Wondering why the clean energy companies in your portfolio have been underperforming? Keep reading to understand how inflation, interest rates, and several other factors may be affecting your portfolio – and what this means for you.

What are the latest developments in inflation and interest rates?

Inflation is the rate at which prices for goods and services increase over time. It is measured as a percentage change in the price of a basket of goods and services. Imagine you spent CHF 100 on groceries in 2022. Due to various factors, the total price has increased and for the exact same basket, you would now have to pay CHF 120. The inflation rate in this example would be 20% p.a..

There are many reasons for price increases, such as higher costs for raw materials or labour. However, some low-level inflation is normal and even healthy for an economy. This is because it encourages people to spend money now rather than later, which can boost economic growth. Elevated levels of inflation, in return, can reduce economic growth, as increased costs hinder investment and innovation. This can go so far that companies can no longer meet their payment obligations and go bankrupt.

One of the main levers that central banks use to control inflation is interest rates. Interest rates reflect the cost of borrowing money. When central banks raise interest rates, it becomes more expensive for people and businesses to borrow money. This can help to slow down the economy and reduce inflation. Vice versa, when central banks lower interest rates, it becomes cheaper to borrow money. This can help to stimulate the economy and increase inflation. Over the course of the last several months, central banks have used the interest rate mechanism extensively in order to maintain price stability and manage inflation.

