Even though it’s rarely talked about, money is very important in Switzerland. But there’s one money question that we are all quietly interested in: how and where can you best save money in Switzerland?

Here’s a hint – diligently saving your money, only to put it into a savings account is not the best way to grow your wealth in the long-term. Later in this article, we will tell you why that is, and how you can invest your Swiss francs to grow in the future. But first, let’s talk about getting those savings in the first place…

Swiss are European champions in saving

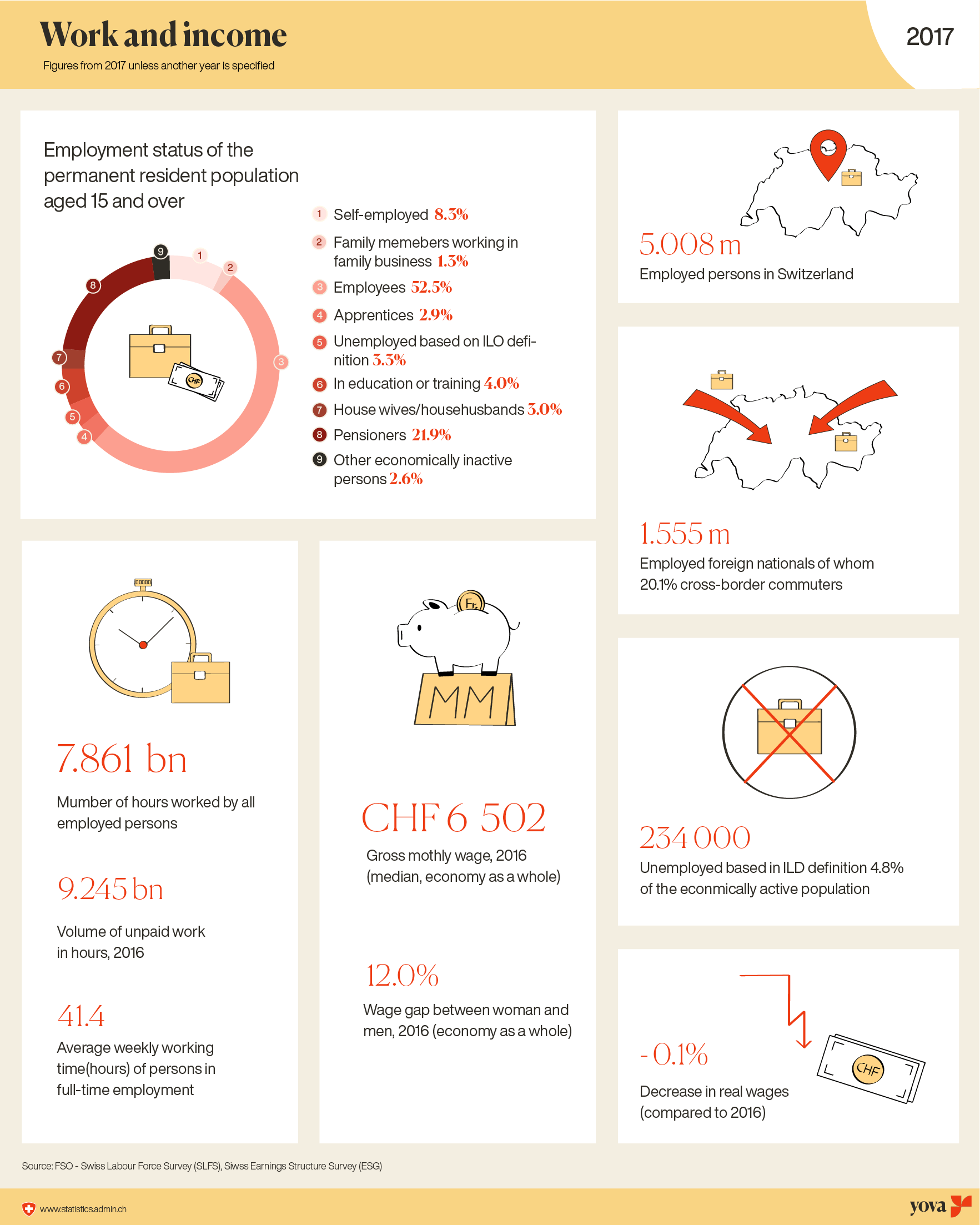

On average, people in Switzerland earn CHF 6’500 gross a month. That puts us in fourth place internationally – only in Monaco, Liechtenstein and Bermuda does the average worker earn more.

On the other hand, Switzerland has high costs of living, which is a burden especially for people with lower incomes. In many cases, housing costs for low-paid workers account for around 30 percent of the salary.

However, Switzerland’s saving rate of just under 19 percent makes our country the best savers in Europe. Specifically, an average Swiss household can set aside around CHF 1,400 per month. Across the border in Germany, the saving rate is less than half.

