What was once unthinkable is now being practiced by more and more banks – they’re charging negative interest on savings. We’ve settled for little to no interest on the balance in our savings account for a long time, but now our savings are facing a kind of “penalty”.

As an investor, this concept can be difficult to understand. You’re probably asking yourself, “Why do I have to pay interest on my savings?”, because until now, we’ve been used to banks only charging interest if you get something from them – for example, taking out a loan. But now, should we really be paying for the bank to hold our money?

In this guide, you’ll find out how this came about, what exactly negative interest rates are, and how you can avoid them.

What are negative interest rates?

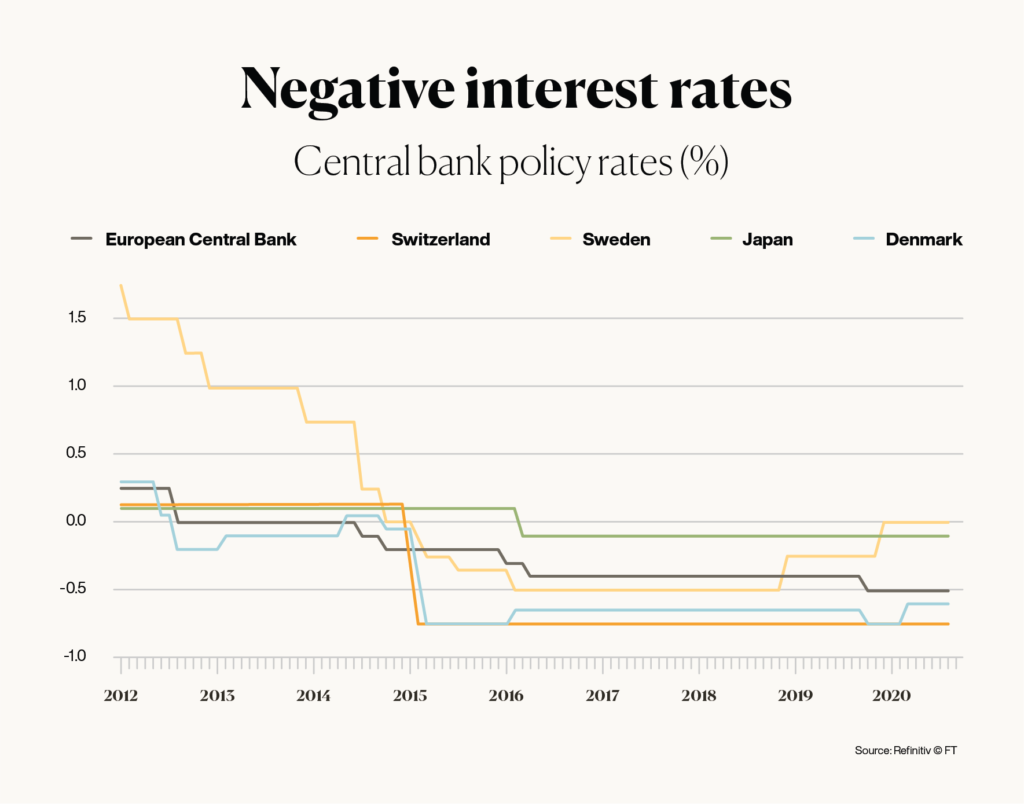

At first glance, it’s difficult to understand why you have to pay penalties on your bank balance, but this can be simply explained: Since 2015, the Swiss National Bank (SNB) has been using its monetary policy to stabilise the key interest rate at -0.75%. On the one hand, this is to make Switzerland less attractive as an investment country for foreign capital and therefore prevent further increases of the Swiss franc against other major currencies, in particular the euro.

On the other hand, it’s intended to create an incentive for commercial banks not to leave money with the SNB, but use it to give affordable loans to their customers, who’d invest it and therefore boost the economy.

So, if the banks take your money and park it at the Swiss National Bank, they’ll incur charges, which they pass on to you.

