Get directly to

- What does your dream retirement look like?

- The power of now

- How much can you contribute to pillar 3a in 2025?

- How about a win-win for you and the planet?

- The basics: Understanding the Swiss pension system

- Your future starts today

When it comes to retirement planning, it’s easy to focus on the here and now and put off thinking about the future. But the lifestyle you want in your retirement starts with the choices you make today.

Whether you’re self-employed without a pension fund or simply looking to strengthen your financial future, pillar 3a is the way to build your savings. By starting early, you set yourself up for financial security – all while enjoying valuable benefits, such as tax savings and potential investment growth.

In this article, you’ll find key information about pillar 3a and why it’s important to think about it.

What does your dream retirement look like?

Beyond the state and occupational pensions, a pillar 3a allows you to maintain an enjoyable and comfortable standard of living when you’re retired. Think of leisurely weekends at a cosy lakefront cabin, annual skiing holidays, or exploring the Alps on your new mountain e-bike – a 3a can help you work towards goals like these.

More and more often, the income earned through basic insurance and occupational benefits is no longer enough for retirement. With a private pension plan, you’ll take back control and proactively address this gap. The earlier you start investing in pillar 3a, the greater the expected capital growth and the more financial freedom you’re likely to have during retirement.

But retirement planning is more than just accumulating wealth – it’s also about securing a sustainable future on a livable planet. With Inyova’s 3a solution, you can invest your retirement savings with impact. By becoming an impact investor, you can create real-word change and help tackle climate change, social inequality, and other pressing global challenges. And the best part? You can do all of this from the comfort of your couch, while generating attractive potential returns.

The power of now

One of the greatest advantages of investing early is the magic of compound interest: The money you invest today has the potential to grow exponentially over time. As your investments earn returns, those returns are reinvested and begin to generate even more earnings. The more time your money has to grow, the more powerful this effect becomes, having the potential to turn even small, regular contributions into significant retirement savings over the years.

Let’s assume an average annual growth rate of 6% in the stock market. If you invest CHF 10,000 with this growth rate, you’ll earn CHF 600 in the first year. Now, instead of withdrawing that profit, you leave it to grow. In the second year, you’ll earn interest on the new total of CHF 10,600, and your profit will increase to CHF 636. Over time, this cycle repeats and accelerates, with your returns growing year after year.

In just five years, your CHF 10,000 investment could grow to CHF 13,382 without any additional deposits. If you leave your investment for another ten years, it could even grow to CHF 23,965.58. This is exactly how your money can work for you – growing steadily and helping you build a secure financial future.

