The markets are continuing to give us a lot to talk about. So, here is another update to bring you up to speed on the latest developments.

A quick intro

The following section is an introduction to inflation rates and the role of central banks. Feel free to skip this section if you’re familiar with the general concept of inflation and the main responsibilities of central banks.

Inflation rate – what it is and how it works

According to the International Monetary Fund (IMF), inflation is the rate of increase in prices over a given period of time. Thus, inflation measures how much more expensive a set of goods and services has become over a certain time period, usually a year. Take your weekly shopping as an example: Imagine, in 2021, you spent CHF 100 for a shopping basket of various grocery items. In 2022, however, you would have to pay CHF 120 for the same set of grocery items. So for an identical shopping basket you had to spend CHF 20 more compared to the previous period. The annual inflation rate used in this example is 20%.

There can be a lot of reasons for such price increases. For example, higher costs for raw materials like the wheat needed to bake bread, are simply passed onto the consumer. That said, it’s also true that economic growth leads to an increasing inflation rate, which is why some low-level inflation is perfectly normal.

Central banks – what are their responsibilities

A central bank is an institution that manages the currency and monetary policy of a country or monetary union, and oversees their commercial banking system. The primary goal of central banks is to maintain the price stability of a currency by controlling inflation. One big lever central banks can use to control inflation is setting interest rates. This tool allows them to either help spur economic growth or slow down economic activity.

What’s the current development of interest rates?

First of all, please keep in mind that not all inflation is bad. In fact, governments and central banks usually aim for an annual target inflation of 2% to both ensure that prices don’t explode as they have done recently, but also so that businesses and individuals can borrow money to support economic growth.

Inflation and interest rates tend to follow the same pattern – when inflation goes up, central banks usually raise interest rates to counter high increases in prices and therefore a higher cost of living. On the other hand, when inflation goes down, central banks tend to lower interest rates to stimulate the economy. While an annual inflation rate higher than 3 – 4% usually triggers central banks to raise interest rates, an annual inflation rate between 1 – 2% is still considered acceptable and means that Central Banks would be quite happy not to intervene.

Why do the central banks raise interest rates and how does it affect the markets?

