Impact investing is all about taking back control to create positive change. Active ownership means actively exercising one’s rights as a shareholder. This includes, in particular, shareholder engagement and voting. Active ownership allows shareholders to publicly pressure and push for change in existing companies and take back control through actively influencing the companies they are owners of.

We can only make real change happen if we get the business community to rethink. To achieve this, we need to take action and become responsible, active shareholders who exercise their voting rights and engage according to their values. We need to stop leaving funds and their proxies to do whatever they want and get closer to the companies we own. As an Inyova impact investor, you are taking responsibility for what our capital is doing and take back control by supporting our community’s shareholder initiatives.

Wondering exactly what Inyova is doing in regard to active ownership? Our Engagement & Voting Policy explains the philosophy behind our initiatives and describes how we create positive change through responsible voting.

Here are all of the Inyova community’s shareholder initiatives to date:

- The Inyova community’s shareholder initiatives 2025

- The Inyova community’s shareholder initiatives 2024

- Voting in 2024

- The Inyova community’s shareholder initiatives 2023

- All AGMs the Inyova community voted at in 2023

- The Inyova community’s shareholder initiatives 2022

- All AGMs the Inyova community voted at in 2022

The Inyova community’s shareholder initiatives 2025

Netflix

Together with the Benedictine Sisters of Mount Scholastica, we’ve re-filed a shareholder resolution at Netflix.

Our goal? To strengthen Netflix’s board-level gender equality governance – especially as a board member faces allegations of misconduct in this area.

Last year, our proposal gained enough support to re-file. This time, we’ve incorporated valuable feedback from larger investors and refined it to make it easier for them to back.

Netflix champions diversity on-screen, but its boardroom policies fall short – risking credibility, alienating talent, and losing audiences.

A shareholder resolution literally puts this issue on the agenda – but it’s more than a vote, it triggers crucial dialogue between major shareholders and the company. But filing a resolution isn’t easy, so we have partnered up with the sisters to enable the Inyova community to do so.

By pushing for change at the top together, we’re ensuring Netflix stays true to its values – both behind the scenes and on-screen. Find the resolution here (page 88)

How investments drive action: Shareholders for Change 2024 engagement report

The Shareholders for Change (SfC) network, which Inyova joined on behalf of its community, just released its 2024 engagement report and shows how investments are helping push companies in the right direction.

In 2024, 20 investor members of SfC, backed by a total of EUR 48 billion in assets under management, engaged with 172 companies and one institution, mostly in Europe. What does that mean? It means filing resolutions, voting at annual general meetings (AGMs), and asking the tough questions to hold companies accountable.

The report offers a great overview of the SfC network’s work, highlighting standout examples and listing every initiative at the end. We’re excited to see initiatives from the Inyova community of impact investors featured so prominently.

Change happens when investors work together. Alone, it’s hard to make companies listen. But with EUR 48 billion and the support of the Inyova community behind us, our collective voice is impossible to ignore. Read the report here.

The Inyova community’s shareholder initiatives 2024

Publicis Groupe / WPP

In 2023, Inyova launched the lighthouse engagement “Stop Greenwashing Ads”. We collected the support of 1,380 Inyova impact investors to convince advertising giant Publicis to stop working for fossil fuel companies. Building on this, we expanded the effort to WPP, the world’s largest PR and advertising firm.

Inyova united a strong alliance of investors, managing USD 132 billion in assets to drive this cause. By working with NGOs like Purpose Disruptors, we strengthened our case and our engagement has helped them secure new research funding.

And it’s making waves: UN Secretary-General António Guterres condemned PR firms for spreading climate misinformation, and the UNFCCC’s Race to Zero campaign is pushing advertising to reduce their climate impact and align with global climate goals.

Inyova, representing its impact investor community, will keep pushing major advertising companies to take responsibility for the climate impact and to stop ties with fossil fuel clients.