According to a January 2021 survey conducted by the accounting firm EY Switzerland, only 11% of banks categorically rule out the possibility of charging negative interest rates to their customers. For context, this figure was 21% in 2020 and 70% in 2016. So, for the most part, it looks like negative interest rates are here to stay.

Which banks charge negative interest rates and how do they do this?

According to a report by Moneyland, more than 20 retail banks in Switzerland are now charging negative interest rates to private customers. This is usually -0.75%, the same percentage that the Swiss National Bank demands from your financial institutions.

What hit the headlines in December 2019 – when Zurich’s Kantonalbank was the first bank to introduce negative interest rates – is now almost the new norm.

Exemptions from negative interest rates have also become harder to get. A few years ago, negative interest rates were mostly charged on savings deposits with a six-figure sum. Now they’re charged on a savings balance of CHF 50,000 or, at some banks, from the first franc!

Are savings without negative interest rates still worthwhile?

There’s no question: negative interest rates are anything but worthwhile. But what about savings on which a small amount of interest is earned? Let’s digress a little.

All the goods on the market – that is, everything you buy as products and services – tend to become more expensive over time. Think about how your grandparents used to be able to buy a bag of candy for a penny, or go to the movies for a franc or two. This is inflation in action.

At present, the annual rate of inflation (the percentage by which products and services are becoming more expensive) is on average 1.2%. This means that you can afford less with the same amount of money than you could a year ago – in business language, this is called a loss of purchasing power.

In many cases, the interest rate shown on your savings balance (taking the inflation rate into account) is eaten up by the rate of inflation. Specifically, this means that if inflation rises faster than the interest rate on your savings account, your money will lose value.

Caution should be taken with financial institutions that don’t publicly declare their intentions to charge negative interest rates but collect them from their customers via hidden costs – through the back door, so to speak. In recent years, some banks have introduced or gradually increased account fees on savings or day-to-day accounts. For you as a consumer, this once again means that your savings account balance will become less and less valuable over time.

What to do if your bank introduces negative interest rates

Anyone who dares to do so can complain to the bank about the negative interest rates. You may be successful, for example, if you’re a long-term customer. Some banks are willing to forego the negative interest rate if they’re persuaded or by pointing out the consequences, such as the possibility of you terminating the account.

If this doesn’t work, you have four ways to respond to your bank introducing negative interest rates:

- Pay the negative interest rates.

- Look for a new bank that doesn’t charge negative interest rates – although these are becoming harder to find.

- Distribute your money to different banks in amounts that are below the negative interest limits.

- Choose an alternative place to keep your money long-term, such as an investment.

If you choose the 4th option, you should still be careful. Many bank advisors use supposed informative discussions about negative interest rates to sell alternative, often significantly overpriced, financial products. It’s best to know in advance whether your bank’s offers are attractive to you or whether you’d rather look for a completely new type of investment instead.

Inyova’s response to negative interest rates

An investment in the stock market is a way to escape negative interest and generate long-term returns instead.

Of course, there’s no guarantee that your investment in stocks will gain value. However, long-term studies have shown that you can achieve average annual returns of around 6% with a medium to long-term investment strategy.

You don’t have to be a finance guru or ultra wealthy person to invest in stocks. Small amounts are enough to achieve financial success step by step. This makes it easy for first-time investors to invest in stocks. You can invest your money responsibly in a sustainable future without compromise and make the world a better place.

Thanks to the intuitive Inyova online tool, you can choose from a wide range of investment topics that best suit you and your values, such as renewable energy and reducing emissions, gender equality and social responsibility. Inyova will then put together a list of companies that are tailored to your needs, personal risk appetite, and financial goals.

In the meantime, we have resigned ourselves to the fact that a savings account is no longer an attractive place to grow wealth in the long term. With the introduction of negative interest rates, savings accounts have become even less of a useful option. Instead, with an Inyova investment you can make a big impact with small amounts of money. Create your free investment strategy today.