Source: FSO / OFS / UST / FSO

Uniquely in Switzerland, the amount of money left at the end of the month depends on the place of residence. That’s because the cost of living and tax rates vary widely from town to town. Many households could increase their cash flow by moving to a place such as Uri or Glarus, where taxes and housing costs are lower. Overall, rural cantons such as Obwalden, Thurgau or Appenzell Innerrhoden are considered financially more attractive than urban cantons. The most expensive places in Switzerland are Geneva and Basel-city. Not only is the cost of housing high – so are the taxes and health insurance premiums.

But even moving to a neighbouring community could be worthwhile – since different municipalities within the cantons also have higher and lower tax rates. You can use this handy tool to calculate your Swiss taxes in different areas.

In spite of the high cost of living, saving in this country is relatively easy. According to a recent survey, half the population manage to save money on a monthly basis, without sacrificing their consumption.

Which leads us to the question….

What are the best ways to save money in Switzerland?

The three biggest ways to save are:

- Saving money in everyday life

- Utilising the right investments

- Reducing taxes

But why save money in the first place?

Whether it’s for a vacation, a planned investment, retirement or a reserve for hard times, it is never a bad idea to have a few Swiss francs on the side. The motivation to save increases if you keep your goals in mind!

Before we deal with the investment options that make the most of your assets, we want to first take a look at how you can save money in everyday life.

The best tips for saving in Switzerland

Put money aside at the beginning of the month

If you wait until the end of the month to set money aside, you will soon realise this is not a successful strategy. It’s too easy to lose sight of your overall spending, particularly when you have money in your account. Suddenly, you’ll find your account empty, without having set aside a cent in savings.

We recommend automating this process, by setting up a monthly transfer each payday. By starting with a lower balance in your day-to-day account, you will plan the month better and avoid unnecessary spending. More than half of all Inyova customers use our monthly plan, in which a small amount of savings automatically move into their investment every month.

Create a budget

It turns out that many people spend all their money each month without knowing afterwards where it all went. The only thing that is clear: the account is empty!

To avoid this scenario, it’s worthwhile to create a budget that keeps track of income and expenditure. Sure, budgeting does not sound like fun for most of us – fortunately there are technological tools that make it easy and painless.

Good apps include “Spending Manager – Tracker” and “Household Book: Money Manager“.

Avoid spontaneous purchases

Online and in the real world, advertising can be very enticing – it often results in people making unplanned purchases.

A great trick is to set a price limit for purchases in advance, for example CHF 50. For items that exceed this value, write down what you would like to buy and consider it after a week. It’s always interesting to see if the desire and the need for the product are still there – you’ll see how many times you have forgotten about both the note and the product after a week.

Put coins aside

With this tip you not only relieve your conscience, but also your wallet. Hardly anyone likes to carry a lot of coins, and when you pay, you often forget to pick the exact amount to get rid of the annoying weight. What follows is even more change!

So why not leave all coins at home? When you ‘feed’ a piggy bank daily, your savings quickly add up (especially in Switzerland, where a handful of coins can be worth CHF 30!). The best part about this method, is that you save money without compromising on anything – aside from the extra weight in your wallet!

Smarter shopping

Grocery shopping is a great place to save money, but don’t worry, we aren’t going to suggest change what you buy – only when you buy it! Remember: The best discounts happen just before closing time. Around one and a half hours before closing, many supermarkets such as Coop and Migros offer fresh products such as meat, dairy products and sandwiches up to 50 percent cheaper. It is especially worthwhile to do a big shop late on a Saturday, as many supermarkets want to get rid of the products before closing on Sunday.

Compare insurance premiums

With this tip you can save several hundred Swiss francs per year, without receiving less healthcare. Simply use the calculator on Comparis to compare your basic health insurance premium and determine whether you still have the best offer. The same applies for car insurance and life insurance.

When changing, pay attention to the notice period stipulated in your insurance contract. For example, the cut off date for changing health insurance in Switzerland is November 30, for the following year. For car insurance, the notice period varies from one to three months, depending on the provider.

Cheap train tickets

All Swiss love our SBB! According to government statistics, each of us takes a train trip around 50 times a year. The trains can be expensive, but not if you know about this saving tip…

The next time you are travelling a longer distance by train, it is worth asking your local gemeinde or community government if there are discounted day tickets available. Most municipalities have a number of day passes for sale at the reduced price of around CHF 40. This pass allows you to travel across Switzerland – even without a Half-Fare Card.

For comparison: SBB usually charges CHF 75 for a day ticket with a Half-Fare travelcard. Without a Half-Fare Card, trips can cost more than CHF 106 (and that’s not first class!).

Save money by investing properly

The money saved by the Swiss usually ends up in a savings account of a Swiss bank. But is that the right thing to do?