Advertising shapes public opinion and behaviour. Through initiatives like this, Inyova and its community are disrupting fossil fuel narratives, supporting NGO campaigns, and promoting responsibility within the advertising industry.Our impact work has been featured in reports by the Purpose Disruptors, InfluenceMap and Planet Tracker.

ShareAction’s Chemicals Decarbonisation working group: Air Liquide

In collaboration with ShareAction, a UK-based organisation championing responsible investment, Inyova impact investors successfully drove progress in the chemical sector.

Our engagement with Air Liquide, one of the world’s largest industrial gases companies, resulted in a Climate Transition Plan, with a commitment to carbon neutrality by 2050. Alongside this, we’ve also called on EU policymakers to tighten rules for “low carbon hydrogen,” ensuring only truly low-emission hydrogen qualifies as such.

We’ll keep monitoring Air Liquide’s progress.

The chemical sector is responsible for 6.3% of global greenhouse gas emissions – yet most companies lack credible plans to fix this. Air Liquide’s commitment sets a powerful example for others to follow. And with stricter rules on fossil-based hydrogen, we can accelerate the shift to climate-neutral production.

Ørsted

Ørsted, a Danish clean energy leader, has officially shut down its last coal-fired power plant. This marks the end of its reliance on coal and is a major step in its year-long transition to 100% clean energy. Ørsted was once called DONG, short for Danish Oil & Natural Gas, so it’s come a long way.

This was also thanks to pressure from the Inyova impact investor community. We joined the Shareholders for Change in engaging Ørsted and its majority owner, the Danish Energy Agency, to keep the pressure up after delays in their coal phase-out plan.

Coal is the most polluting way to produce electricity. An energy company phasing out coal is a big step towards a fossil-free future.

Banque Cantonale Vaudoise

When media reports revealed that Swiss cantonal bank Banque Cantonale Vaudoise (BCV) held shares in Elbit Systems, Inyova’s impact investors took important action. Elbit is a defence company criticised for its role in military conflicts. Our community flagged this issue, and our experts engaged BCV.

After our engagement, BCV confirmed that it no longer holds shares in Elbit Systems. This is an important step for a more ethical Swiss investment place and it shows how accountability is growing among financial institutions.

This change shows how Inyova’s community of impact investors can help uncover and clean up ethical breaches in the Swiss financial ecosystem.

Stora Enso

Harvesting operations of Sustainable Forestry champion Stora Enso were linked to damaging a rare, protected species of freshwater mussel in Finland.

On behalf of 3,300 impact investors we stepped in to get answers. Stora Enso didn’t just acknowledge the issue – they acted decisively and swiftly identified key areas for improvement:

- Stronger safeguards: Immediately halted harvesting in all restricted areas and updated operational guidelines.

- Better oversight: Strengthened monitoring, increased inspections, and introduced enhanced staff training.

- Full transparency: Reported findings to environmental authorities and worked with experts to restore the habitat.

Even sustainability leaders face setbacks. What sets them apart is how they respond.

Using the voices of our impact investors, we ensured Stora Enso took swift, decisive action – raising the bar for responsible forestry. This is what true corporate accountability looks like.

Influencing EUR 48 billion in sustainable finance: Inyova joins board of the Shareholders for Change

Andreas, Inyova’s Head of Impact, has been elected to the board of Shareholders for Change (SfC), a network of European asset managers using their collective power to drive sustainability since 2017.

SfC unites 20 members from across Europe – including the Ethos Foundation, GLS Investments, and Alternative Bank Schweiz – who collectively manage over EUR 48 billion in assets.

Power in numbers. That’s what makes investor networks like SfC so important. Alone, an investor can call for change. But together, with EUR 48 billion behind us, we make companies listen – and act.

Collaboration with other investors is a key part of our engagement strategy. The board position allows the Inyova community to shape the network’s direction.

Shareholders for Change board members Alix Roy, Ugo Biggeri, Andreas von Angerer

Insure Our Future – Helvetia Holding, Swiss Re, Zürich Insurance

Insurance companies play a key role in the transformation of the economy. Their risk modelling and coverage determines which projects are being realised and which are not. Unfortunately, insurance companies continue to insure and finance fossil fuel projects that are not aligned with a 1.5°C global warming pathway.

