We get it. Investing is a task that’s easy to procrastinate on – especially if your bank balance is reassuringly healthy.

Yet, the No. 1 factor that will make you a successful investor is time. That’s thanks to the compound interest formula, the most powerful way for growing your wealth.

Compound interest happens when your money earns interest… and then it earns interest on that interest… and interest on that interest… and so on.

Think of your investment as if it’s rolling down a hill like a snowball, growing bigger and bigger as time goes on. The important term here is as time goes on.

In the long-term, the effect is dramatic – Albert Einstein supposedly called it “the most powerful force in the universe”, while this academic article went as far to label the effect a “miracle”.

The numbers are clear: Assuming the average annual stock market return of six percent, a CHF 10,000 investment will grow by more than CHF 3,300 in 5 years – without you making any additional deposits.

Meanwhile, the compounding effect on CHF 10,000 in your bank account is so minuscule that it barely produces a fraction of a single centime. Your money only earns around 0.01 percent interest in a Swiss bank account, which is too insignificant to cultivate any benefit of compound interest. Read more to find out how you can calculate compound interest for your investments.

Compound Interest Explained

What is compound interest? As mentioned above, compound interest is one of the most powerful ways to steadily increase the value of your investment over an extended period of time – even if you don’t invest more money. As you can see in the compound interest formula below, it allows investors to double, triple and further increase the value of their investment.

“Let money work for you” – this famous quote from the financial world is never more fitting than when you talk about compound interest.

And this is how it works: Assuming the stock market continues its average annual growth rate , the value of your investment will increase by around 6% each year. If we think about an investment of CHF 10,000 with a growth rate of 6% p.a, you will make a profit of CHF 600 in one year. Of course, it’s likely that some years will have stronger growth, and some years will see a dip. For simplicity’s sake, let’s stick with the 6% annual growth, which is the average stock market performance of the last century (including all recessions and market crashes).

The next step is the determining factor: Since you have done your research and have gone into stock market investing with a long-term view, you do not withdraw your principal investment or the CHF 600 profit after the first year. And this is where the magic of compound interest happens – because over the next year you will then receive interest not on CHF 10,000, but CHF 10,600. Therefore, your profit will increase to CHF 636 in comparison to the CHF 600 in the previous year.

Then the next year, the effect of the compound interest is going to be even stronger: Now you receive interest on the sum of CHF 11,236, which means your profit will further increase to CHF 674. And that means that your investment increased from CHF 10,000 to CHF 11,910 in only three years – without you investing any more money.

In other words, your profit will increase automatically without a new investment being necessary. And that’s what you call compound interest.

In the next paragraphs we are going to explain how you can easily calculate compound interest using the compound interest formula. But first, let’s look at an example for better understanding the dynamics of compound interest.

This table shows how CHF 10,000 will grow, even when no additional investment is made. Thanks to compound interest, an investment in the stock market will double approximately every 12 years.

| Stock Market | Bank Account | |||

|---|---|---|---|---|

| Year 0 | CHF 10,000 | CHF 10,000 | ||

| Year 1 | 10,600 | 10,001 | ||

| Year 2 | 11,236 | 10,002 | ||

| Year 3 | 11,910 | 10,003 | ||

| Year 4 | 12,625 | 10,004 | ||

| Year 5 | 13,382 | 10,005 | ||

| Year 10 | 17,908 | 10,010 | ||

| Year 20 | 32,071 | 10’020 | ||

| Year 30 | 57,435 | 10,030 | ||

| Year 40 | 102,857 | 10,040 | ||

| Year 50 | 184,202 | 10,050 |

Each figure has been rounded to the nearest franc.

To make sense of this, let’s use the compound interest calculation example of two everyday investors: Marco and Max.

They each invest CHF 10,000 in the same diversified stock market strategy.

In the year 2028, they withdraw their money.

Marco has CHF 17,908..

But Max has just CHF 13,382. A full CHF 4,526 less.

Remember, they each invested in the same portfolio of stocks, and to allow a fair comparison, we will assume both achieved the average annual stock market return of six percent.

So what did Marco do differently?

He got started right away, while Max didn’t get around to investing his money until 2023 – a full 5 years from now.

Even though Marco never added money to his investment, compounding interest meant he ended up with A LOT more than Max the procrastinating investor.

With that money, Marco could go on a month-long trip, buy a top-of-the-line mountain bike, or a fancy designer sofa. Of course, he could also keep the money invested – it would grow to more than CHF 42,000 in 25 years. In the next paragraph we will explain how you can conveniently calculate compound interest with the right formula.

