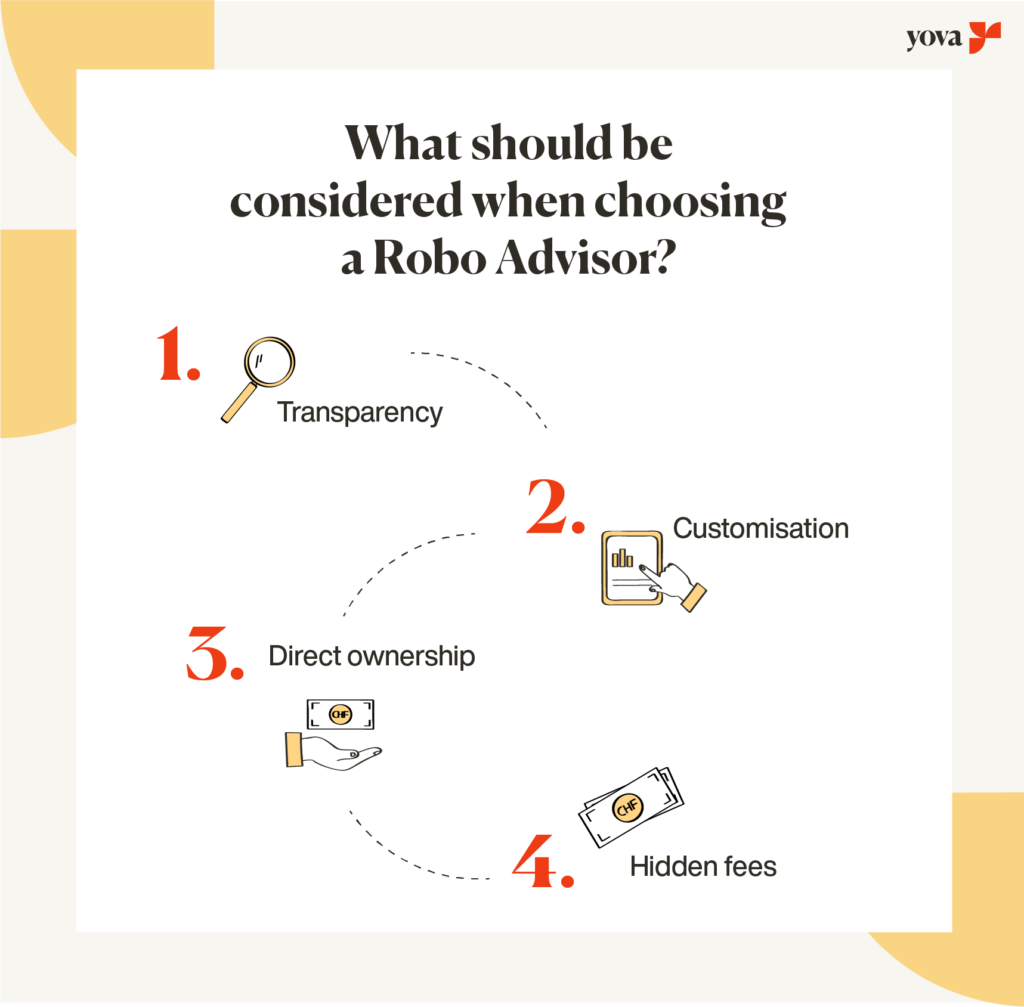

But what are the differences between the various service providers?

The table above gives a good overview on the advantages and disadvantages of the different providers. Now we will have a closer look at the differences between the different Swiss Robo Advisors.

Many Robo Advisors in Switzerland focus on investing in ETFs (Exchange Traded Funds) and index funds, such as iShares. However, this carries certain risks and problems, such as loss of control and lack of transparency. Since these investments are managed by third parties (and not the Robo Advisor itself), there are additional middlemen and cost layers standing between you and your investment.

Through ETFs and funds, you may also involuntarily invest in companies you don’t trust — even investments labelled “green” or “sustainable” sometimes include questionable companies. But with Inyova, you have complete control over the industries and companies you invest in.

All of these factors play an important role for prospective investors when it comes to investing money in Switzerland through digital asset consultants. But with some Robo Advisor providers, things can get confusing — especially with regards to fees.

How much are the fees for investing with a Robo Advisor?

Most Robo Advisors charge an annual fee somewhere between 0.5 percent and 1.5 percent of the investment amount. At most providers, investors are also charged other fees, such as “product costs” (usually the case when trading ETFs) as well as “exchange” and “transaction fees”. Almost all providers charge annual product fees averaging 0.15 to 0.3 percent of the investment amount. Unfortunately, many hide these additional costs in the small print, which means that the total cost of the investment is much higher than the customer expects when they sign up.

Inyova differs from other suppliers in this respect as well. We’re committed to being as transparent about fees as we are about our company selection.

When you invest through Inyova, you pay an annual all-inclusive fee between 0.6 and 1.2 %, depending on the total balance in your account. You can always see how much you pay annually in your Inyova dashboard. Find out more about fees at Inyova here.

The biggest Robo Advisor provider in Switzerland

Nowadays, you can find several Robo Advisors in Switzerland.

Inyova is the leading online platform in Switzerland dedicated to investing in sustainable and socially responsible companies. We empower you to choose the impact topics and companies in your portfolio, while also adjusting your portfolio according to your individual risk preferences. You’re the registered owner of the shares, and the earnings are credited directly to your bank account. Learn more about Impact Investing with Inyova here.

And Inyova makes all this possible for as little as CHF 2,000. We explain exactly how it works in the ‘Our investment strategy’ section of this article.