That’s why Inyova asked you, our community of impact investors, to co-sign a letter to three of the largest Swiss insurance companies: Helvetia Holding, Swiss Re, the Zurich Insurance Group. In the letter, we urged them to strengthen their policies on fossil fuels and to expand their coverage of green, clean and sustainable solutions. In the end, a total of almost 1,250 of your signatures backed our letters to these insurance giants.

Our progress

This allowed Inyova to have discussions with Zurich and Swiss Re, during which we addressed the questions outlined in our letters. These conversations provided us with valuable insights into the specific challenges and decision-making processes at both companies. Additionally, we have scheduled a call with Helvetia, who informed us that they plan to provide updates and increased disclosure on the topic throughout the year.

We also spoke on behalf of the Inyova impact investors at the AGMs of Zurich and Swiss Re

At the Zurich AGM, there were many questions about their involvement with fossil fuels. Michel Lies, chairman of the board of the Zürich Insurance Group, declined to provide detailed responses to our questions, stating that everything had already been addressed. Nonetheless, when it was our turn, we used the opportunity to re-emphasize the importance of the issues raised and defended the number of questions from shareholders.

At Swiss Re’s AGM, on the other hand, the CEO responded to our questions with a completely different tone and thorough answers. He detailed the challenges in setting targets for “insured emissions” across all business lines, noting that the methodologies are still under development.

Concrete outcomes

Zurich has announced that they will tighten their oil and gas policies by no longer insuring new oil and gas projects. Meanwhile, Swiss Re plans to enhance transparency regarding their progress in the transition to sustainable practices.

Our continuous efforts and the commitment of the Inyova community are making an impact. We will maintain our dialogue with these insurance giants and continue to push for concrete changes.

Netflix

In 2024, we achieved a major milestone in our engagement with Netflix. Inyova’s goal was to thoroughly investigate the allegations against their prominent board member, Mathias Döpfner. To this end, we co-filed a shareholder resolution to enhance the Netflix Code of Ethics, which currently does not address the alleged conduct by Döpfner. Additionally, we called for a report that documents how Netflix board members comply with the amended code.

To file the resolution, we teamed up with the Benedictine Sisters of Mount Scholastica, who are known for their shareholder activism, particularly in engaging arms manufacturers in the US.

Inyova also published a detailed investor briefing that explains the background of the resolution. Additionally, we have actively reached out (Proxy Statement, page 92) to fellow Netflix shareholders about the resolution, which will be up for a vote on 6 June 2024 at the Netflix AGM.

We will continue to pursue our engagement with Netflix and advocate for stricter codes of conduct to foster a culture of transparency and integrity.

Beiersdorf

As part of a collaboration with the Dutch Association of Investors for Sustainable Development (VBDO), Inyova engaged Beiersdorf to reflect on and reduce their use of plastic packaging.

In a recent call, Beiersdorf agreed to present their strategy and answer our questions. The targets of the company include:

- 50% reduction in fossil-based virgin plastics in packaging by 2025 (compared to the 2019 baseline)

- 30% recycled material in plastic packaging by 2025 (compared to the 2019 baseline)

- 100% of packaging refillable, reusable, or recyclable by 2025

To date, they have achieved:

- A 16% reduction in fossil-based virgin plastics

- 12% recycled material

- 80% of their packaging is designed for recycling, with 67% globally recyclable

Inyova was impressed by the strategy Beiersdorf presented. The VBDO expert also agreed and praised the progress. They emphasised that Beiersdorf’s lobbying supports important regulations like the Global Plastics Treaty.

We will continue to stay engaged and closely monitor Beiersdorf’s developments to ensure that the ambitious goals are achieved.

BMW

In November 2023, German broadcasters NDR, WDR, and the Sueddeutsche Zeitung reported on environmental pollution and poor working conditions at a cobalt supplier of BMW in Morocco. According to these reports, the mine contaminates nearby water sources with arsenic.

