Being a woman is great. But living in a man’s world can be challenging, especially when it comes to finances. Here are 10 hard-to-swallow truths about women and money to help you make the right financial decisions not only for yourself, but for a female future too.

1. Money is much more than just money

Yes, it pays the bills. But money can also embody the ability to quit a job you are unhappy with, the house you want to buy, the hopes for your children, or the ability to end a relationship, simply because they are no longer financially dependent on their partner. It also can be a driving force to positively impact the world you leave behind.

2. Women pay more money

Ever heard of pink tax? That’s the additional price women pay on certain products or services, just because they cater to their specific needs. It starts with a little bit more for the pink razor and ends with a couple of hundred more for a haircut.

3. Women earn less money

CHF 108 billion a year. That’s how much more money Swiss men roughly earn over women, according to economist Mascha Madörin who used Eurostat data from 2014 for her research. Roughly three-quarters of this disparity results from an unequal distribution of paid and unpaid work.

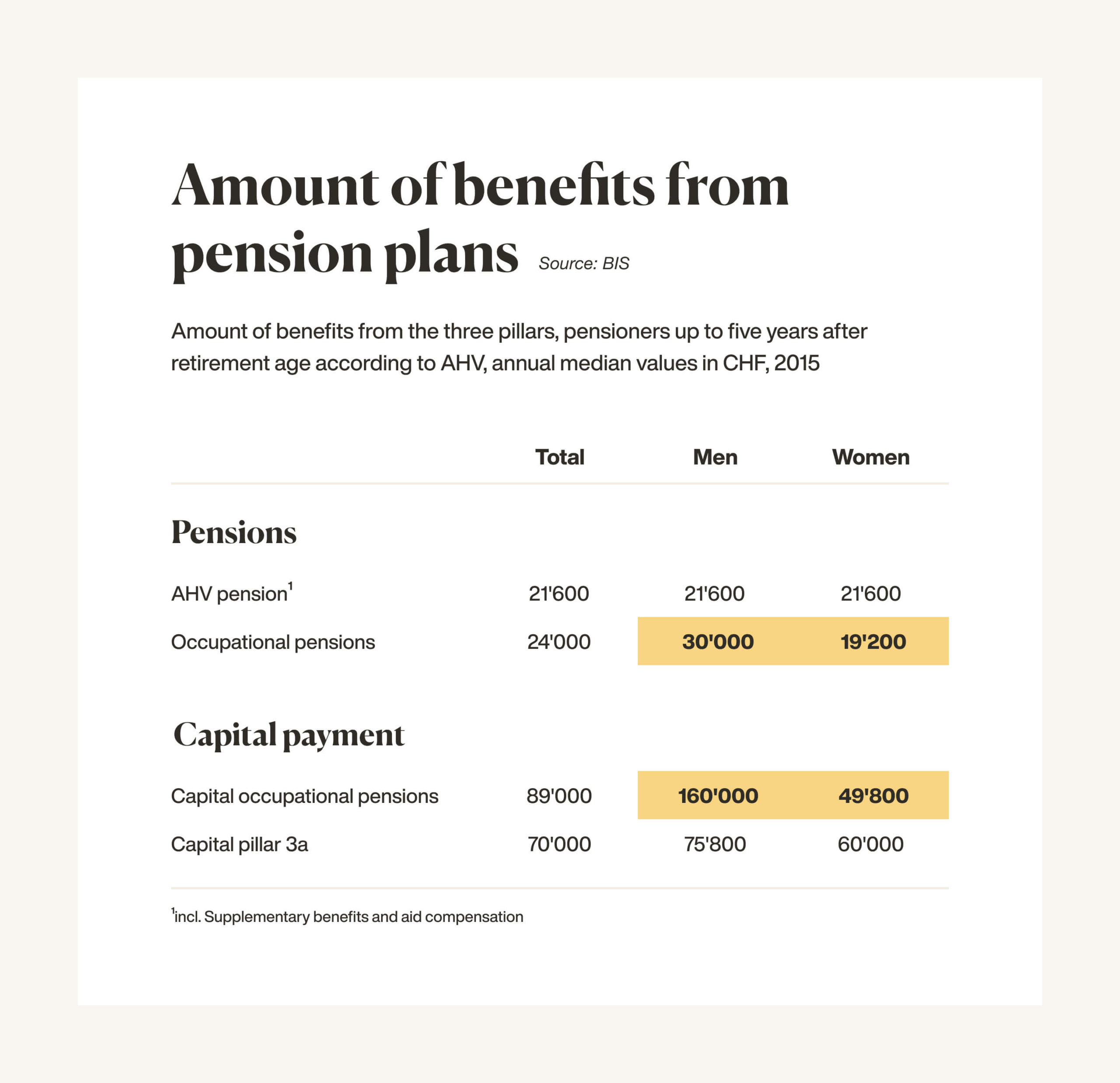

4. Women have less money

Women are subjected to a higher risk of poverty, especially later in life. While the differences in AHV pensions between women and men are marginal, the difference in occupational pensions is large:

5. Society sends women and girls damaging money messages

Most financial media is largely consumed by men and thus often written by and from the perspective of men. It’s all about growing wealth, selecting winners, and the thrill of trading. Financial articles written for women on the other hand, often tend to sound patronising or don’t take the topic seriously by giving lifestyle tips disguised as financial advice.

6. Women invest less than men

Some women even lose as much money over their lives from the gender investing gap as they do from the infamous gender pay gap. That’s why we are happy to see that 33% of Inyova Impact Investors are already women, with this share consistently increasing over time. This is often explained away by the damaging stereotype that women don’t invest because they are risk-averse, however many studies now show that it’s not quite that simple and misses the root of the problem: people who have less money are inherently less likely to take financial risks.

7. Women invest in a more selective way than men

Women are more selective than men in general. That naturally leads to them choosing their investments wisely, based on their values rather than market indications. With Inyova you can do just that: simply select your values and we take care of the rest. Try our free investment strategy tool now.

8. Time in the market is more meaningful than timing the market

While movies like ‘The Wolf of Wall Street’ might make it seem exhilarating to rapidly trade stocks over the course of one day, statistics have shown that day traders are incredibly unlikely to make money in the long-run. Historically, investing in a diversified portfolio and being patient over longer periods of time has been shown to have great potential for consistent returns.

9. Money in the bank doesn’t grow

If your savings are sitting in any major Swiss bank the interest rate will be somewhere around 0.01 percent. That means your balance will increase by just CHF 1 per year on a CHF 10,000 balance. In five years you will have grown your wealth by a whopping CHF 5. Given that there are also bank fees and inflation to consider, and that banks typically invest your savings into their own (often not sustainably themed) funds, your money will shrink rather than grow. This makes investing the only choice to responsibly increase your wealth over time.

10. Women having more money is always a good thing

Nothing bad will happen if women have more power. And nothing bad will happen when they have more wealth. On the contrary, with more funds women can elevate themselves to new heights, learn new skills, buy that home they always dreamed of, and provide their children with a better future.