Are Robo Advisors the future of asset management in Switzerland?

Robo advisor investments currently account for only a small proportion of the approximately CHF 2,161 billion managed in Switzerland. This was revealed in the 2019 Asset Management Study published by The Institute for Financial Services at Lucerne University.

These figures may be slightly distorted, as Switzerland is the global centre of private banking and manages the assets of very wealthy individuals and families from a number of countries. But even when this is taken into account, Robo Advisors still account for only a small part of the total.

Will this change in the future?

In general, we’re seeing a worldwide trend towards digital asset management. While Switzerland is currently lagging behind, this is likely to change in the coming years.

One reason for this is the increasing willingness to invest. One study found that, although most people have clear financial goals, half of Millennials wanted help understanding investment risk before diving in. Robo Advisors appeal to precisely this generation thanks to their simplicity.

Another factor driving this trend is the low-interest rates and unattractive conditions offered by Swiss banks. These days, hardly any banks offer more than 0.1 percent interest on a savings account. Since digital asset managers barely require any special attention, they’re also suitable for people who don’t have time to deal with their financial investments on a daily basis.

Inyova digitises long-established investing methods used by private banks to make impact investing accessible to everyone.

Given the current trend it’s likely that Robo Advisors will be managing an increasing volume of assets in Switzerland in the years ahead.

Let’s take a quick look at the USA. Robo Advisors already manage 2 percent of the assets in the US and can — according to these forecasts — expect continued rapid growth. Next year, more than one billion US dollars worth of assets will be invested using them. By 2022, this figure could be more than four times as high, amounting to 4.6 billion US dollars.

Who should invest with the help of a Robo Advisor in Switzerland?

The biggest advantage of using a Robo Advisor is that it’s truly suitable for everyone. The automation of the investment processes and the simple, digital management of the portfolio enable people with a small budget to invest in the stock market for the first time.

At the same time, it’s also an ideal investing opportunity for people who have large sums of money at their disposal.

Today, anyone can invest in shares – without a huge capital!

At Inyova, we recommend our customers start with a minimum initial investment amount of CHF 2,000. That way, your portfolio will consist of 30 to 40 different stocks and will be sufficiently diversified. This means your investment is spread broadly between companies from different countries, currencies, industries, and other factors. Because your portfolio is composed of many small investments, it is less exposed to fluctuations in particular sectors or regions. Even if you don’t have this capital at your disposal yet, you can still create a savings plan at Inyova for as little as CHF 500. Discover how in our article about investing with small amounts.

Invest with Inyova for a better future!

Above all, our concept is intended to appeal to people who consider it important to create a positive impact with their assets. It doesn’t matter whether you have previous experience with investments or are just starting out. Investors at Inyova have one thing in common: they believe that they can contribute to a sustainable and fair future for all.

The companies that Inyova suggests for you have all gone through a thorough review process before being classified into 16 impact topics. You decide which of these impact topics are important to you and have the final say in which companies you invest in. It’s also possible to exclude criteria, such as animal testing and nuclear, so that such companies will not be included in your portfolio.

In our whitepaper, you can read more about our approach, as well as how we deal with greenwashing!

Our investment strategy

We’d love to promise that your investment will yield the expected return in the planned amount of time. Unfortunately, we simply can’t do that. Each Inyova strategy is designed to perform in line with the global economy. Basically, this means we expect your portfolio to increase when the stock markets rise. Although we follow the best practices to minimise risk and optimise profits, it’s essential to understand that we can’t guarantee performance. No reputable asset manager can.

At Inyova, we follow a passive investing strategy. The reason for this is simple— it’s the most reliable way of investing!

Some people are convinced that they can predict the market and thus make more profit with short-term buys and sells. In reality, however, it’s usually the opposite. Whereas short-term fluctuations are unpredictable, long-term growth is more constant and often greater. That’s why we recommend the approach “buy and hold”. Many professionals, such as legendary investor Warren Buffett, employ this strategy.

At Inyova, we also use the approach of Harry M. Markowitz’s ‘Efficient Frontier’ strategy. It states that for each financial profile, there is a portfolio that maximises the returns for that investor within the desired level of risk.

To ensure the risk of your portfolio is always in line with your wishes, we rebalance your portfolio once a year (or more often if necessary). This is all included in Inyova’s service and doesn’t cost you any additional fees.

Remember, regardless of what is promised elsewhere, there’s no such thing as a Robo Advisor programmed to guarantee risk-free returns.

Summary: What you need to know about Robo Advisors in Switzerland

- Robo Advisors have revolutionised investing, particularly for investors with smaller sums of money. That’s because fees are low and investments are typically easy to set up and manage.

- Most Robo Advisors in Switzerland trade with ETFs. Their setup is often opaque and it’s not possible to include or exclude individual companies. Besides that, you buy into a complex financial product where you don’t actually own the shares. By contrast, investing with Inyova means that you become a direct shareholder in each company in your portfolio, and therefore can choose exactly what you invest in.

- Inyova has developed an algorithm that acts as a digital asset manager when compiling your portfolio. There are many experts behind our technology, as well as our friendly customer specialists who are there to help you every step of the way to sustainable investment. You can find the people behind Inyova here.

Do you have more questions about Robo Advisors? Although most Robo Advisor providers are purely digital products, at Inyova we believe it’s important to be there for you at all times and to provide you with professional answers from our team. If you have any questions, please feel free to contact us.

Planning your investment is free of charge!

Curious? Would you like to know more about how to invest with the help of a Robo Advisor in Switzerland? Create your personal and free investment strategy now — sustainable investing has never been easier!