In response, we, in collaboration with Shareholders for Change, a network of European investors focused on shareholder engagement, reached out to BMW to inquire about their investigation into these claims. BMW informed us that they are conducting an on-site audit and will share the results with us.

However, to our disappointment, we had to learn about the results through the news. Consequently, we addressed the lack of satisfactory communication at their 2024 AGM, posing additional questions about the audit findings. In response, BMW’s CEO committed that it cannot be fully excluded that the pollution is coming from the mine.

Inyova remains engaged with BMW and will continue to monitor its supply chain management and electrification strategy to ensure such issues are addressed and sustainable practices are promoted.

Swiss Re

In November 2023, Swiss Re hit the headlines for its practices in Brazil. Swiss Re was reportedly offering insurance to farms involved in the illegal deforestation of the Amazon rainforest.

We reached out to Swiss Re along with Ethius, Forma Futura and GLS Investments, three fellow members of Shareholders for Change, to learn more about their response to this controversy.

Inyova did not receive satisfactory answers in a first call, but in a second exchange relevant questions were answered and measures to avoid such cases in the future were explained. We will continue to monitor Swiss Re’s progress moving forward.

Voting in 2024

Since May 2024, Inyova has been using the “As You Vote” voting service from As You Sow. This service allows us to vote based on rules to promote sustainable development in our investment universe. We consider “As You Vote” the service most aligned with Inyova’s values and its community of impact investors.

You can find the As You Vote guidelines here.

In 2024, the Inyova community used its voting power to shape a more sustainable and equitable future. Together, we supported 68 shareholder proposals that aimed to drive meaningful change. Four of these reached majority support, while 42 exceeded the important 10% threshold – sending a strong message to companies about what matters to investors.

Proposals related to good governance led the way, with emerging themes such as ethical AI, transparency around gender pay equity, and freedom of association gaining significant momentum.Notably, the AI ethics proposal received the highest level of support.

We also actively rejected 17 anti-ESG proposals that would have slowed progress on environmental, social, and governance (ESG) issues. One extreme example asked Amazon to ease content moderation – potentially enabling hate speech against minorities. Thanks to coordinated voting, nearly all of these proposals fell below the level required to be reintroduced, demonstrating the collective impact of aligned investor voices.

Shareholder voting remains one of the most effective tools to foster responsible business practices. Even in an increasingly polarised landscape, every vote contributes to the momentum toward a greener, fairer world. By uplifting forward-looking proposals and aligning with shared ESG values, we protect progress and help build a future we can all believe in.

The Inyova community’s shareholder initiatives 2023

Ørsted

In October 2023, Inyova joined forces with Shareholders for Change members Ethius and GLS Investment to confront Ørsted over its delayed coal phase-out. The Danish Energy Agency, which is the majority shareholder of the company, had instructed Ørsted to continue operating the coal-fired power plants. Inyova therefore also reached out to the agency and asked it to prevent further delays in the phase-out.

Both Ørsted and the agency gave assurances that the coal phase-out would be completed by September 2024. This response has satisfied Inyova for the time being and there is currently no need for further action. Nevertheless, Inyova will closely monitor compliance with the promised phase-out and intervene again if there are any signs of delays.

Beiersdorf

In May 2023, Inyova co-signed an investor statement to major fast-moving consumer goods companies and retailers regarding their use of plastic packaging. The initiative was joined by investors managing about USD 10 trillion in assets and was covered by the Financial Times. As part of this initiative, the coalition has reached out to 36 companies, including Beiersdorf.

Beiersdorf is part of the plastic value chain and contributes to the plastic waste generation. While the company is moving in a good direction with regards to the aforementioned initiatives, more efforts are needed to reduce plastic packaging and waste.

Inyova is therefore leading the efforts in engaging with Beiersdorf and has taken over communication with the company. As part of this, we sent a letter to Beiersdorf on 10 August 2023, urging for immediate action to diminish plastics from significant users of plastic packaging.

