When thinking about where impact investing will be in the next 25 to 50 years, it’s clear that the future lies with Millennials and Generation Z. These two generations will determine whether investments become more ethical and sustainable, or simply pad the pockets of wealthy business people.

But what characterises these groups? And how can Inyova ultimately help these new generations change the future for good?

It starts with trust, transparency, and mutual respect.

Who are Millennials and Gen Zers?

We talk about them a lot, but who exactly are these new generations?

Millennials were born between 1981 and 1995, and currently make up most of the workforce. They’re known for being digitally connected and for wanting instant gratification, work-life balance, new experiences, and social collaboration.

Loosely defined as those born between 1996 and 2010, Gen Zers value diversity and are entrepreneurial, pragmatic, and technology savvy. As of 2020, this demographic constitutes one-third of the global population. That’s a lot of purchasing power and influence in the workplace!

These generations might get a bad rap for being shallow and self-centered, but our research finds quite the opposite. Young people tend to behave more sustainably: They eat less meat, pay attention to issues like ocean plastic and deforestation, and buy organic and free range when possible.

This all sounds promising, but does it affect whether youth will engage in ethical investing?

The answer is clear: yes!

Here are some key findings supporting this new trend:

- 86% of Millennials are interested in impact investing, and Millennials are twice as likely to invest in funds targeting social or environmental causes than the general population.

- Around three-quarters (72%) of Gen Zers expressed hope that responsible investing could improve sustainability outcomes.

This is exciting for us at Inyova because it shows there’s a new wave of sustainable investing on the horizon in Switzerland.

What is sustainable investing?

Now, let’s look more closely at what exactly “sustainable investing” means.

At Inyova, we use the same definition for sustainable investing as the Global Impact Investing Network (GIIN) – that is, “investments made with the intention to generate social and environmental impact alongside a financial return”.

It’s important to note that many studies have shown impact investors can yield returns equal or greater to the market rate.

Impact investing is also important because it bridges the gap between philanthropy (money given with no expectation for financial return) and traditional investing (money invested with little thought for the impact these companies have on the world). It leads to real outcomes for the Sustainable Development Goals.

Our customers directly own shares in companies making a difference. For example, Tesla has driven the car industry to take electric vehicles seriously, and Xylem has funded new systems to purify and transport water to help the world’s poor. Talk about a major impact!

Barriers to sustainable investing

Now, if impact is such a priority for Millennials and Gen Zers, and investing can make a tangible difference in the world, why is there not more sustainable investing today?

Well, traditionally, impact investing was hard work.

Historically, only wealthy customers of private banks could afford to invest. For others, sustainable investing meant assuming very high risk or low returns.

Our research uncovered that many popular sustainability funds contain companies with questionable social impact. This includes food conglomerate Nestle, oil company Total SA, and Saudi Arabia Mining!

