Veganism has seen a huge upward trend in recent years. Not only can this be seen in the rising share of the population that eats vegan food, but also in the growing sales of plant-based foods such as meat and milk substitutes.

So, it may come as no surprise that investing in vegan stocks is also catching people’s attention. Intrigued? In this article we’ll introduce you to three relevant companies, show you how you can buy vegan stocks, and explain what you need to consider when doing so.

What qualifies as a vegan stock?

In simple terms, “veganism” is the practice of abstaining from all animal products. Vegans don’t consume foods such as milk, meat, eggs and honey, they don’t wear leather or fur clothing, and they don’t use cosmetic products that have been tested on animals. Any use of animal products in all areas of life is totally avoided.

According to these criteria, the ‘perfect’ vegan stock comes from a company that produces only plant-based products, and also ensures that their suppliers don’t use animal products in the process.

There are many factors that come into veganism. Not everyone who chooses to adopt a vegan diet or lifestyle does so for the same reasons: People may become vegan if they:

- Are striving for a healthier lifestyle

- Want to protect the environment (60% of greenhouse gas emissions come from meat consumption)

- Are concerned for animal welfare and ethical standards.

Here’s a bit of an eye opener for you: a report by the Boston Consulting Group showed that investing in plant-based meat alternatives is one of the most important and determining factors in reducing greenhouse gas emissions.

Choosing vegan stocks doesn’t have to be black and white

When looking to invest in vegan food stocks, there are certainly reasons for including companies that don’t exclusively produce vegan products – for example, some companies that produce vegan foods may also produce meat-based foods. These companies can still encourage people to choose a vegan diet and help reduce greenhouse gas emissions through their plant-based substitutes.

A good example is the German company Rügenwalder Mühle. They produce processed meat products like sausages, but they also offer a large and growing range of vegan meat substitutes.

When you invest with Inyova, you can select your favourite impact topics when you create your profile, including “plant-based food” and the exclusion criteria of “no meat” and “no animal testing”.

Although Rügenwalder Mühle is not part of the Inyova universe, the company is attracting interest from some investors who want to invest their money in vegan stocks. You could still view it as a company that encourages people to go vegan and therefore has a positive animal and environmental impact.

Are vegan stocks a growing market?

The transition to new food systems will transform existing profit streams and create new ones. The resulting market is expected to increase fivefold globally by 2030, generating annual revenues of USD 1.5 trillion. In addition to companies already producing new protein products, this transition will create investment opportunities in the form of companies offering specialised products and services to companies in the value chain. Among the new proteins, plant-based meat alternatives are most likely to reach the mass market.