Read more on the initiative here.

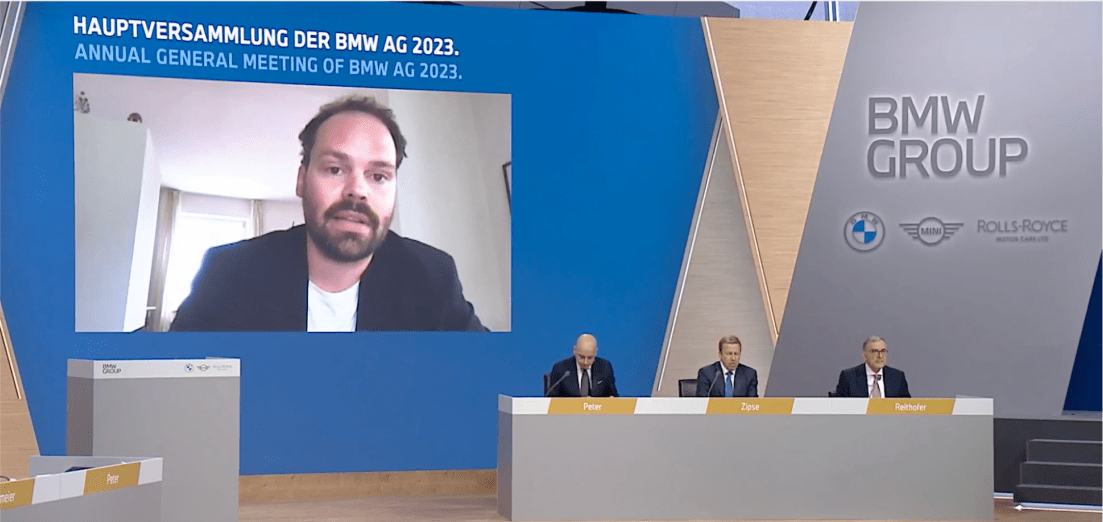

BMW

In 2022, the Inyova community launched a successful engagement initiative with BMW to address the company’s insufficient electrification strategy and a lack of diversity on their board.

Since we started our Shareholder Impact Initiative, the car manufacturer has made significant progress in its commitment to electric mobility and expanded its BEV offerings across all segments. However, there are still areas of concern. Despite the electric push, BMW continues to invest in the development of combustion engines.

Following up on this initiative, Inyova’s Head of Impact delivered a live speech at the company’s AGM on 11 May 2023. We were able to pose critical questions concerning the proportion of BMW’s investments in combustion engines versus electric vehicles and will continue to push for more positive change at BMW.

Netflix

In addition to his role as CEO at Axel Springer, Mathias Döpfner is a member of the Board of Directors at Netflix. Since October 2021, media reported allegations of inappropriate behaviour by Döpfner, related to a misconduct scandal at Bild, Axel Springer’s largest media house.

In response to these allegations, Inyova attempted to start an engagement with Netflix in 2022, but could not establish a dialogue with the company. So in 2023, Inyova decided to file a recommendation to vote against Döpfner as a board member of Netflix at their 2023 AGM citing concerns over his alleged behaviour and potential impact on Netflix’s reputation.

While Döpfner was re-elected (receiving about 18% of AGAINST votes), various media outlets (here, here and here) covered Inyova’s concerns, thereby increasing the public pressure on Netflix to respond.

Publicis

Early 2023, over 2,000 Inyova impact investors joined the Shareholder Impact Initiative calling on Publicis Groupe to stop working with fossil fuel clients. The Inyova community has been engaging with Publicis regarding the climate impact of their advertising services, especially when provided to high-carbon emitting clients such as fossil fuel companies.

In close collaboration with NGOs such as Clean Creatives, InfluenceMap and Purpose Disruptors and an investor alliance that combined manages more than EUR 16 billion in assets, we were able to raise the issue live at the Publicis’ AGM in May 2023. Based on their response, Inyova will now continue to try to deepen the conversation around the climate impacts of their services.