Calculate compound interest online

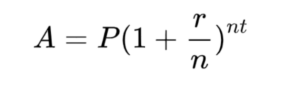

A = Amount at the end of your investment period

P = Principal (the money you invest in the beginning)

r = Interest rate or growth rate (around 6% for an average stock market investment)

n = Number of times the interest is compounded (e.g. once a year)

t = Time (the number of years you plan to invest for)

Above you can find the compound interest formula. It may look complicated at first, but it’s actually a pretty easy calculation. A is the total amount or the value of your investment after a certain time. P is the principal or original investment. r is the given interest rate and n is the number of times the interest is compounded and the total time.

All you have to do now is to add in your digits (principal, interest rate, number of times the interest is compounded) into the formula and you will immediately receive the results on how much you can increase the value of your investment over a certain time – all thanks to compound interest.

Now you can receive these results even easier. With this simple online compound interest calculator, you can examine your possible profits from compound interest without you needing to calculate anything yourself.

Or, calculate compound interest yourself using a compound interest formula like this…

(10,000 X 1.06) X 1.06 X 1.06 X 1.06 X 1.06 = CHF 13,382

That’s the compound interest on a 10,000 deposit, assuming 6 percent annual return over a 5 year time period.

As you will notice, compound interest becomes more impressive (or perhaps more frightening) over time.

Not in a position to invest 10,000 francs?

Here’s some great news. By making monthly contributions of CHF 100, your investment will grow even bigger than the numbers we’ve mentioned so far.

Let’s say you took CHF 100 each month, and put it into the same diversified stock market strategy as Marco. In 20 years, you will have CHF 45,344 (24,000 in direct contributions and more than 20,000 in pure profit).

In 30 years, your nest egg will have more than doubled again – to CHF 97,451.

Over the years, investing CHF 100 each month is better than a single deposit of CHF 10,000.

N.B. If you go down this route of small monthly contributions, check the investment provider does not charge fees each time money is added to the investment. Inyova does not do this, but many do.

Why You Should Consider a Savings Plan

Our goal is to make it as easy as possible for you to add money to your investment through an automatic payment.

Let’s say you invested 10,000 francs, and then added 1,000 francs annually.

That’s around 83 francs a month – less than the cost of going out for dinner.

As countless behavioural psychologists have noted, you won’t miss that money. Because it automatically moves into your investment, you never experience the negative emotions around “giving it up”.

Instead, you get the extremely positive emotions of your wealth growing substantially.

In 20 years, your nest egg will grow to an impressive 68,857 francs. In 30 years, it will be 135,493 francs. That’s an epic six-figure achievement – cumulative compound interest and cumulative saving at their best.

Naturally, the earlier deposits experience the most compounding interest. Assuming an average return of six percent per year, the first 1,000 francs deposited would be worth 3,207 francs at the end of a 20-year investment term and 5,743 at the end of a 30-year investment term.

Basically, for those early deposits, the return on investment is 5.7 times more than what you put in.

Compound interest calculator with monthly contributions

| One-off CHF 10,000

investment |

Monthly CHF 100

investment |

One-off CHF 10,000 +

CHF 1,000 added each year |

||||

|---|---|---|---|---|---|---|

| Year 5 | 13’382 | 6’949 |

19’019 |

|||

| Year 10 | 17,908 | 16,247 |

31,089 |

|||

| Year 20 | 32,071 | 45,344 |

68,857 |

|||

| Year 30 | 57,435 | 97,451 |

136,493 |

|||

| Year 50 | 184,202 | 357,883 |

474’537 |

|||

| Year 50 contributions | 10,000 | 60,000 |

60,000 |

|||

| Year 50 profit | 174,202 | 297,883 |

414,537 |

Each figure has been rounded to the nearest franc.

The bottom line on compound interest

If there’s one point you take from this article, it’s this: Don’t let your hard earned cash wither away in a low-interest bank account.

Even small investments make a difference – so long as you start early. The sooner you invest, the bigger the boost your money will get from compound interest.

Getting started is easy. The first step is to get your free investment strategy. Using our easy online tool, you pick what areas you’re interested in (things like renewable energy, electromobility, and plant-based food), and what values are important to you (things like human rights and gender equality). You’ll also have the option to exclude companies with interests in nuclear, meat, alcohol, and weapons. After that, you’ll see the exact list of companies we recommend for you. These will be selected according to your values, interests, risk profile and financial goals.

Get your free impact investing strategy here.

If you have an Inyova strategy already, login to view it here.

If you’ve accepted your strategy, congratulations! By investing, you not only support a company’s success, you become part of that success… growing your savings and having a positive impact on the world at the same time.