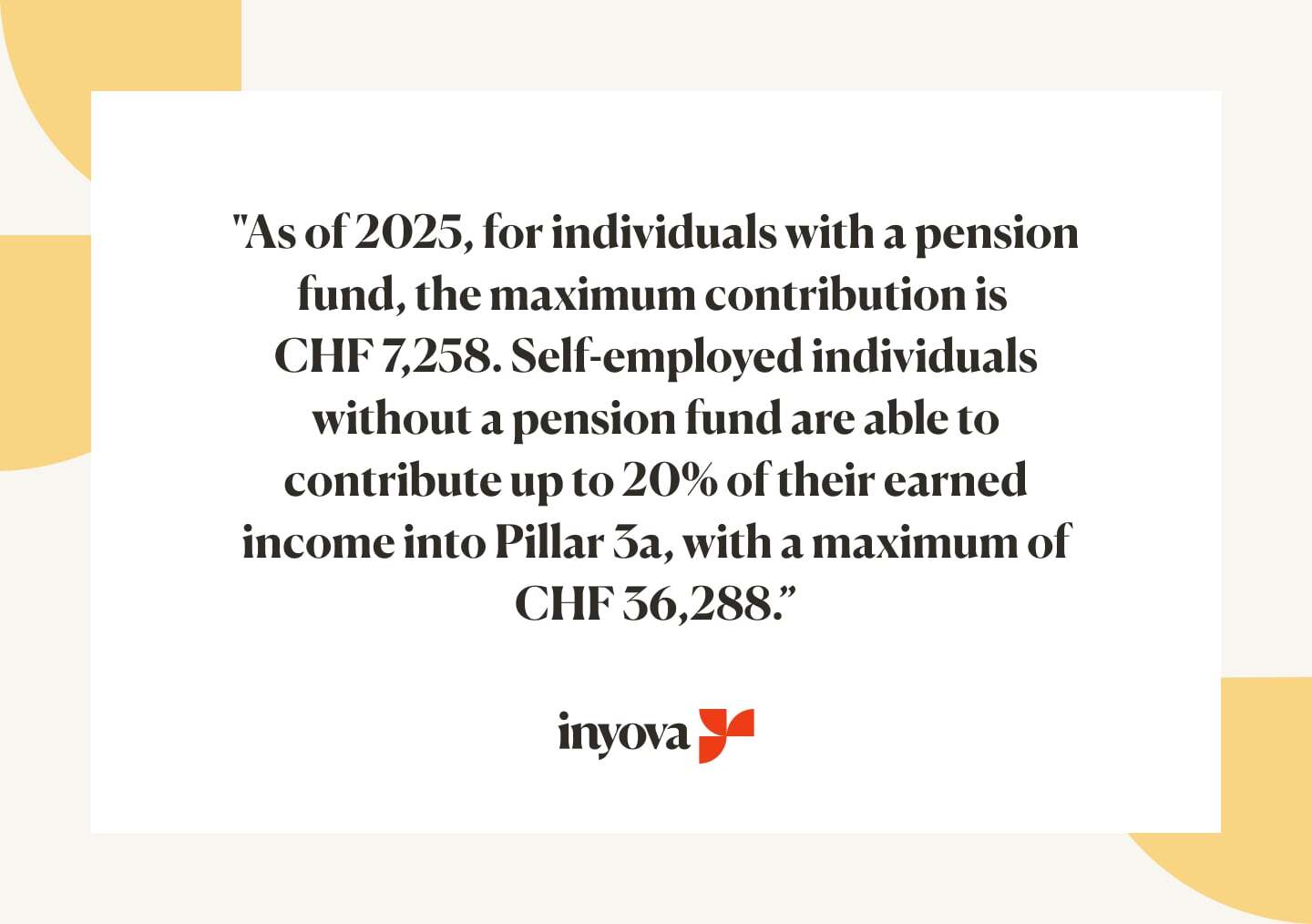

How much can you contribute to pillar 3a in 2025?

This maximum amount is determined annually by the Swiss Federal Social Insurance Office and is adjusted according to inflation.

For 2025, the contribution limits for pillar 3a accounts are even higher than in 2024. For individuals with a pension fund, the maximum contribution is CHF 7,258. Self-employed individuals without a pension fund are able to contribute up to 20% of their earned income, with a maximum of CHF 36,288.

One of the great advantages of pillar 3a is that you’ll get one immediate benefit: tax savings. This means that your contributions are deducted from your taxable income, offering you instant financial relief and making it easier to save for the future.

(By the way – this is the reason why deposits into pillar 3a are limited and only possible up to a maximum amount specified by law.)

How about a win-win for you and the planet?

With Inyova’s Pillar 3a, you get more than a typical retirement plan – you get the opportunity to make a positive impact on the world while securing your financial future.

Inyova offers attractive investment opportunities across a wide range of industries. By buying fractional shares, your portfolio is widely and effectively diversified – even with smaller investments. All of this is possible with a minimum investment of just CHF 100.

Future-proof growth

Upgrade your retirement savings by investing in a sustainable economy. With Inyova 3a, you become an impact investor, creating real, positive change in the world – all while generating attractive potential returns.

Effortless impact

Make a difference without leaving your couch. Our fully digital platform makes it simple to align your investments with your values. Whether you’re starting fresh or transferring an existing account, Inyova 3a makes impact investing easier than ever.