Our next steps will include a follow up to our second letter to seek dialogue with the decision makers of Publicis as well as further work with NGOs and other companies to continue raising awareness and applying pressure.

ABB

In December 2022, ABB was ordered to pay USD 460 million total to US authorities to settle criminal and civil charges relating to a corruption scheme in South Africa. Based on the news, Inyova reached out to ABB to learn more about the actions taken to avoid such misconduct in the future.

They let us know that they self-reported the issue to authorities once they had discovered it. ABB also took further steps to ensure compliance in the future, such as the termination of all employees involved in the misconduct, enhanced internal accounting controls around public tenders, and the introduction of a new code of conduct.

Veolia

In October 2022, one of our data providers flagged that Veolia is involved in nuclear weapons. Via a joint venture, Veolia provides bespoke on-board and shipyard logistics for the maintenance and repair of French submarines that carry nuclear warheads.

We reached out to Veolia to start a dialogue with them about the issue, and to ask them to provide a plan to cease the controversial business. We received an unsatisfactory response which lacked a clear timeline and didn’t eliminate the possibility of the company getting involved with nuclear weapons in the future. Further emails remained unanswered despite following up several times. After we notified them that we’re going to sell all our Veolia shares, the company was still unable to assure us they would discontinue their involvement. Given Inyova’s zero-tolerance policy towards any involvement with weapons of mass destruction, we divested all our holdings in Veolia.

All AGMs the Inyova community voted at in 2023

Exercising voting rights at the annual general meeting (AGM) is a core element of active ownership to drive change at companies. If there is an issue with the company, investors may decide to vote against the company board on specific agenda items. Importantly, these proposals don’t actually have to pass for them to be considered a success. Based on experience by the Ethos foundation, even an opposition level of just 10% already sends a strong signal to the company, which can force them to proactively address an issue.

Inyova supports resolutions that ask for more accountability and disclosure on key issues like climate change or diversity. Here are all the AGMs the Inyova community voted at in 2023:

California Water Service Group – 31 May, 2023

We supported a resolution filed by Nia Impact Capital that called for science-based GHG reduction targets aligned with the Paris Agreement and a respective action plan. The resolution gained about 32.5% of the votes.

American Water Works AGM – 10 May, 2023

Inyova voted to support a resolution that called for a Racial equity audit. The resolution filed by Trillium Asset Management asked the company to assess the racial impacts of its policies, practices, products, and services. For example, detrimental impacts of water privatisation plans on water affordability in Black and Latinx communities. The resolution gathered 40.02% votes in favour.

AbbVie AGM – 5 May, 2023

We supported resolutions that called for greater transparency on political spending and lobbying and whether they match the company’s publicly stated values such as women’s access to reproductive health care or climate change mitigation. Both resolutions gained around 36% of the votes.

There was also a resolution that requested an inquiry into limitation of access to medicine due to patents. About 30% voted in favour. Another resolution received a majority vote (53.5%). It called for a simple majority vote to eliminate supermajority voting requirements, which would improve shareholder rights. We voted to support both of these resolutions.

Eli Lilly AGM – 1 May, 2023

There were several shareholder resolutions to support at this AGM. We voted amongst others in favour of the following resolutions:

- Patents and Access – asking to establish and report on a process to determine when to limit access to certain medicines through patents. It received only about 10% of all votes.

- Lobbying Alignment & Lobbying Disclosure – asking to investigate how the company reconciles commitments to both innovation and patient access in their lobbying activities, and how much they spend on lobbying. Both resolutions received some noteworthy support by investors: 22.5% and 31% voted in favour.

- Diversity, equity, and inclusion data by the NGO ‘As You Sow’ requesting Eli Lilly to report on the effectiveness of their diversity, equity, and inclusion efforts. 27% of shareholders supported the resolution.

We also helped to vote down a resolution filed by a right-wing group asking about the risks associated with supporting abortion. This received less than 2% of total votes.

