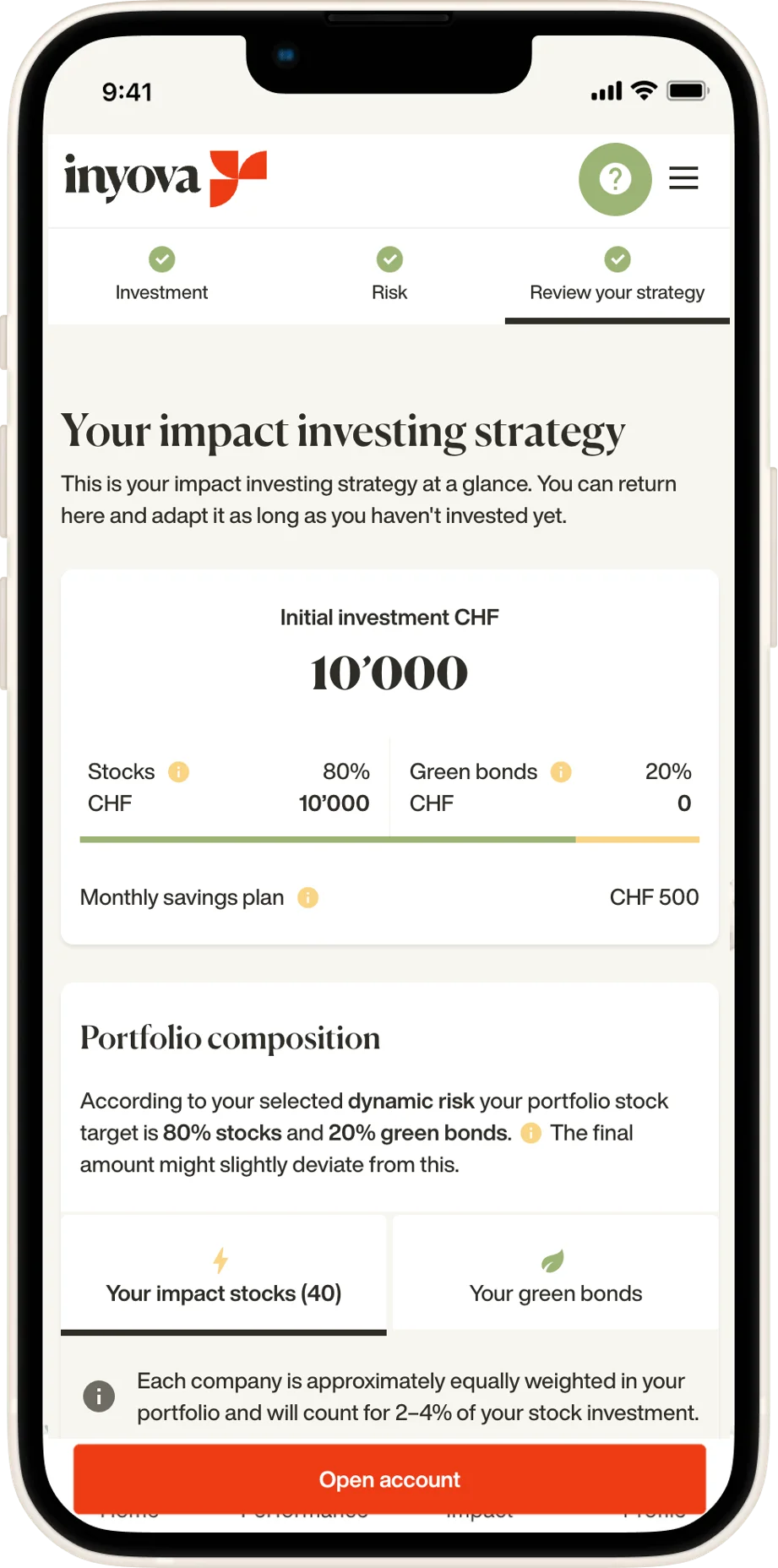

The choice is yours: start with a single investment, set up a monthly deposit, or do both! Your strategy is invested once your account reaches CHF 2000, and it's designed to generate attractive returns in 5-10 years.

Single investment

Savings plan

of your investment account balance. The more you save the less you pay.

-

Your own secure Swiss bank account Our transaction bank, Saxo Bank Switzerland, is regulated by the Swiss Financial Markets Supervisory Authority (FINMA). As an asset manager, Inyova, based in Switzerland, strictly adheres to the legal requirements and is continuously supervised by FINMA. -

Unlimited investments & withdrawals Unlike other providers, there are no fees or limits on adding or withdrawing money from your investment. If you need to withdraw, you can usually have your money within a few days. -

All transactions fees The all-in fee includes all transaction costs for buying and selling instruments at our partner bank. -

Annual strategy adjustment You verify your risk profile once a year to make sure your investment stays aligned with your situation and preferences. -

Regular rebalancing Your portfolio is broadly diversified and designed to profit from stock market growth in the long-term. We regularly rebalance your portfolio to maintain the optimal level of risk.

-

Local customer support Our friendly customer success team is here for you when you need it. We are a digital service with a human heart! -

Financial reporting & tax statements We provide a yearly tax statement at the beginning of each year that you can attach to your tax report or submit using eTax. The value of your investment is updated in the app on a daily basis. -

Continuous portfolio management Your portfolio is actively managed by a dedicated team of experts, ensuring your investments are always optimally allocated for long-term performance and impact. -

Corporate Actions Management Corporate actions includes things like takeovers, bonus issues, rights issues, and consolidations at the companies you are invested in. We keep track of these and manage them on your behalf. -

Dedicated impact team Inyova’s dedicated Impact Team are our in-house sustainability experts. They monitor the companies you invest in, and work with companies to improve their sustainability impact. The team also researches more companies to add to the Inyova universe.

What you’ll pay

0.6 – 1.2% p.a. depending on the total balance in your account

Comparing the annual fees on a CHF 10,000 investment

- Impact Focus

- Full transparency

- No experience required

- Impact focus All investments made with the intention to generate a measurable, beneficial social or environmental impact, alongside a financial return.

- Full transparency

- No experience required

- Impact focus

- Full transparency

- No experience required

- Impact focus

- Full transparency

- No experience required

A likeminded community of changemakers

With Inyova, you’re never alone. Connect with other impact investors at our open nights, online events, and on our social media channels. You can also meet the Inyova team, and even the decision-makers at companies you invest in!