Your impact investing options

Every Inyova offering offers strong return opportunities and a positive impact on our planet and society.

Investment type

Investment type

Minimum investment

Minimum investment

Flexible withdrawals

Flexible withdrawals

Additional deposits

Additional deposits

Fee

Fee

Impact mechanism

Impact mechanism

Tax benefits

Tax benefits

You can deduct Pillar 3a contributions from your taxable income. This reduces the tax you pay every year you make a deposit.

Daily investment reporting

Daily investment reporting

Designed for long-term returns

Designed for long-term returns

Diversified portfolio

Diversified portfolio

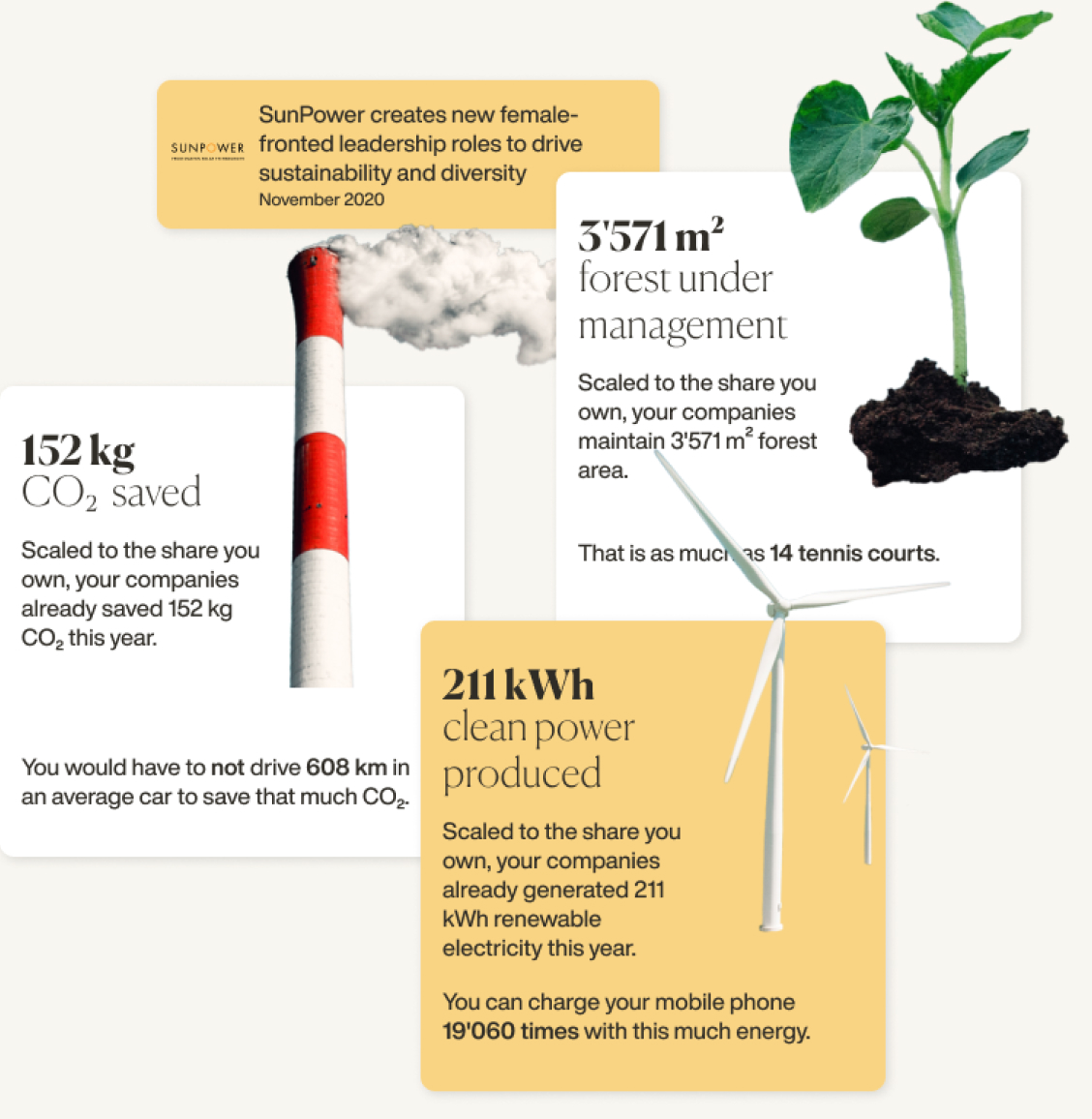

Impact news and company metrics

Impact news and company metrics

Professional monitoring and management

Professional monitoring and management

24/7 customer support

24/7 customer support

Inyova Invest

Designed for long-term investing, with access to your money if you need it.

Flexible investment

Flexible investment

CHF 2'000

CHF 2'000 minimum investment

Unlimited

Unlimited withdrawals

Unlimited

Unlimited deposits

0.9–1.2% p. a.

Fee of 0.9 – 1.2% p. a.

Active Ownership

Active Ownership

Active Ownership is the core impact mechanism as an investor. With Inyova, you have:

- Voting power

- Possibility to engage with companies

- Right to inspect corporate documents

- Right to sue for wrongful acts

More on Shareholder rights in our voting and engagement policy

No Tax benefits

Daily investment reporting

Designed for long-term returns

Diversified portfolio

Impact news and company metrics

Professional monitoring and management

24/7 customer support

Inyova 3a

A truly sustainable Pillar 3a with immediate tax benefits. Access your money when you reach retirement.

Retirement savings

Retirement savings

CHF 100

CHF 100 minimum investment

At retirement age

At retirement age

You can withdraw 3a assets no earlier than five years before the regular retirement age.

There are some exceptions, for example:

- Self-employment

- Moving abroad

- Financing home ownership

Maximum of CHF 7,258 per year, up to CHF 36,288 if you're self-employed

Maximum of CHF 7,258 per year, up to CHF 36,288 if you're self-employed

0.8% p. a.

Fee of 0.8% p. a.

Active Ownership

Active Ownership

You are the owner of the stocks that you invest in, which means you are granted rights in the company. They are:

- Voting power

- Ownership

- Right to transfer ownership

- Dividends

- Right to inspect corporate documents

- Right to sue for wrongful acts.

More on Shareholder rights here

Tax benefits

You can deduct Pillar 3a contributions from your taxable income. This reduces the tax you pay every year you make a deposit.

Daily investment reporting

Designed for long-term returns

Diversified portfolio

Impact news and company metrics

Professional monitoring and management

24/7 customer support

Inyova Grow

For project investments with interest. Access your funds after the project term.

Project bonds

Project bonds

CHF 2'000

CHF 2'000 minimum investment

After project bond maturity

After project bond maturity

Project-dependent

Project-dependent

0.95% p.a.

0.1–0.95% p.a.

Investment into green projects

Investment into green projects

No Tax benefits

Daily investment reporting

Designed for long-term returns

Diversified portfolio

Impact news and company metrics

Professional monitoring and management

24/7 customer support

Get your free impact investing strategy in just a few clicks

We’ll guide you through every step. There’s no obligation if you decide it’s not right for you.