Like you, we are deeply saddened by Russia’s invasion of Ukraine. We condemn Vladimir Putin’s violation of international law and attack on democracy. As participants in the global community, it is our hope that this situation may be resolved through peaceful measures and ongoing suffering is avoided.

Some people in our community have asked us how this situation affects their investment with Inyova. In this article, Inyova’s Chief Investment Officer Cristian von Angerer gives insight into the stock market. He answers the most frequently ask questions, including:

- Why does the invasion affect the stock market?

- How can Inyova investments withstand such crises?

- What is Inyova doing in response to this situation?

Why does the invasion affect the stock market?

As tensions between Russia and Ukraine reached crisis point, shock waves rippled through stock markets around the world. The value of most stocks dropped, and there was also a lot of volatility (a.k.a up and down movements).

There are three main reasons why the invasion of Ukraine has caused this reaction in global stock markets:

- Oil and gas supply

Western governments are imposing new sanctions, and in return, risking access to Russian oil and gas. And when supply goes down, prices go up. This means less growth and less profits for many companies. Typically, these costs are passed on to consumers, who pay more for goods and services (this trend is called ‘inflation’). The problem with rising inflation is that consumers tend to tighten their spending, which in turn makes the situation even harder for companies. For example, it can push interest rates up, which means companies pay more to borrow money.

- Russia is a major global player

Russia is the 11th biggest economy in the world, and tough sanctions cut the country out of global trade. This can have wide-reaching effects – for example, Russia is one of the biggest exporters of industrial metals worldwide, and it also imports a lot of technology and cars.

Meanwhile, exports from Ukraine are likely to go down as people flee to safer areas. One example of a commodity that could be affected is wheat – Ukraine is a major exporter of this product, which is a key ingredient in various food products.

- General nervousness

You might be wondering why companies that don’t depend on oil and gas have also taken a hit. This comes down to how nervous investors are feeling. Some investors worry that the situation will get worse, and they move their money into less volatile assets, such as bonds, instead.

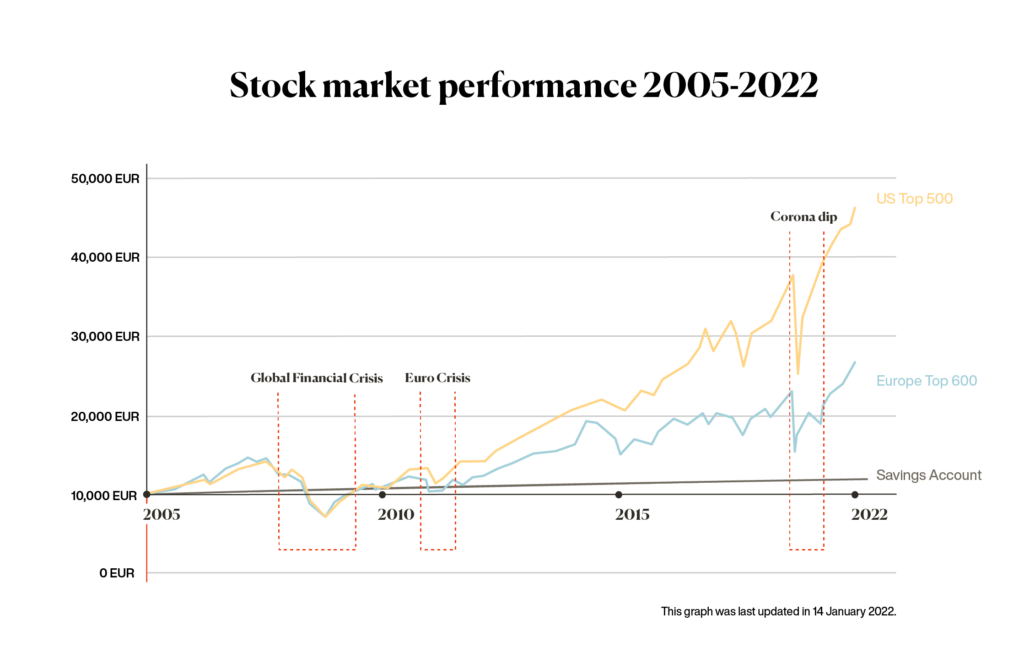

As you can see in the graph below, history shows us that investors who are able to ride out the storm have always returned to making strong gains once again.

So, although it’s natural to feel nervous, it’s important to remember: we expect these events to happen from time to time, and we design your portfolio to withstand them in the long-term.

How can Inyova investments withstand such crises?

With Inyova, your portfolio is well diversified. It contains 30-40 individual stocks, spread across different industries, regions, company sizes, and other factors. Depending on the level of risk that is suitable for you, your investment may also include Green Bonds, which typically experience slower but more stable growth (fewer up and down movements along the way).

Thanks to Inyova’s diversification methods, you avoid a situation where “all your eggs are in one basket”. Even if some companies, industries or regions experience hard times as a result of the Ukrainian invasion, your investment is still designed to generate attractive returns in the long-term (you should have a view of holding onto your investment for at least 5-10 years).

Let’s take a look at this chart:

Not so long ago, when the pandemic first swept across the world, the global stock markets experienced a significant drop. Some investors panicked and sold their stocks at this point. On the other hand, the investors who stayed calm and stayed true to their long-term strategy were soon making strong gains once again.

What is Inyova doing in response to the situation in Ukraine?

Firstly, our investment team is always monitoring global events. As different stocks move up and down, we make sure your portfolio stays diversified and in-line with your risk profile.

Secondly, we moved quickly to sell stocks with ties to Russia. There was only one such company in the Inyova Universe: Yandex. This Digital Champion is headquartered in the Netherlands, but its primary market is Russia. It’s important to note that no company has more than 2-3% of your total investment. So if Yandex was in your portfolio, it was only a very small part of it.

For investors who prefer a more stable investment – less potential for growth, in exchange for less potential for losses – it is possible to include Green Bonds in your Inyova investment strategy. Generally speaking, bonds are less risky than stocks, as they tend to be less volatile and are more stable (think: less up and down movements on a day-to-day basis). Not only do green bonds allow you to directly fund great and impactful green projects, but they also help maintain a steady balance in your portfolio’s performance.

If you have any questions, please reach out to our Customer Success Team on +41 44 271 50 00. We are always happy to help you!