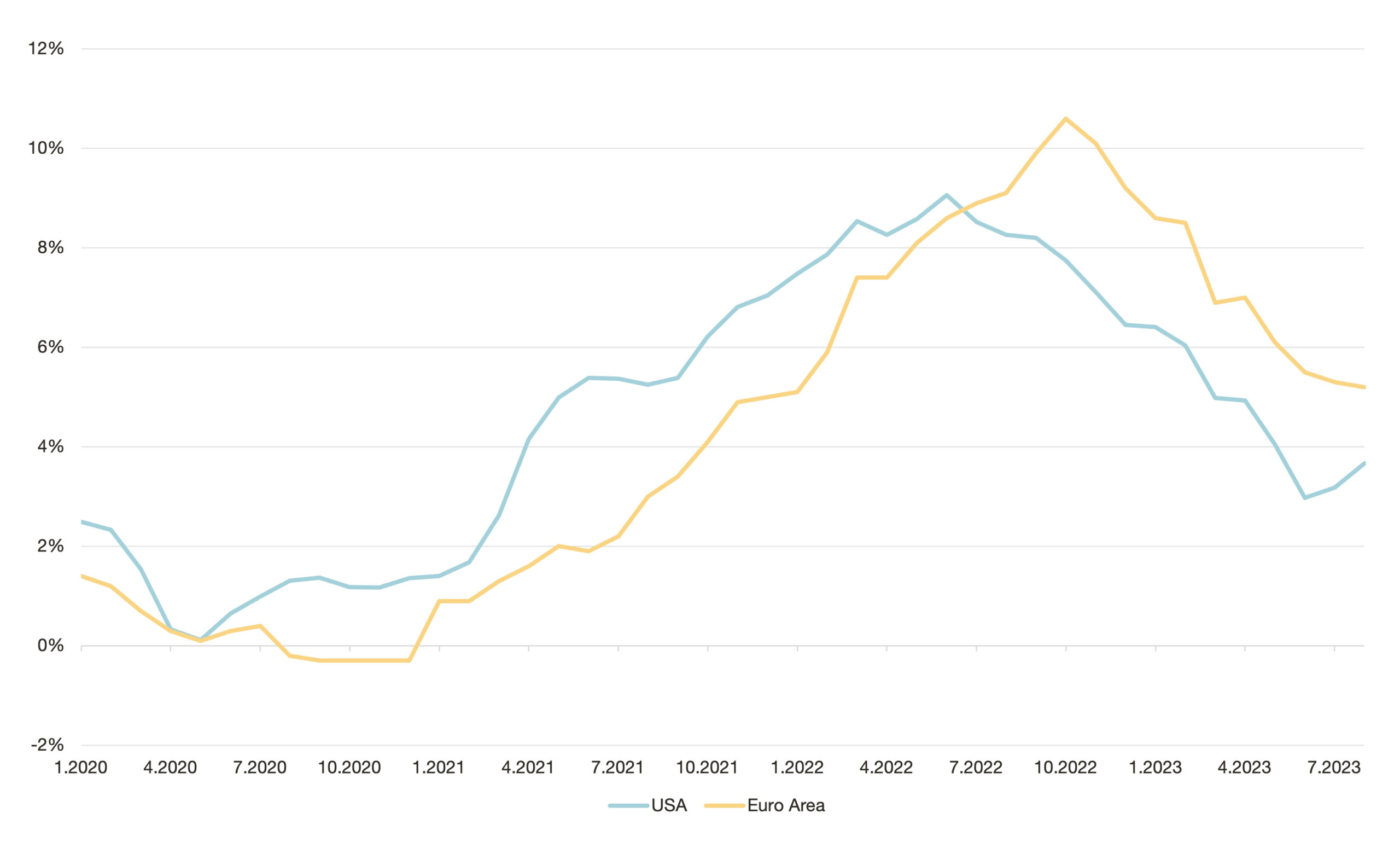

Inflation rates USA and Euro Area

The United States

The US Inflation Rate was at 3.67% in August 2023, compared to 3.18% in July 2023 and 8.26% last year. In June 2023, for the first time in more than two years, inflation decreased below 4%. The long-term target inflation rate of the US Federal Reserve is at 2%.

The US Federal Reserve (Fed) has raised interest rates in an effort to combat inflation. The Fed’s interest rate is now 5.5%, up from 5.25% in June 2023.

Euro Area

Inflation in the euro zone decreased to 5.2% in August 2023 (5.3% in July). While the inflation rate has continuously declined since November 2022, it is still significantly above the ECB’s target inflation rate of 2%.

In order to fight high inflation rates the European Central Bank (ECB) has also raised interest rates. The ECB’s main refinancing rate is now 4.5%, up from 4.25% in July 2023.

Despite the current market situation, there are some companies that show particularly positive developments on the stock market. You can find a comprehensive article on these positive outliers here. However, there are also many companies that are suffering from inflation and interest rate developments. Companies that are strongly affected by high inflation and high interest rates are typically those that have high input costs, high capital expenditure, and/or low liquidity. Among other industries, the clean energy sector has been strongly affected by these developments.

Why is the clean energy sector struggling?

First, a definition of clean energy companies

Clean energy companies are companies that develop, produce, or sell clean energy products and services. Clean energy is energy that is produced from renewable sources, such as solar, wind, hydro, geothermal, and biomass. It is also energy that is produced from sources that emit low or no greenhouse gases.

Clean energy companies play an important role in the global transition to a clean energy economy. By developing and deploying clean energy technologies, these companies are helping to reduce greenhouse gas emissions and combat climate change. In addition to that they are also creating jobs and boosting economic growth.

What are the current challenges for clean energy companies?

The clean energy sector is struggling in the current environment of high inflation and high interest rates for a number of reasons.

1. High input costs

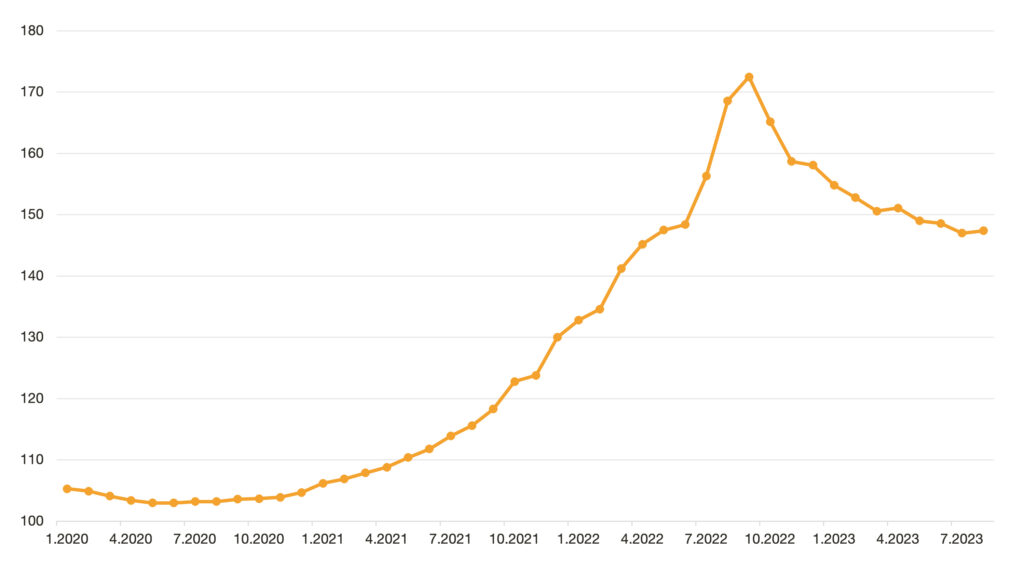

Clean Energy companies are heavily reliant on raw materials or other inputs that become more expensive during inflation. Clean energy projects often require large upfront investments in equipment and materials, such as solar panels, wind turbines, and batteries. The cost of these inputs has increased significantly in recent months due to inflation. Having been at a record high at the end of 2022, industrial prices in the euro area fell further down the line but are still at a relatively high level.

