Understanding the Swiss pension system is important — and it doesn’t need to be complicated. In this article, we’ll take a look at Pillar 3a, the private pension. We’ll clarify the most important questions around this topic and show you the differences between providers. Enjoy!

What is Pillar 3a?

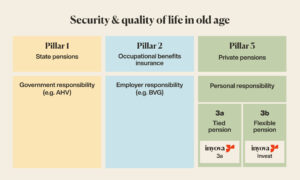

The Swiss pension system is based on three pillars:

- 1st pillar: The state pension

- 2nd pillar: The workplace pension

- 3rd pillar: The private pension

The 3rd pillar is voluntary and serves to maintain your standard of living during retirement and as a means to close any gaps in pension provision. You may have heard that the 3rd pillar is made up of Pillar 3a and Pillar 3b.

There’s a big difference between Pillar 3a and 3b. Pillar 3a is a so-called “restricted pension plan”. The money saved and invested in Pillar 3a is for retirement and can only be withdrawn in specific cases (more about that later). The big advantage is that you can make immediate tax savings with a Pillar 3a.

Pillar 3b, on the other hand, is an “unrestricted pension plan”. You decide how you want to invest your money — and you can reallocate it at will, invest it elsewhere, or simply leave it in your account. While Pillar 3b gives you all the flexibility you could ever need, it does not offer any tax incentives. You probably already have a Pillar 3b without even knowing: it includes the classic cash reserves, private investments and life insurance, or the classic investment solution offered by Inyova.

What is the maximum amount I can pay into Pillar 3a?

The exact amount that can be paid into Pillar 3a depends largely on your income and whether you have access to a pension fund.

A person with a pension fund, for instance, an employee in a company, can deposit a maximum annual amount of CHF 7,056 in 2023. Most people fall into this category.

A person without a pension fund, for example, someone who is self-employed, can pay a maximum of 20% of their earned income into their Pillar 3a account, however, at most CHF 35,280 in 2023.

Can I pay in more than the maximum Pillar 3a amount?

Sorry! It’s not possible to pay more than the maximum amount into Pillar 3a. The maximum amount per year that you can pay into your Pillar 3a in 2023 is either CHF 7,056 (if you have a Pillar 2 pension fund) or CHF 35,280 (if you don’t have a Pillar 2 pension fund). If you pay more than this amount, it will be automatically refunded by the insurance company or bank.

What are the key benefits of Pillar 3a?

Investing in Pillar 3a offers three major benefits:

- Tax savings

One of the biggest advantages with Pillar 3a is the immediate tax relief. Depending on the tax rate, you’ll save several thousand Swiss francs in taxes every year. - Compound interest effect

Thanks to the long investment period, you will benefit from the compound interest effect for many years. If you start saving money in Pillar 3a early on, it’s likely you’ll end up with much more than the amount you deposited. - Impact

Inyova exists to help you invest in sustainable, socially responsible companies — companies that solve the big global challenges of our time, such as climate change and gender equality.

Can I have 3a accounts with multiple providers?

Yes, you can have as many 3a accounts as you like. This approach can make sense from a tax point of view. A Pillar 3a comparison on comparis.ch shows that, by having several accounts, you can withdraw your funds from each account in a different year. Typically, this creates a tax saving.

If you already have a 3a account with another provider, this doesn’t mean you can’t have a 3a account with Inyova too. You can even transfer your existing 3a from another provider to Inyova!

By when do I have to pay into Pillar 3a?

Since deposits into Pillar 3a are voluntary, there’s no obligation to make yearly contributions (with Inyova, at least. Some providers require regular payments). If you do decide to make a deposit, the money must be received into your Pillar 3a account by the end of the year, no later than 31st December. To ensure your money is received on time, you should aim to open your account and transfer your funds before Christmas.

There is also a maximum age at which contributions are possible: you can only pay money into your Pillar 3a account until three years before your desired retirement date.

For example, if you plan to retire at the regular OASI retirement age (65 for men and 64 for women in Switzerland), the last contribution should be made three years before that. So, either at the age of 62 for a man or 61 for a woman.

If the money is paid out before the end of the three years, the saved taxes are retrospectively reclaimed, and you lose your tax advantage.

When can I withdraw money from Pillar 3a?

You can withdraw the money from Pillar 3a as early as five years before you reach the OASI retirement age (i.e. from the age of 59 for women and 60 for men).

However, there are exceptions to this rule. There are some special cases in which you can withdraw money earlier. These include:

- Financing a home you live in

- Repaying a mortgage

- Paying into the pension fund

- Becoming self-employed

- Moving abroad

- Becoming disabled or dying

Keep in mind that if you withdraw the money invested in your Pillar 3a account early, perhaps to buy a house, the money withdrawn will be taxed in the same way that your income is taxed.

Do I pay taxes on Pillar 3a?

Investments in Pillar 3a are deducted from your income, which means that you pay less taxes. For example, if you earn CHF 100,000 and deposit CHF 6,833 into your Pillar 3a investment, you’ll only pay tax on CHF 93,167 of your income.

Some taxes are due when you withdraw money from your Pillar 3a. Speak to a qualified tax adviser to understand how this works in your individual situation.

What happens to my Pillar 3a assets if I die?

In the event of death, the money from Pillar 3a is not lost. It is inherited by your beneficiaries. In descending order, the following individuals will be considered:

- Spouse

- Direct descendants; persons who received significant support from the deceased in the last five years before their death; a person who had lived with the deceased in a marriage-like relationship in the last five years before their death; or a person who must support any children from their relationship.

- Parents

- Siblings

- Other heirs

The existing Pillar 3a funds are paid out in one amount to the surviving beneficiary. They will then have to pay inheritance taxes.

How is my money invested in Pillar 3a?

The money you pay into Pillar 3a is always put aside until the age of retirement. There are two types of provision available:

- Restricted pension insurance with insurance companies

- Restricted pension with a bank or foundation

Which Pillar 3a investment is the best?

We do not want to make a blanket statement. Any investment, especially one regarding your own pension plan, is always an individual matter.

Here are some things you should consider when choosing the right provider:

- Hidden fees

Does the Pillar 3a product provider tell you about all the fees and when they are due? You might be surprised at how some providers respond to the question of fees.

- Complexity

Guaranteed income and risk protection sound good, but do you know how they work? Are the conditions clear? It’s also important to know whether you’re required to make deposits on a regular basis or whether you can pause at any time.

- Impact

Do you own company shares directly with your Pillar 3a product, or does your money go into a generic fund? How much control do you have over your portfolio? Can you decide which themes and companies you invest in, and which ones you avoid?

What’s special about Inyova?

Many Pillar 3a pension products are based on funds. These are generic products that offer little in the way of flexibility, control, or impact.

What makes Inyova unique is that you can invest in individual stocks. We’re the only provider to offer this type of pension investment. This allows you to invest specifically in companies whose mission you support and to incorporate your personal ethics into your investment.

More reasons why Inyova stands out from the rest:

- Transparent fees without minimum deposit

At Inyova, you pay a transparent fee, which is clearly communicated in advance. There are no nasty surprises. You have full freedom to choose your investment amount each year.

- Personalised – You are in control of your stocks

You have full control over every share in your portfolio. If you don’t want to invest in a certain company, you can easily remove it from your strategy so that your vision of the future is reflected by the companies you invest in.

With an Inyova 3a, you generate long-term wealth, while investing in the companies solving big global challenges. All without compromising the return on your investment. Start your truly sustainable Inyova 3a now!