The Inyova Community has voted: according to the online survey we held in November, 90 percent of the questioned people under 40 think that society clearly needs a change towards sustainability.

During November, we asked our audience on social media and online to participate in the Inyova Sustainability Survey 2020. 409 people have followed our call, thank you so much for your participation.

We wanted to know about your personal sustainability goals, what future role the finance industry should play when it comes to sustainability and what would influence your choice when reviewing financial products.

The results show a clear case and go along nicely with expert opinions: sustainability is going to be the (almost) only constant issue in the future. According to our survey results, almost every second person sees sustainable consumption and production as essential. Companies that disregard climate change or don’t offer a sustainable product, can only persist as niche players at most.

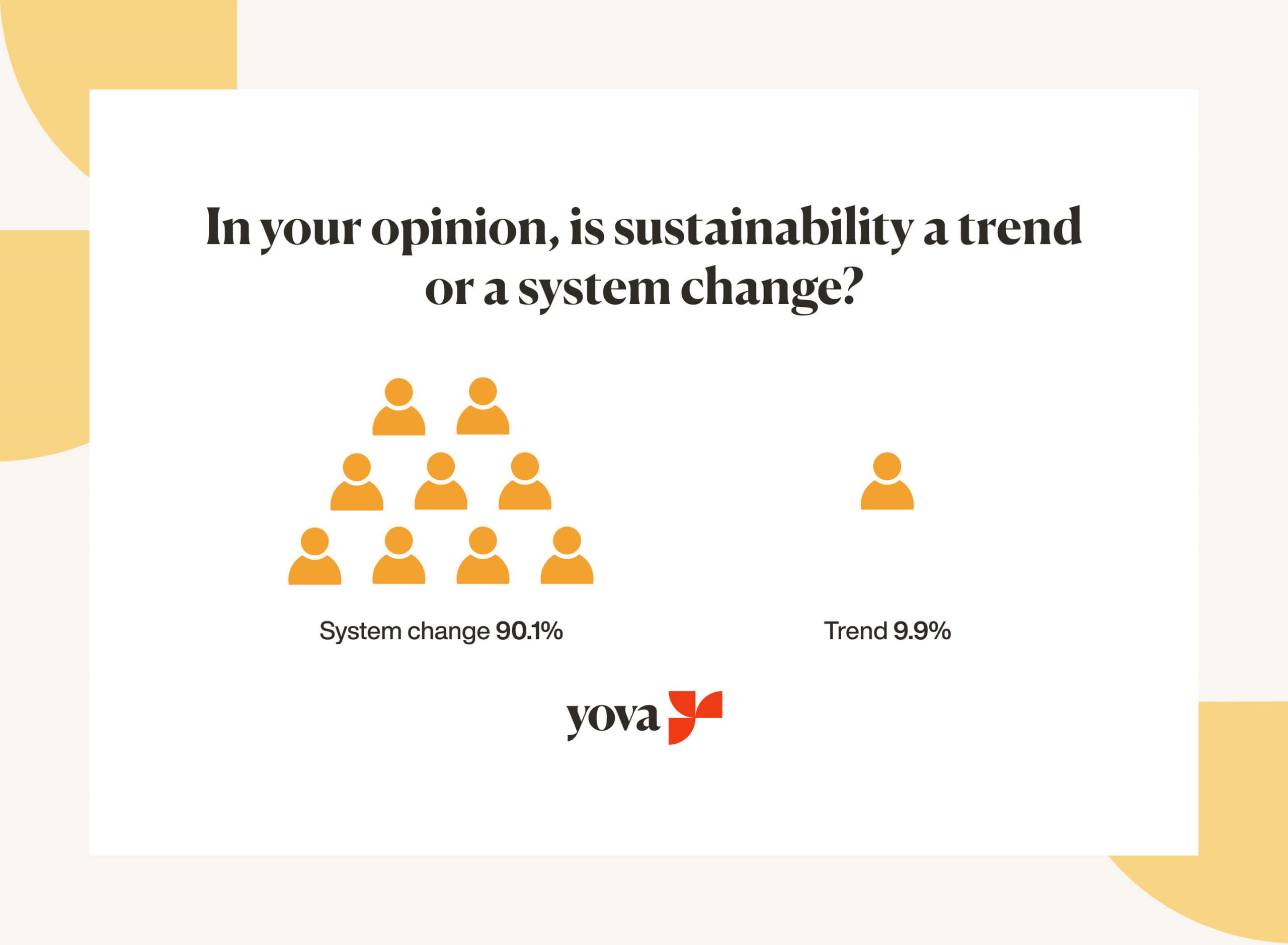

It gets even more visible when we look at the interviewed people under 40 years of age: 90 percent of them see sustainability no longer as a simple trend, but rather as a very much needed systemic change for our society.

In our survey, 90.1% of people have stated that they see sustainability as a systemic change.