Swiss-made tax savings

Invest with confidence through a regulated Swiss provider and enjoy significant tax benefits. Deduct up to CHF 7,258 from your taxable income in 2025 – or CHF 36,288 if you’re self-employed.

Ready to make the switch?

Are you ready to make your retirement savings more impactful with Inyova’s Pillar 3a? Setting up your Inyova 3a account is easy – click here to get started.

Already have a 3a account?

You can conveniently transfer an existing Pillar 3a in four easy steps:

- Create an Inyova 3a account.

- Log in to your 3a dashboard to print and fill in the transfer form (to find your transfer form, go to the tab “Fund” and click on “Transfer an existing 3a”).

- Mail it to your current 3a provider (via post).

- Sit back and relax. Your 3a account will be transferred.

You can hold multiple Pillar 3a accounts, so if you prefer, you can also keep your existing 3a account alongside your new Inyova 3a.

How to effectively manage your Pillar 3a account

In times when low interest rates are shaping the Swiss financial landscape, simply keeping your money in a bank account may not be the smartest strategy. High fees, low interest rates and inflation can erode the value of your savings over time. .

That’s why more and more people in Switzerland are opting to invest their pillar 3a assets on the stock market. At Inyova, the investment risk is reduced by diversifying across different companies, industries and regions.

To maximise the potential of your pillar 3a, it is important to make regular payments into your pillar 3a account. Many people choose to draw up a savings plan, where they set aside a certain amount every month for their private pension.

By regularly depositing a fixed amount and investing in the same assets, your capital is more resilient to market fluctuations.This approach allows you to take advantage of a balanced average cost, which helps your investment grow steadily over time.

To set yourself up for long-term wealth and contribute to a future-proof, sustainable economy, start your Inyova 3a here.