Johnson & Johnson AGM – 27 April, 2023

At the Johnson & Johnson AGM, we supported two shareholder resolutions that were up for vote: one by Oxfam asking for a report on how Covid-19 vaccine is being priced, receiving almost 32% of total votes, and another one demanding a report on how the use of patents might limit access to medicines, which was supported by about 14% of shareholders.

Pfizer AGM – 27 April, 2023

We supported shareholder resolutions on access to medicine, political donations and governance issues:

- There was strong support for the resolutions that addressed the transfer of intellectual property and know-how to facilitate the production of COVID-19 vaccine (43% in favour) and the impact of extended patent exclusivities on product access (30% in favour).

- Unfortunately, the resolution asking to check whether donations to political parties are in line with Pfizer’s policies to end discrimination against women, i.e. whether the company also funds Republican candidates that want to end important rights such as abortion, only received 14% of votes.

Texas Instruments AGM – 27 April, 2023

At the AGM of chipmaker Texas Instruments, there was an important resolution asking the company to implement a due diligence process to determine whether their products are being used by Russian forces in their invasion of Ukraine. About 23% of shareholders voted in favour, including the Inyova community.

Adobe AGM – 20 April, 2023

There was only a single resolution filed at the AGM of Adobe. It addresses the prison-industrial complex in the US (if you’re interested in learning more about this issue, we recommend the Netflix documentary “13th”). The resolution asked the company to analyse whether their hiring practices related to people with arrest or incarceration records, which in the US are predominantly people of colour, are aligned with publicly stated diversity, equity, and inclusion policies and goals.

About 17% of shareholders including the Inyova community supported this resolution.

Apple AGM – 10 March, 2023

At Apple, our voting addressed issues of diversity and inclusion. First, we supported a resolution to force Apple to disclose median pay gaps across race and gender. This resolution received 34% of the votes. This might trigger Apple’s management to fix the issue proactively to avoid another vote at the next AGM.

We also voted against a resolution that is part of the current anti-ESG trend in the US. It was filed by a right-wing front group and sought to audit whether there is any discrimination against employees deemed ‘non-diverse’, explicitly trying to undermine last year’s AGM vote in favour of a civil rights audit on discrimination on the basis of race, sex, orientation, and ethnic categories. Our vote helped to defeat this resolution, receiving just 1% of votes.

Ørsted AGM – 7 March, 2023

At Ørsted, there were no specific shareholder resolutions to support but we decided to vote against the board on several agenda items. This is because Ørsted has increased their share of coal power from 2% to 4% in 2022 – something we find deeply troubling as coal is the most polluting way to produce electricity. We voted against approving Ørsted’s annual report and their remuneration scheme – items which normally pass without a second thought – to make a statement and show our discontent about this development.

The majority of investors decided to vote in line with board recommendations. Only the remuneration scheme received a considerable opposition level of almost 3%. This means, we will now make our concerns heard by seeking direct dialogue with the company ahead of their next AGM.

The Inyova community’s shareholder initiatives 2022

BMW

In February 2022, Inyova started to engage BMW on their electrification strategy and board diversity. BMW was regarded as a laggard when it comes to electro mobility and they were missing diversity and specific expertise on sustainable mobility on their supervisory board.

The idea was to provide BMW with a list of female mobility experts to diversify their board and to strengthen their positioning amid the mobility transition. However, BMW was not interested in our list of candidates, that’s why we nominated an expert in sustainable mobility for the board: Susan Shaheen, a Professor in Civil and Environmental Engineering at UC Berkeley.

While Susan was not elected to the board, the initiative received major media attention (see here, here, here and here) and fellow shareholders of BMW addressed all the issues Inyova had raised in their Investor Briefing during the 2022 AGM of BMW.

In addition to the nomination, Inyova’s Head of Impact also made a video statement pointing out the current weakness at BMW in terms of electrification and board diversity, which also received broad media coverage (see here, here and here) and increased the public pressure on BMW to change.