It is a misconception that money in a savings account will grow over time. Today, interest rates of less than 0.01 percent are the reality. At the same time, rising inflation (around 0.9 percent in in 2018), means the money you put into your savings account is losing value over time.

This makes investing an attractive alternative. But there are two sides to this argument – On the one hand, a good investment brings more income, but on the other hand, it comes with more risk of losing money.

Three popular options for investing money are:

- Real Estate

- Index Funds

- The stock market

Investment in real estate

While everyone was rushing to invest in real estate a few years ago, the tide has turned, with high prices causing many people to question the underlying value of real estate investments.

According to the latest Raiffeisen study “Real Estate Switzerland”, real estate prices rose between 0.8% (apartments) and 1.7% (single-family homes) in 2018. By contrast, rents fell by up to 2% in the same period. These trends are being driven by a high number of vacancies and decreasing immigration compared to the years between 2016 and 2018.

In some cases though, buying a home that you will live in continues to be a worthwhile investment – especially since interest on 5-year fixed-rate mortgages are currently at an all-time low.

Investing with stocks and index funds

In general, when investing in the stock market, you should always take a long term view. Stock prices are constantly changing and there’s a chance you will lose money if you withdraw your investment at the wrong time. On the other hand, the advantage of most equity investments is the good liquidity. If you really need your money back in a hurry, you can sell your shares and have cash within a week.

If properly managed, the stock market offers good profit expectations compared with the savings accounts of major Swiss banks. Exchange-traded funds (known ETFs) are currently in vogue, offering beginners a way to easily and conveniently participate in the stock market. However, one drawback is that you are forced to buy a bundled set of stocks and can’t select or eliminate specific companies from your investment. This lack of flexibility is especially important for investors who want to determine what companies they invest in, and what their individual risk profile should look like.

In funds, the distribution of the profit depends on the average performance of your package. A recent study carried out by Quirin Privatbank showed that there are large differences in the returns of ETFs and that millions of dollars in profits are lost each year.

Caution should also be exercised with regard to transaction costs and taxes. At Inyova there are no hidden fees – transparency is very important to us.

Then why doesn’t everyone invest?

As mentioned earlier, investing in the stock market comes with risk – even the best experts can find themselves in the midst of an unpredictable crises. This risk factor stops many people from investing their money, although with the right management everyone can find an appropriate balance between risk and return. Of course, when investing in equities, there is a correlation between the level of return and the risk you have to take. So if you want to be on the safe side, you can’t expect a huge payout down the track.