Taking a closer look at the financial industry, we found that 80 percent of the questioned people under 40 want financial systems to be held accountable for upholding the sustainability goals of the UN. According to the majority of questioned people, the sustainability of a financial product seems to be the most important deciding factor, not low fees or digital options.

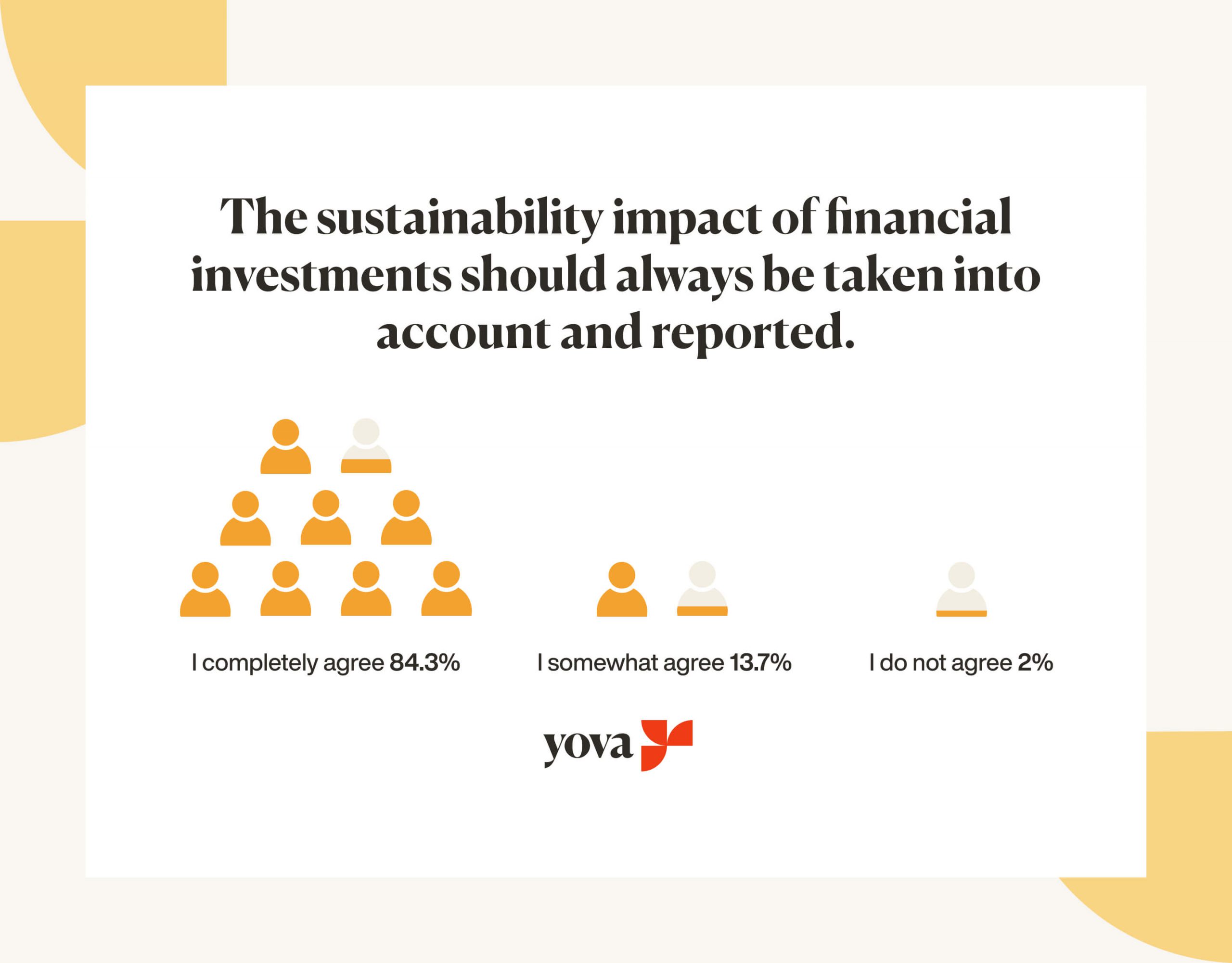

The sustainability impact of financial products needs to be transparent, according to 84 percent of all questioned people, while 65 percent think the market is not offering enough solutions as of yet. This is probably a result of the still prevalent greenwashing in the finance industry. Customers find it hard to spot truly green investment products. That’s why you should bank on impact investing if you really want to make a difference.

84.3% of the people asked in our survey agree, think that the sustainability impact of financial products should

always be taken into account.

An investment needs to have a real impact, to even be considered as impact investing. According to the University of Zurich, such an impact is held by active shareholders, if they directly influence the company they invest in.

We offer exactly that – Inyova impact investors are shareholders of their portfolio companies. Inyova enables you to have a positive social and ecological impact – and to benefit from the financial returns too. In case you are interested, here is a detailed whitepaper to find out more on how we measure the criteria of each of our companies before we add them to our portfolios. You’ll also get an explanation of why it is important to measure companies according to their hand- and footprint.