Producer Price Index – Industrial products (total)

Source: Statistisches Bundesamt (Destatis), 2023

2. Low liquidity and higher financing costs

Inflation can increase a company’s costs, while high interest rates can make it more expensive for the company to borrow money. This can lead to a situation where the company has less cash on hand. As a consequence, it becomes more difficult to meet its financial obligations or – on the other side – to invest in innovation and projects. Clean energy companies tend to be in the earlier stages of their business cycles. Therefore, they might currently lack the financial means to realise large projects. At the same time, it is more expensive for them to take out loans for big projects due to the high interest rates. This reduces the investment and innovation power of these companies.

3. Reduced demand

High inflation and high interest rates can lead to a slowdown in economic growth. This can reduce the demand for clean energy, as businesses and consumers may be less likely to invest in new projects or are more cost-conscious.

What’s the impact of global competition on the clean energy sector?

When looking at the global clean energy market, the impact of Chinese competitors in particular on European and North American manufacturers is huge. In recent years, China has become a major player in the renewable energy market. China is already the leader in the solar sector, and it is now increasing its market share in wind turbines and batteries for electric vehicles. This is putting pressure on European producers (S&P Global, 2022; Mobility Foresight, 2021).

Chinese manufacturers have a competitive advantage over European rivals due to their financial resilience, efficient supply chain, and lack of reliance on international expansion. While European manufacturers have to deal with supply chain disruptions, the war in Ukraine, and rising raw material costs, Chinese producers have continued to benefit from falling turbine prices and a strong domestic market. In addition, Chinese companies have built the most efficient and cost-effective supply chain in the industry, giving them a significant edge over their European and North American competitors (S&P Global, 2022).

But this is not the whole story. Many overseas solar companies are selling their products at prices that are lower than the cost of making them. This is called “price dumping”. Five solar companies, including two from China, were recently found to be violating trade laws by price dumping. They were doing this by shipping their products through other countries, where labour and materials costs are lower (Reuters, 2023). This makes it very difficult for North American and European solar companies to stay in business, and until regulators stop price dumping, it will be hard for them to compete.

What’s the effect of these challenges on the development of clean energy companies?