Read more on the initiative here.

Adecco

In March 2022, Adecco acquired a majority stake in Akka Technologies, a technology consulting firm that also provides engineering and test services for missiles carrying nuclear warheads. Inyova contacted Adecco and learned that they have no plans to withdraw from this harmful business in the short term. Thus, we divested all our holdings in Veolia.

After divestment, Adecco informed us that they implemented a controversial weapons policy that prohibits them from entering into contracts that involve any service for controversial weapons such as nuclear weapons. They also told us that they are renegotiating the affected contracts of Akka Technologies. Inyova will monitor developments closely.

Netflix

After several investigative media reports (New York Times, Financial Times and Der Spiegel) on alleged misbehaviour of Netflix board member Mathias Döpfner, Inyova decided to reach out to Netflix to ask them to investigate these allegations. As we did not receive any response from Netflix, we planned to file a shareholder resolution in collaboration with As You Sow, an NGO specialised in active ownership in the US.

The idea was to file a resolution that asks Netflix to publish a policy on non-discrimination that includes a prohibition of harassment and abusive behaviour or complicity therein and details on whistleblower protection (e.g. by adding such a policy to their existing code of ethics). Netflix should require each board member to sign this policy and should establish relevant means (e.g. audits) to ensure each board member’s compliance with this policy, including all of their roles, not only as a board member of Netflix, and report on results. We were optimistic that such a resolution will shine light on the allegations regarding Mathias Döpfner’s conduct at Bild and Axel Springer and might trigger investigations on whether he is fit for the role at Netflix.

However, we failed to meet all formalities to file the resolution. We’ll aim for another shot in 2023.

Spotify

Early 2022, Inyova reached out to Spotify multiple times regarding how the spread of misinformation related to Covid-19 had been handled on their platform. We wanted to learn more about measures to systematically screen for and control the spread of misinformation on the platform.

Unfortunately, we did not receive any response.

LTG

We engaged with them after we found out about their involvement in nuclear weapons testing via a new acquisition. At the time, they could not provide plans to sell off this controversial company anytime in the near future – so we divested.

However, after only 6 months, they informed us that they had taken action and sold their stake in the nuclear weapons testing. This was a perfect example of how addressing crucial issues through an engagement dialogue, can create real change at a company.

Zur Rose / DocMorris

In November 2021, Inyova organised a public shareholder engagement event with Walter Oberhänsli, CEO of DocMorris (formerly, Zur Rose). In our engagement talk, we took a close look at Zur Rose and their overall sustainability strategy.

Members of the Inyova impact investor community also had the opportunity to raise questions directly. Here’s the engagement report that includes all details.

All AGMs the Inyova community voted at in 2022

Tesla

At Tesla’s 2022 AGM in August, Inyova voted to support shareholder proposals to improve working conditions. Whilst leading the way in terms of e-mobility and transport of the future, Tesla has a poor social footprint. From preventing trade unions via tweets to concerns regarding racist practices and discrimination in factories, the list is long. Tesla needs to improve their working conditions to become a truly sustainable company.

With the shares of Inyova impact investors, we supported 8 shareholder proposals calling for a report on anti-harassment and discrimination efforts, an investigation into problematic arbitration practices, and a policy on freedom of association. Votes on 5 of these resolutions went well, but failed by a tight margin. However, 1 received more than 50% of overall votes. This proposal could be crucial – it will enable shareholders to nominate members to the board of directors. This opens up new opportunities to change poor labour practices at Tesla.

BMW

This was the first time voting at Inyova. We wanted to support our own candidate, Susan Shaheen, in the first place but also voted against BMW’s candidate and the board members that were responsible for his nomination.

Susan Shaheen received 15% of independent votes, that is, excluding the votes of the BMW heirs Susanne Klatten and Stefan Quandt. Members of the supervisory board received quite a high share of ‘Against’ votes (19%, even worse for Quandt and Klatten, 28% and 26%) – which is always a sign that the shareholders are not entirely happy with the current course.