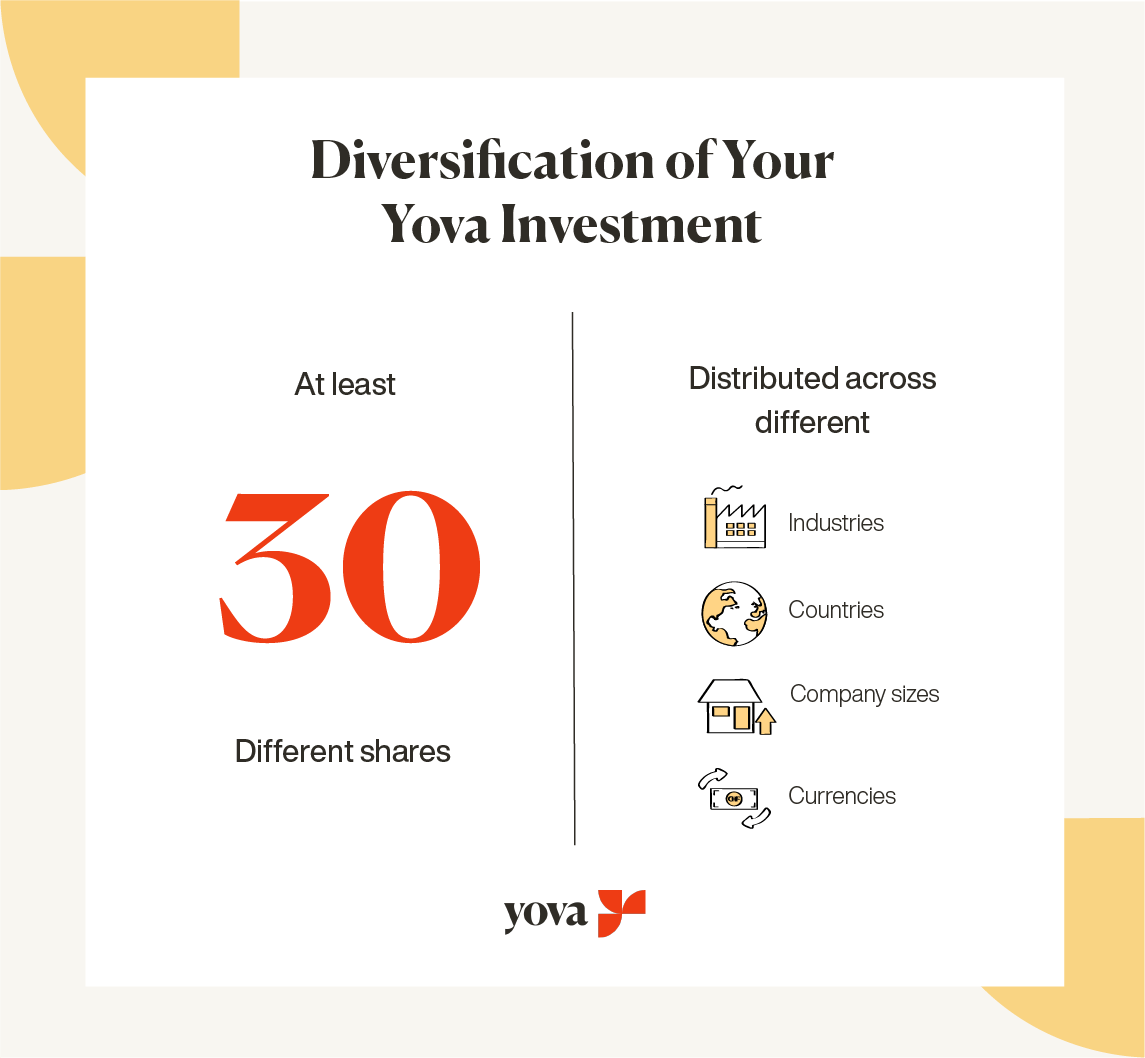

One of the most important rules in the stock market is to diversify your investment. This means that instead of putting all your eggs in one basket (or all your money into a few companies or industries), you spread your investment across a range of factors. The idea behind diversification is that losses in one area are often offset by the profits of another.

In practice, Inyova believes that your investment should be split between at least 30 different stocks. Your investment should also be spread across different industries, countries, currencies, and company sizes to minimises the risk you carry.

Depending on how long you want to tie your money into an investment, it is also worth considering splitting your investment between stocks and government bonds. While equities may fluctuate quickly in the short term, they offer better long-term returns. The advantage of government bonds, on the other hand, is that they are hardly susceptible to fluctuations and therefore more suitable for a short-term investment. Naturally, they also have a smaller profit distribution.

Can I invest too little money?

Now you may think: That sounds great, but isn’t the stock market only for those who have large sums available?

Although this rumor persists, it is actually a misconception that only large amounts can be invested in the stock market. There’s also opportunities for investors on a smaller budget to invest in equities.

The minimum for a good investment base is around CHF 2,000. But even for those who have a smaller budget, there are possibilities. With Inyova, you can already start with 500 Swiss francs, if you decide to set up a monthly savings plan.

Saving taxes in Switzerland

We’ve already discussed that you pay different levels of tax, depending on where you live. However, one thing is the same nationwide: Those who want to save taxes and money at the same time, should take a look at the pension plan through the 3rd pillar.

Saving money through the 3rd pillar

One way to save money in Switzerland, is the private provision by the Pillar 3a, the deposit amount of which can be deducted from the tax. Although owners of a 3a account typically accept very low returns of less than 1% per year, they do benefit from tax savings.

Anyone who pays the maximum each year amount of CHF 6’826 (as of 2019) can deduct this amount from their taxable income. Attention: In principle, unlimited 3a accounts can be opened per person. However, the maximum amount of CHF 6’826 is per person and not per account and can therefore only be deducted once.

As this study shows, one out of every four Swiss women, and every third Swiss citizen already pays into pillar 3a before the age of 25. The main advantage of starting saving early is that you benefit from compound interest, even if interest rates are currently very low. Pension savers can take advantage of a long investment horizon and thus increase their chances of higher returns.

Most young people have a 3rd Pillar account, although the greatest return potential of Pillar 3a lies in the form of an investment. At present, only one out of four people makes use of the opportunity, as the risk of losses appears too high to many.

Your private investment portfolio should not be without private retirement provision through pillar 3a, as it represents a good and safe investment. However, the optimal investment for retirement provision should be more diverse and supplemented by further private investments. Our Inyova experts will be happy to help you put together an additional long-term investment.

Saving money made easy

In summary, there are easy ways you can save money in Switzerland, without making significant changes to your lifestyle. But while it is good to implement these easy ways of saving money, it’s important to also think about investing so that your money grows over time.

Would you like to see what your Inyova investment might look like? The first step is to get your personalised impact investing strategy – it’s free and non-binding. Using our easy online tool, you pick investment themes based on your personal values and interests. We show you exactly what stocks we recommend you invest in.

From there, our team will create a personalised investment strategy for you to consider. This is completely free & non-binding.

Get your free impact investing strategy here.