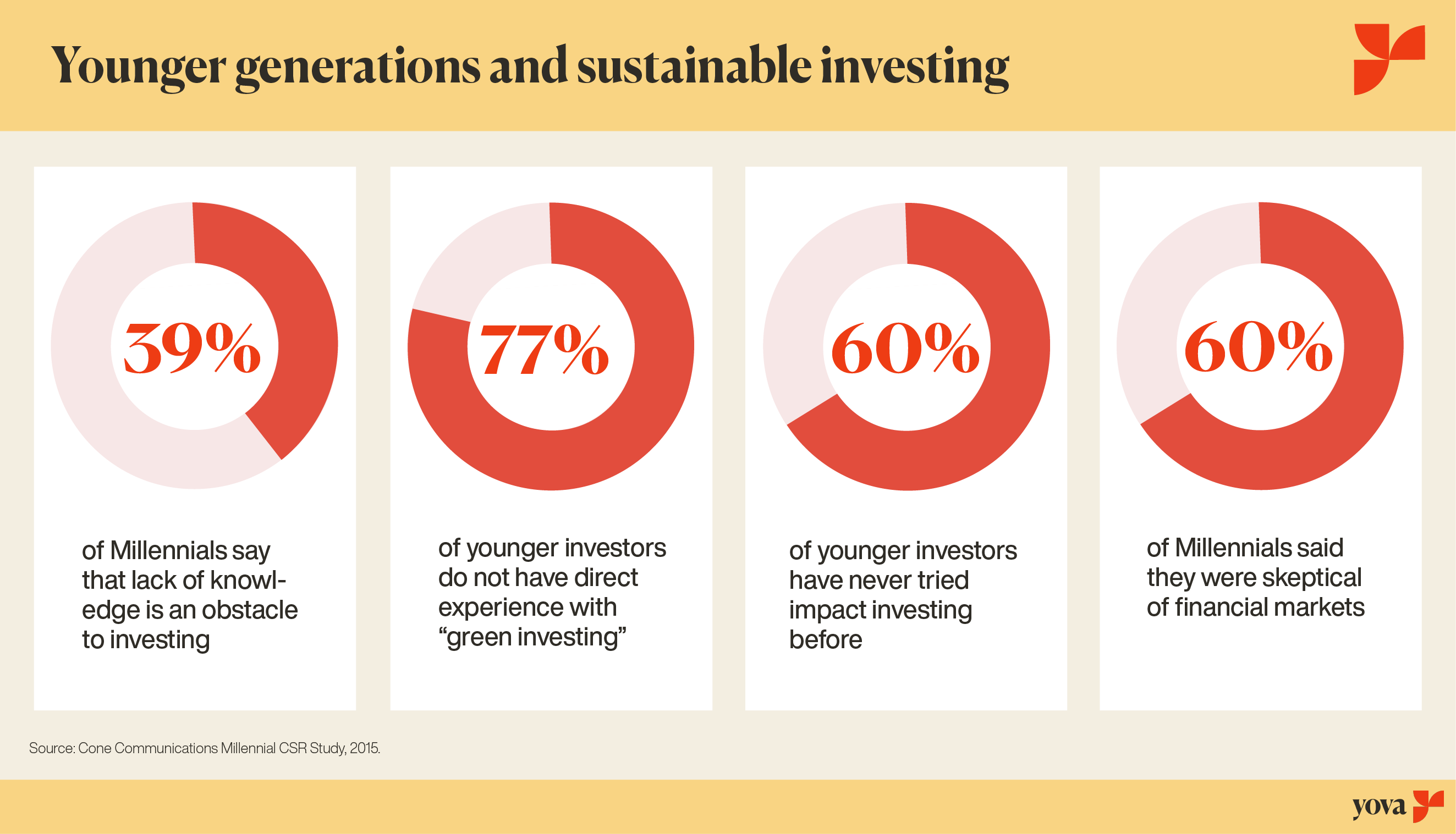

We often find that younger generations simply don’t know how to make ethical investments. 39% of Millennials say that lack of knowledge is an obstacle to investing. 77% of younger investors do not have direct experience with “green investing” and two-thirds have never tried impact investing before.

Additionally, 60% of Millennials surveyed by ShareBuilder said they were skeptical of financial markets. Who can blame them, when considering the impact the financial crisis had on many of their families?

For Millennials and Gen Zers, existing options just don’t seem promising. That’s why we want to create a new culture of trust and accessibility.

Future opportunities for sustainable investing

What could sustainable investing look like if we build the future we want?

Current trends paint a nice picture – sustainable investing in Switzerland has grown over 17% annually over the past four years.

Luckily, sustainable investing is on the rise at the same time as Millennials are reaching a point where they have savings to invest and the first Gen Zers are entering the workforce.

To put this in perspective, Millennials hold CHF 1.4 trillion in purchasing power and, together with Gen Zers, they are expected to eventually receive over CHF 30 trillion in assets from Baby Boomer parents. This is the biggest asset transfer in history – and if it’s invested in sustainable companies, the positive impacts will ripple through society.

Here’s what we’re doing to inspire young investors:

- Catering to their social and environmental values

Cone Communications Millennial CSR Study, over 90% of Millennials want to switch to cause-related brands and 70% want to spend more on ethical products. 72% of Gen Zers, history’s most ethnically and racially diverse generation, believe that racial equality is the most important cause for businesses and governments to currently address. - Integrating with their favourite technologies

From smartphones and tablets to Instagram and Facebook, Millennials and Gen Zers are the first generations that grew up with technology. For personal finance and investing, young investors are turning to digital and mobile-first solutions. Popular trends include robo-advisors, budgeting apps, cryptocurrency, and cashless transactions. - Providing honest and clear communications

Labeled as the “True Gen”, Gen Z has earned a reputation for searching for truth and asking institutions in power to be held accountable for their actions and transparent about their policies.

By now, it should be clear that Gen Zers and Millennials are changing the future. That’s why we’ve developed a new approach that is fully digital and transparent, making investing more personalised and accessible to investors with all levels of experience.

How Inyova is helping younger generations get started in sustainable investing

At Inyova, we want Millennials and Gen Zers to understand where their money is going and what they’re paying for our service. They don’t need to worry about hidden fees, lengthy contracts or complex jargon. At Inyova, there’s just one all-inclusive fee and an easy-to-use interface.

Through our online app, anyone can select the impact topics they care about, customise their investment strategy, and open up a personal account. Any amount from CHF 2000 can be diversified into a portfolio that’s designed to provide financial returns, and also make the world a better place.

Every company that goes into an Inyova portfolio is assessed according to the following criteria:

- A company’s handprint: its impact on 12 topics that create a better world, from renewable energy and clean water to disease eradication and advancing education

- A company’s footprint: its adoption of four good business pillars related to low carbon emissions, gender equality, fair wages, and human rights

- Environmental, social, and governance (ESG) rating

We also give investors the choice to exclude companies with coal or gas, nuclear, pesticides, alcohol, tobacco, meat, animal testing, and weapons. You can learn more about our approach to best assess companies here.

As we see it, Millennials and Gen Zers represent the future of sustainable investing and we want to help them build it.

Are you part of the new generations? What’s your view on sustainable investing? Give impact investing a shot and take your first step with us today.