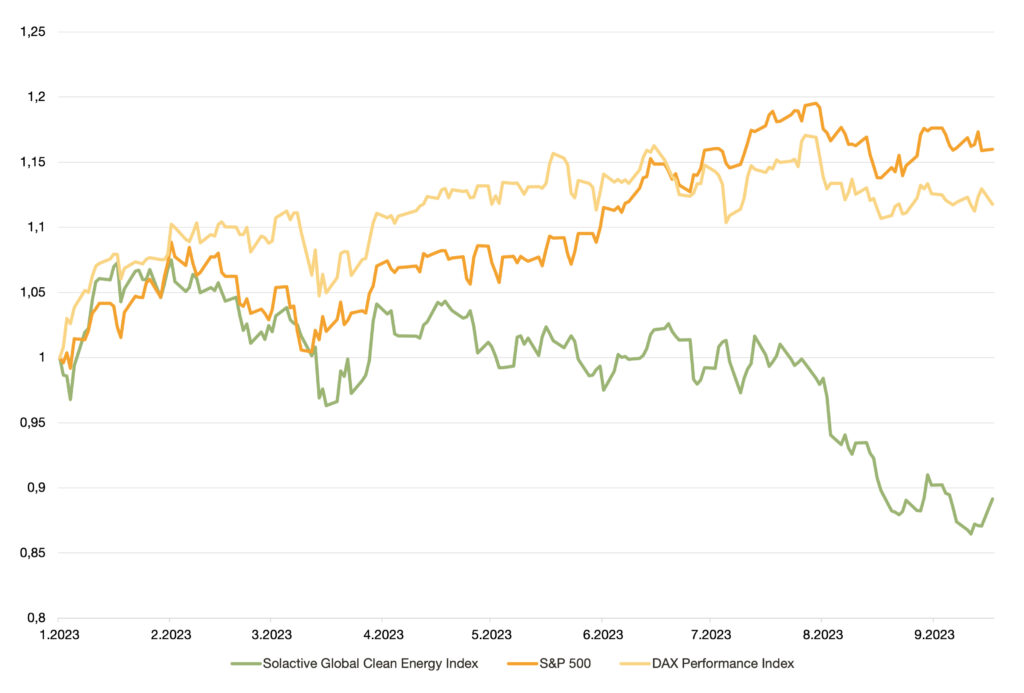

To assess the effect of the above developments on the performance of clean energy companies, it is helpful to look at the Solactive Global Clean Energy Index. Due to its composition and focus, the index is a good representative of the clean energy sector as a whole. The Solactive Global Clean Energy Index is a stock market index that tracks the performance of companies that are involved in the clean energy industry. This includes companies that produce renewable energy, such as solar and wind power, as well as companies that develop and manufacture clean energy technologies, such as electric vehicles and battery storage systems. The index is weighted by market capitalisation, meaning that the largest companies in the index have the biggest impact on its performance. The index has a global focus, with 38 companies mainly from Europe, North-America and Japan. Currently, no Chinese companies are part of the index. Therefore, the index cannot benefit from the developments of the Chinese companies. The Solactive Global Clean Energy Index is a popular benchmark for investors who are interested in investing in the clean energy sector. Here are some of the companies that are included in the Solactive Global Clean Energy Index: EDP RENOVAVEIS SA, FIRST SOLAR INC, ORSTED A/S, TESLA INC, and many others.

Until February 2023, the performance of the S&P 500, DAX 40 and Solactive Global Clean Energy Index developed very similarly. Since February, however, the developments have diverged. While the S&P 500 and the DAX 40 have developed positively since then, the Solactive Global Clean Energy Index has seen a decreasing trend. This suggests that the high inflation, increased interest rates and the pressure from overseas competition have a significant impact on the performance of clean energy companies.

What does this mean for your portfolio?

More than 90% of Inyova Impact investors have added renewable energy as a handprint topic to their investment strategy in the first half of 2023. European and Northern American clean energy manufacturers are well-positioned for the future, despite current pressure from inflation, interest rates, and overseas competitors. European clean energy companies are at the forefront of innovation, developing and deploying new technologies to help the world transition to a clean energy future. In 2022, European clean energy companies attracted EUR 11 billion in investment capital (Cleantech for Europe, 2023). Among other things, these investments are helping to accelerate the development and commercialisation of new technologies, such as offshore wind, solar photovoltaics, and battery storage. European clean energy companies are also leading the way in the development of new business models, such as energy-as-a-service and community energy. These models are helping to make clean energy more affordable and accessible to everyone (World Economic Forum, 2023).

In addition to that, the awareness of the need for green energy among people and governments increases. During the last few years, we’ve seen a major boost in global clean energy spending and a predicted USD 1,740 billion to be invested in clean energies in 2023. Spending on fossil fuel energies is predicted to be around USD 1,050 billion in the same period (IEA, 2023).

While clean energy stocks are currently on a bit of a downward slide, there is scientific support that sustainable investments in general are more likely to pay off and outperform conventional investments in the long run (NYU Stern, 2021). The reason for that is that the latter is more likely to contain “stranded assets” that may currently be driving up share prices, even though there is a prospect that these assets could become worthless in the future. A good example of a “stranded asset” for a fossil fuel company is a proven but undeveloped oil and gas reserve. As the world moves away from fossil fuels, there will be less demand for oil and gas. This means that some oil and gas reserves will never be developed, and the companies that own them will lose billions of dollars in potential profits. Sustainable companies – on the other hand – are less at risk of stranded assets because they are investing in the future. The world is transitioning to a clean energy economy, and sustainable companies are at the forefront of this transition. They are developing and deploying new technologies that will help us reduce our reliance on fossil fuels and address the climate crisis.

It is also important to note that your portfolio is well-diversified with stocks and bonds covering numerous sectors, regions, currencies and countries. It includes large, medium and smaller companies from different industries. Nevertheless, we are continuously reviewing your portfolio and making sure that it is well-diversified. Secondly, we also constantly assess whether we want to add new companies in innovative fields. If we find interesting companies that also meet our strict performance and sustainability criteria, we will add them to the Inyova universe. Your investment with Inyova is a long-term approach that focuses on the generation of long-term profits.