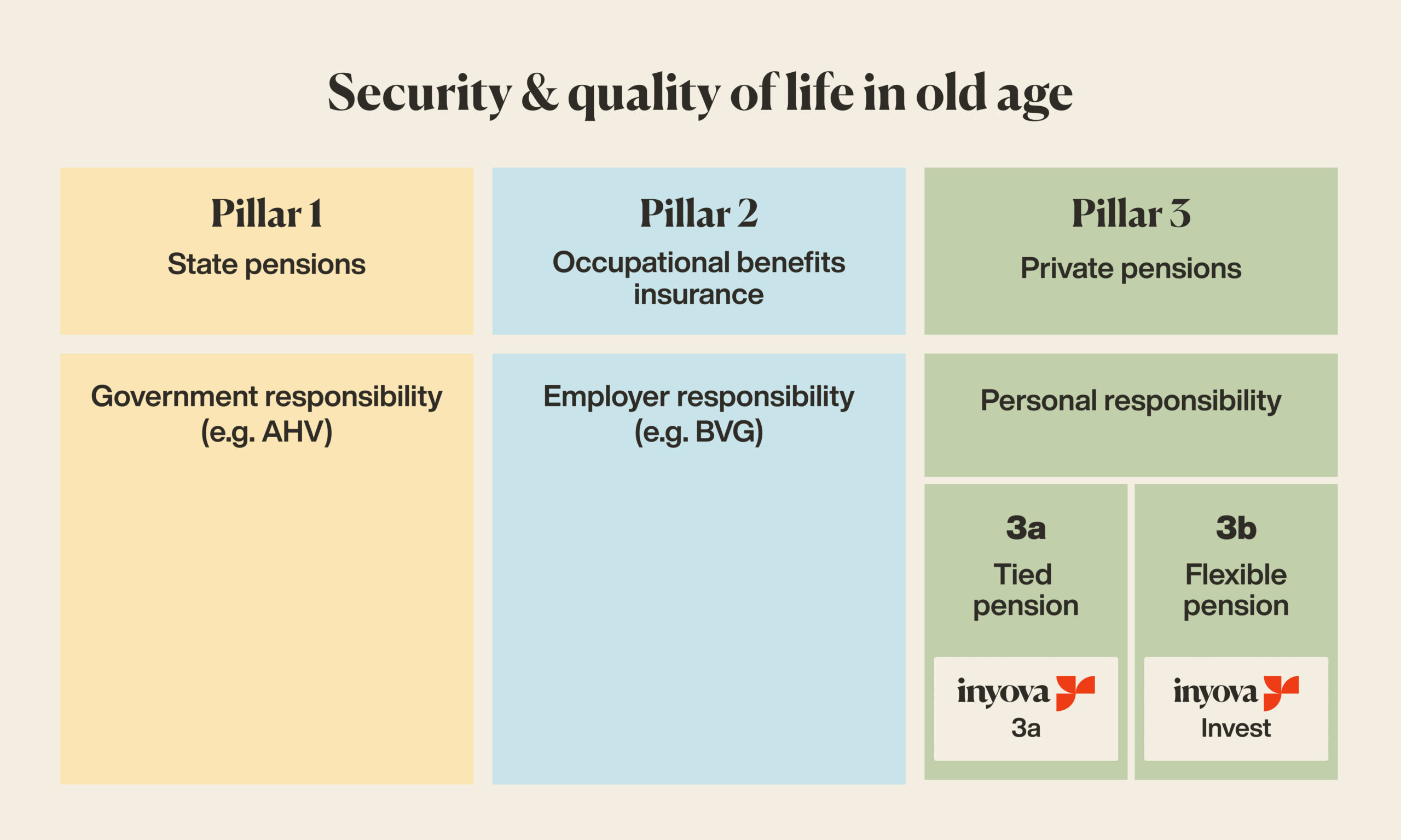

The basics: Understanding the Swiss pension system

The Swiss pension system builds on the so-called 3-pillar principle.

The 1st pillar is the state pension – the Old-Age and Survivors’ Insurance (OASI) – which aims to support the livelihood of every citizen. Deposits into the state pension scheme are required by law and are not credited to an account in your name. The money deposited is passed on directly to the current generation of retirees.

However, with our ageing population, deposits are shared among an ever-increasing number of recipients. That’s why the other pillars of the Swiss pension system are essential to maintain your desired lifestyle in retirement.

The 2nd pillar is the mandatory pension that your employer pays, also called your occupational benefit plan (OP). It is regulated by the Swiss Federal Act on Occupational Retirement, Survivors’ and Disability Pension Plans (BVG).

Depending on the employer and pension fund, extra occupational pension is also possible. This is not subject to the regulations of the BVG. The extra occupational pension is voluntary for the employer and is often only offered as a fringe benefit at managerial level.

Finally, the 3rd pillar brings private pension into play. The private pension plan serves to supplement the 1st and 2nd pillars and is intended to maintain your usual standard of living in retirement (remember, pillars 1 and 2 are usually not enough on their own). Private pension plans are divided into restricted pension plans (pillar 3a) and unrestricted pension plans (Pillar 3b).

Pillar 3a offers tax benefits, and the capital deposited into it is roughly tied up until retirement – you can withdraw the money from pillar 3a as early as five years before you reach the OASI retirement age (i.e. from the age of 65 for both women and men).

Plus, if you’re planning to buy a property, start a business, or relocate abroad, you have the flexibility to withdraw your pillar 3a funds early under certain conditions.

On the other hand, the unrestricted, more flexible pillar 3b is based on the assets that you save privately for your pension and has no requirements as to the form of investment. There are no maximum contributions in pillar 3b, however, the contributions are not tax-deductible. One example of pillar 3b is Inyova’s range of regular investment solutions. Account management is flexible, and capital can be withdrawn at any time without legal requirements.

Your future starts today

Today is the best time to start investing in your retirement. By contributing early to a pillar 3a, you maximise its potential for capital growth, allowing even small deposits to grow significantly over the years. Even more, pillar 3a not only helps build your retirement savings but also offers tax benefits, as contributions are deductible from your taxable income.

How you invest your money matters. With Inyova’s 3a, you’re creating real-world impact, contributing to a liveable planet while also securing your financial freedom for retirement.

Start now to set yourself and the planet up for a secure and fulfilling future.