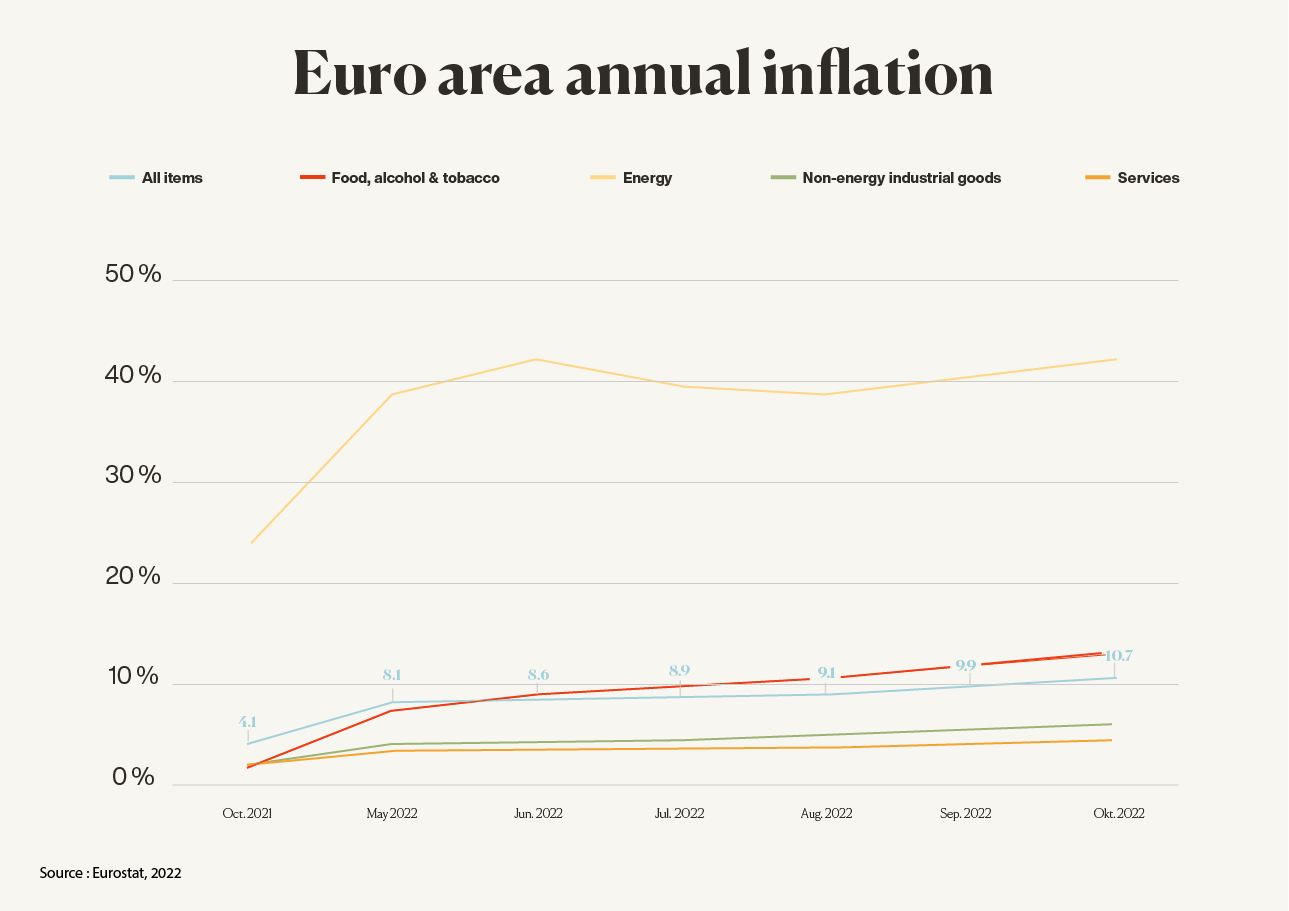

Due to the ongoing skyrocketing inflation, central banks all over the world are taking drastic measures to curb inflation and reach price stability. For instance, prices increased by more than 8% year-over-year for more than six consecutive months in the US. In the Eurozone, inflation hit double digits for the first time ever and jumped to a record of 10% per year in September 2022. Inflation in Switzerland has been higher than usual at 3.5%.

Despite the overall negative developments, there were some positive developments in the United States last week: the inflation rate in the US was lower than expected, at 7.7%. This suggests that the US Federal Reserve may exercise more restraint when adjusting interest rates in the future and experts are hoping that the inflation rate has already reached its peak. These expectations positively affected share prices – important global indices such as the S&P 500 and DAX showed strong positive development last week.

By raising interest rates, central banks want to slow down the economy. Both, consumers and businesses, need to cut down on spending as the cost of financing is going up and the cost of goods is becoming more expensive. But there is more to it than that. Higher inflation affects economies in multiple ways:

- Increased mortgage interest payments but also a higher return on savings.

- Higher financing cost and cost of goods for businesses.

- Elevated unemployment rates and overall confidence in the economy decreases.

For the reasons mentioned above, the performance of stocks declines when inflation is high and interest rates are on the rise.

As an example, imagine the owner of a solar park. When inflation and interest rates rise, the costs for the maintenance of the solar park rise. To make matters worse, the costs of borrowing money to buy the solar panels needed for the solar park also increase. The owner may only be able to pass on a small part of these increased prices to their customers, which would lead to a decrease in the companies’ profit margins.

In addition, people get more interest on their savings. Only last year, banks were charging negative interest rates. Today, many banks in Germany have begun offering some interest on money sitting in bank accounts. This pushes down the demand for stocks and therefore the stock price, too.

We’ve explained in a previous blog post how bond prices and inflation rates are related. Here is a short recap: An increase in the interest rates means that the value of bonds decreases, as these bonds have locked in a lower interest rate than they would pay now. As you can see, there is often a negative correlation between bond prices and inflation. Meaning that if inflation and interest rates are rising, bond prices go down.

As demand for goods decreases during an economic slowdown, prices will also go down, which will taper down inflation. Once inflation goes down, central banks can again ease interest rates, which will help stimulate the economy. That said, the ongoing war in Ukraine and the overarching global conflicts we are seeing in other parts of the world are likely to continue to weigh on the economy.

What does this mean for you and your Inyova investment?

Your Inyova portfolio generally moves in line with the US & European markets. As the stock market is expected to move in cycles with the economy, it is completely normal that your portfolio is experiencing a downtrend when the economy is slowing down.

We have said it before and we will say it again – historically after every downturn, there was an upward trend and the best way to benefit from this upward movement was to stay invested. Please note: The past performance of financial markets and instruments is never an indicator of future performance.

If you have any questions about your portfolio, please reach out to our Customer Success team. You can email us at [email protected] or call 044 271 50 00. We’re here to help!