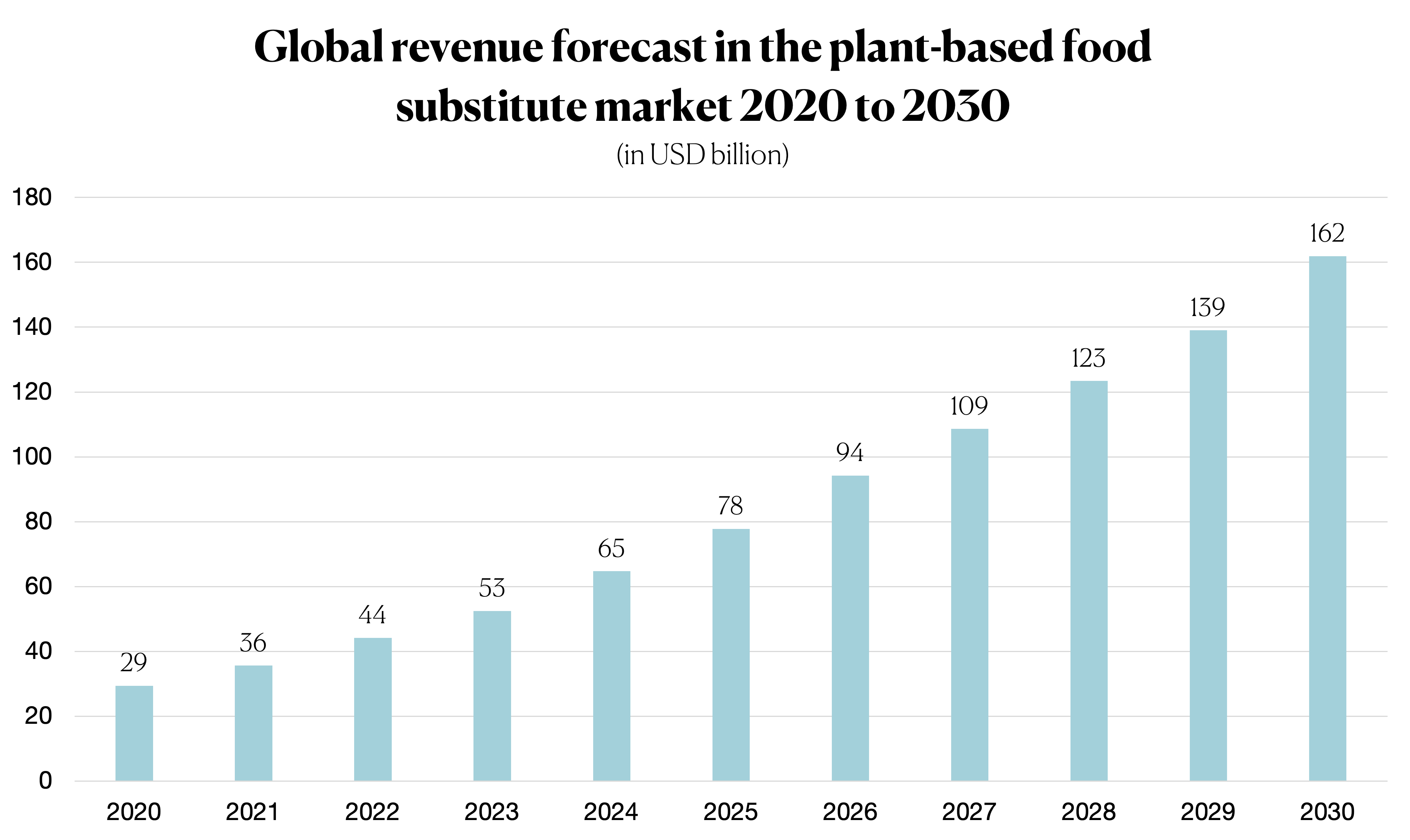

In 2020, global sales of plant-based foods were USD 29.4 billion. According to the forecast, the market value is expected to rise to USD 161.9 billion in 2030.

Source: Statista, 2023. Global plant-based substitutes market revenue from 2020 to 2030.

A long-term approach to investing in vegan stocks

Here’s just one final note before we look at some vegan stock companies in detail. As well as sustainable impact investing, Inyova also focuses on diversifying its investments.

A diversified portfolio of 30 to 40 company shares from various countries, industries and currencies, allowing for natural market fluctuations, has in the past achieved a good average annual return of around 6%.

Of course, the stock market has good and bad years, and any equity investment carries the risk of a loss. However, a long investment horizon and a well-diversified portfolio have consistently proven to be profitable strategies in the past.

However, if you only rely on vegan or vegetarian stocks, your portfolio will be more volatile because it consists of only a few stocks – of course, the fewer the stocks, the more likely you are to notice a potentially negative impact on overall performance. In addition, regulation, environmental impacts, and many other macroeconomic and industry-specific factors may hit the vegan business sector hard, which would be reflected in your portfolio.

That’s why many experts emphasize the importance of a long-term and diversified investment.

Examples of 3 vegan stocks to invest in

Below we would like to present three companies, all of which contribute to veganism and in which you can invest with Inyova. Some are directly involved in producing vegan foods, whilst others are active as suppliers. Please note that this is not investment advice.

Is your favourite company, such as the German firm ‘Veganz’, not listed below? This may be because the company doesn’t meet our financial criteria – it may be too small, or the stock price may be too volatile. However, the number of companies you can invest in at Inyova is growing, so it may be possible to buy vegan stocks of your desired company in the future.

Beyond Meat – Plant-based meat substitutes

When we talk about vegan meat substitutes, the name and products of Beyond Meat are amongst the most common. Founded in 2009, the company produces vegan sausages, burgers, minced meat, and more.

In 2019, it became the first food producer of purely plant-based products to venture out onto the stock market. Its products are sold in more than 128,000 supermarkets and generated sales of USD 464.7 million in 2021 alone.Although Beyond Meat does an excellent job of making vegan products palatable to the general public, there’s room for improvement. One example is the source of its ingredients, with Beyond Meat lacking transparency around this. Not much is known about the source of the ingredients the company uses for its burgers and other products. With Active Ownership via Inyova, you can make an active contribution here and push the company towards greater transparency.

Oatly – Oat drinks

After Beyond Meat, Oatly was the second company in the purely plant-based food sector to make the jump onto the stock market in 2021. Oatly was founded in 1994 under the name of Ceba Foods.

The idea for Oatly arose when Swedish researcher Rickard Öste searched for milk alternatives and developed an enzyme that could break down oats and turn them into a milky liquid. In 2021, the company generated annual revenues of USD 643.2 million – an increase of 52.6% over the previous year.However, Oatly came under fire from its followers in 2020 when it received an investment of USD 200 million from investment company Blackstone – a company not necessarily known for its sustainable approach.

AAK – Vegetable oils and fats for the food industry

Like Oatly, AAK is a Swedish company, but unlike the two companies presented so far, it is not primarily active in the production of plant-based foods.

Rather, AAK produces vegetable fats and oils used in the food industry, for example, to achieve a meatier consistency for vegetarian burgers. The company does also supply non-vegan producers.

In the 2021 financial year, the company generated sales of SEK 35.638 billion, equivalent to around CHF 3.85 billion. However, there are many problems associated with the food sector and AAK is not immune from them either.The company is heavily involved in the palm oil industry and processed 1.7% of the world’s palm oil in 2017. Thankfully, AAK is working to find sustainable alternatives and increased its share of palm oil from deforestation-free production from 50% to 67% in 2021. The company is continuously monitored by Inyova so we remain aware of and able to react to any changes.

How to invest in vegan stocks with Inyova?

If you care about animal welfare, the environment, and other aspects of sustainability, and want to make a difference with your investment in vegan stocks, Inyova can help you.

At Inyova, you don’t invest in just any sustainable funds (especially those that may not be as sustainable as first thought), but rather you choose the impact topics that match your values. These might not just be plant-based food, but areas like renewable energy, better education, and so on.

Then, based on what you have chosen, your very own diversified portfolio of approximately 30 – 40 stocks from different countries, industries and other factors will be compiled. Depending on the risk profile, green bonds are also added. As mentioned above, diversification helps to reduce the impact of a single stock on the entire portfolio.

If you don’t like a certain company in your portfolio, you can always remove it and replace it with a different one.

A big difference between Inyova and fund providers is the fact you can personalise your portfolio as described above, and the fact that you own the stocks. As a result, you can participate in company-relevant decisions with your voting rights as a shareholder.

With Inyova you can easily invest in a better future and do your part with little effort. Create your free Impact Investing Strategy now.

Conclusion: Sustainable food sector stocks are becoming more important

Veganism is booming and has become a huge trend in recent years. There are many reasons why more and more people are choosing a plant-based diet, whether for ethical, health, or environmental reasons.

By buying a vegan stock, you can support veganism and drive the production of these meat alternatives.

Creating your own portfolio at Inyova is not only fun, but it’s also quick and can be done with as little as CHF 2’000. Here’s how it works:

- Create a free Inyova account

- Choose the Impact topics such as “plant-based food” and other areas that are important to you

- Answer the following questions and allow us to create your strategy.

Voila! You’re now ready and can positively influence the world with Inyova. Have fun investing!